Interactive Brokers Group (IBKR): Fresh Retail Focus and Strong Results Revive Valuation Discussion

If you’re deciding what to do with shares of Interactive Brokers Group (IBKR) after its latest update, you’re not alone. The company just reported quarterly results that topped consensus estimates on both revenue and earnings, and it is shifting more attention toward retail investors. This move is being positioned as a catalyst for ongoing revenue growth. This account growth story, especially adding 96,000 new accounts in just one month and marking a 32% increase year-over-year, is catching the market’s eye as a potential turning point in the company’s growth narrative.

In the bigger picture, Interactive Brokers Group has been building momentum. Over the past year, the stock has surged nearly 97%, and it is up more than 42% year-to-date. This follows a multi-year run that few in the financial sector can match, reflecting the strategic bets management has made on technology and diversification. While the stock’s moves have been supported by stronger earnings, investors are still weighing whether shifting toward retail clients will have a lasting effect, especially given recent fluctuations in trading activity and competition in the space.

So after such a run and the latest positive results, is IBKR offering a rare chance to buy into future growth, or has the market already baked in these optimistic expectations?

Most Popular Narrative: 1.8% Undervalued

According to the most widely followed narrative, Interactive Brokers Group is considered slightly undervalued, with its current market price trailing a consensus estimate of its fair value. This outlook is based on expectations for ongoing product innovation, continued global expansion, and favorable structural tailwinds.

Record client credit balances at $107.1 billion, up 36% over last year, indicate a strong trust in the platform and substantial funds availability for trading. This could possibly lead to higher net interest income from margin loans as clients leverage their positions.

Want to know what’s fueling this optimistic valuation? The fair value estimate is connected to a set of aggressive growth assumptions and a premium profit multiple rarely seen outside of the fastest-growing sectors. If you are curious about what leads analysts to believe the runway for earnings and revenue might be so long, you will want to explore the full narrative behind these headline numbers.

Result: Fair Value of $66.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unpredictable market conditions and intensifying competition could quickly challenge this growth narrative. These factors could potentially limit upside for Interactive Brokers Group ahead.

Find out about the key risks to this Interactive Brokers Group narrative.Another View: When Popular Valuation Methods Disagree

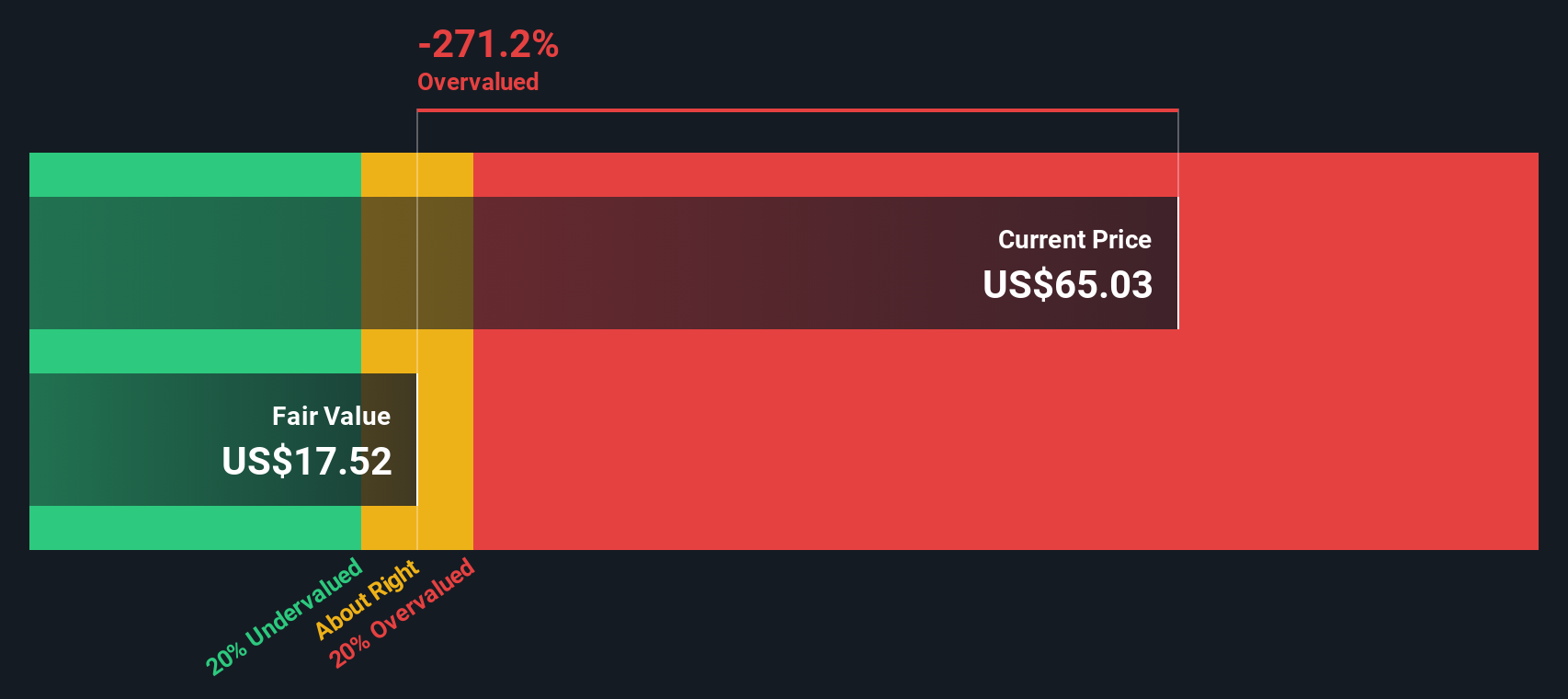

Looking from a different angle, the SWS DCF model suggests a less optimistic picture than the current market and analyst estimates. This raises the question: which method offers the more realistic outlook on Interactive Brokers Group?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Interactive Brokers Group Narrative

If these views don’t fully align with your insights, you can quickly dig into the numbers yourself and shape your own perspective in minutes. Do it your way.

A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

No smart investor sticks to just one play. Expand your search and spot unique winners with these targeted opportunities. Don’t let the next breakout pass you by.

- Pinpoint hidden potential among small-cap growth stories by checking out penny stocks with strong financials set to rewrite their industries.

- Capture robust yields and create a dependable income stream with dividend stocks with yields > 3% delivering attractive dividend payouts above 3%.

- Ride the AI revolution by selecting AI penny stocks poised to shape the future with fascinating advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal