Jacobs Solutions (NYSE:J) Valuation in Focus Following Major Puerto Rico Infrastructure Project Win

Jacobs Solutions (NYSE:J) just landed a significant role in Puerto Rico’s infrastructure overhaul. The company has been picked by the Puerto Rico Aqueduct and Sewer Authority to design a new, resilient ocean outfall pipeline in Mayagüez. The project replaces a 1.1-mile pipeline that was badly damaged by Hurricane María, and is part of a much larger effort to modernize and strengthen the island’s water system. This latest win shines a light on Jacobs’ ability to take on complex projects tied to environmental protection and critical infrastructure, which is something investors are watching closely.

Zooming out, Jacobs Solutions has notched a gain of more than 22% over the past year, a performance that stands out alongside steady revenue and sharply rising net income. Recent weeks have seen steady momentum, with a 16% surge in the past three months reflecting both renewed investor interest and a string of project wins. While the client announcement in Puerto Rico isn’t the first of its kind for the company, it does reinforce Jacobs’ strategic push into high-impact public works and may position it for future growth in similar markets.

After this action-packed year, are investors looking at an entry point ahead of further upside, or are today’s prices already capturing all the future growth on the table?

Most Popular Narrative: 4.2% Undervalued

The prevailing narrative suggests that Jacobs Solutions is currently trading below its estimated fair value, indicating some upside potential for investors.

Record-high backlog growth (up 14% year-over-year) in Water, Advanced Facilities, and Critical Infrastructure, driven by global infrastructure modernization, water scarcity, and data center expansion, provides strong visibility into multi-year revenue growth and supports confidence in accelerating top-line results into FY '26 and beyond.

What is fueling this narrative? Think massive future earnings, ambitious margin targets, and a valuation framework that could surprise even experienced investors. Are you ready to uncover the numbers behind this bold price target? The full story reveals how growth assumptions and margin expansion plans shape the idea of Jacobs Solutions as undervalued right now.

Result: Fair Value of $155.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, policy shifts affecting public sector spending or risks associated with executing large infrastructure projects could quickly challenge the case for further upside.

Find out about the key risks to this Jacobs Solutions narrative.Another Perspective: Looking at Market Ratios

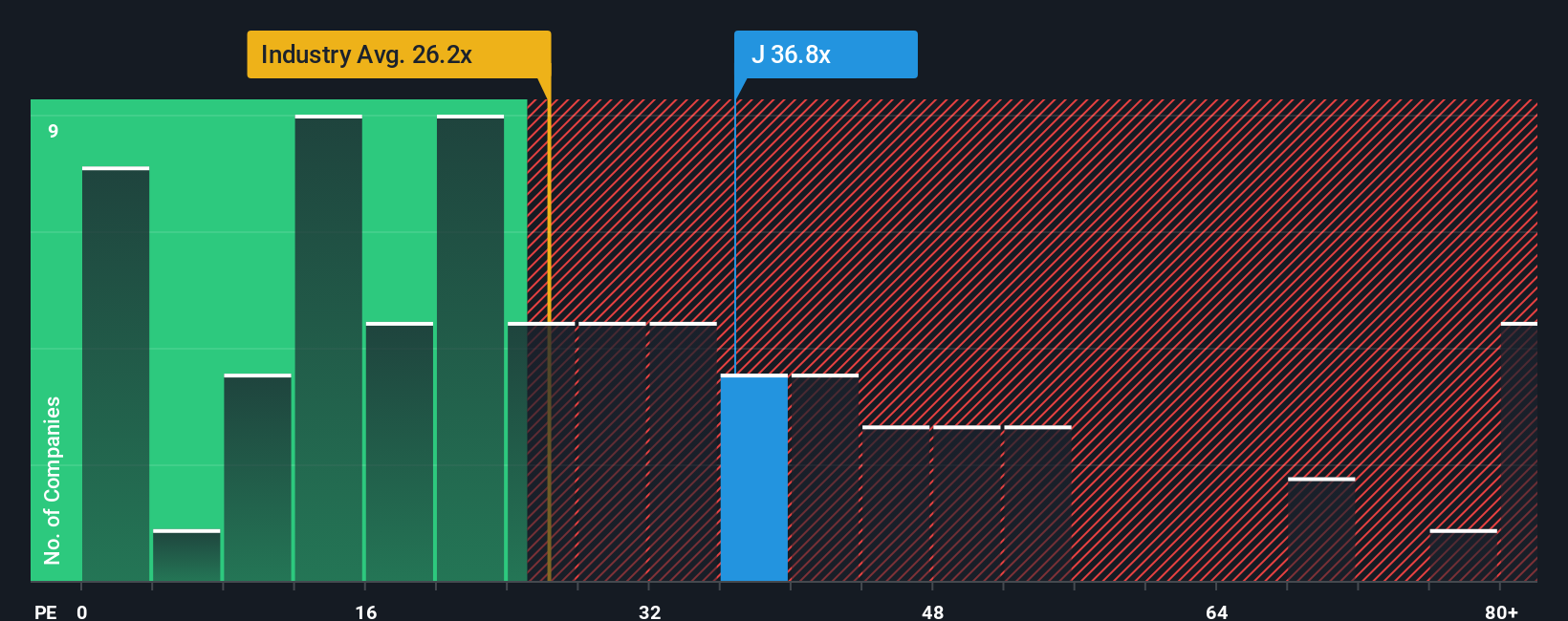

While analyst forecasts suggest Jacobs Solutions is currently undervalued, a closer look at its share price relative to industry averages tells a different story. By this method, the company appears more expensive than its sector rivals. Which approach offers the truer picture?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Jacobs Solutions Narrative

If you want to dig deeper into the numbers and shape your own viewpoint, it's easy to build your own analysis in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Jacobs Solutions.

Looking for More Investment Ideas?

If you want an edge in today’s market, step beyond the obvious picks and give yourself a shot at outperformance. The right ideas could help you stay ahead of the next market trend and find hidden winners. Do not let great opportunities pass you by.

- Uncover companies using artificial intelligence to shake up entire industries with our hand-picked selection of AI penny stocks.

- Kickstart your search for tomorrow’s value leaders and snap up potential bargains by reviewing our curated list of undervalued stocks based on cash flows.

- Zero in on top-performing businesses rewarding shareholders with strong yields by exploring our standout group of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal