Does Government Backing of Non-Academic Education Alter the Bull Case for New Oriental (EDU)?

- Earlier this week, nine Chinese government departments, including the Ministry of Commerce, introduced new policies encouraging the growth of vocational skills training and non-academic education markets.

- Supportive measures now make it easier for companies like New Oriental Education & Technology Group to obtain permits and access low-cost facilities, enabling expanded participation in arts, science, and technology education.

- We will examine how increased official support for non-academic education could influence the company’s evolving growth and business outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

New Oriental Education & Technology Group Investment Narrative Recap

For shareholders in New Oriental Education & Technology Group, the core thesis revolves around the company's ability to capture resilient consumer demand for enrichment and non-academic learning as Chinese society increasingly values premium education services. The recent policy shift supporting vocational and non-academic education addresses a key short-term catalyst, regulatory and administrative bottlenecks, but intensifying competition and slower-than-market revenue growth remain material risks that could limit margin and earnings expansion.

Among recent announcements, management's guidance for fiscal 2026 anticipates up to 10% top-line growth, reflecting confidence in ongoing demand for new learning products even as the sector faces periodic regulatory and economic hurdles. The timing of the new government measures could help unlock additional growth opportunities and improve visibility for this target, but any lasting margin uplift will depend on the company's ability to differentiate as rivals crowd the non-academic segment.

By contrast, investors should remain alert to signs of rising customer acquisition costs eating into...

Read the full narrative on New Oriental Education & Technology Group (it's free!)

New Oriental Education & Technology Group's narrative projects $6.5 billion in revenue and $628.5 million in earnings by 2028. This requires 9.7% yearly revenue growth and a $256.8 million earnings increase from $371.7 million today.

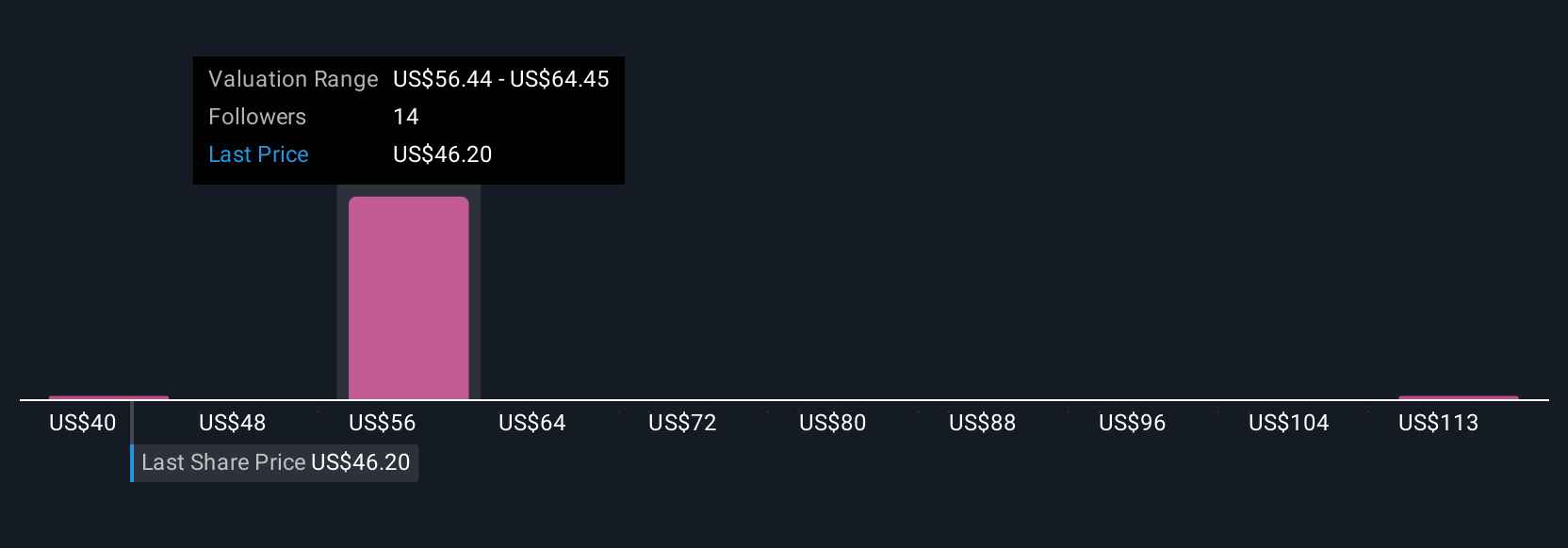

Uncover how New Oriental Education & Technology Group's forecasts yield a $57.53 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered four independent fair value estimates for New Oriental, stretching from US$38.90 to US$126.59 per share. While optimism centers on new non-academic growth, wider market caution persists on whether expansion can consistently offset margin risk or sector volatility, consider reviewing multiple viewpoints before making up your mind.

Explore 4 other fair value estimates on New Oriental Education & Technology Group - why the stock might be worth 25% less than the current price!

Build Your Own New Oriental Education & Technology Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Oriental Education & Technology Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free New Oriental Education & Technology Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Oriental Education & Technology Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal