Will Amkor (AMKR) Use Its Debt Refinancing to Strengthen US Semiconductor Packaging Leadership?

- Earlier this month, Amkor Technology announced it had completed a US$500 million private placement offering of 5.875% senior unsecured notes due 2033, using the proceeds in part to redeem its outstanding US$400 million 6.625% senior notes due 2027 and to fund general corporate purposes.

- This refinancing not only supports Amkor’s balance sheet but also aligns with its large-scale US expansion, furthering its role in domestic chip manufacturing amid broader industry reshoring initiatives.

- We'll examine how this debt refinancing enhances Amkor's capital structure and reinforces its US-based semiconductor packaging ambitions.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Amkor Technology Investment Narrative Recap

To want to own shares in Amkor Technology today, you need to believe in the lasting demand for advanced chip packaging fueled by AI and U.S. technology reshoring, and that Amkor’s major expansion in the U.S. will unlock improved profitability. The recent US$500 million note refinancing slightly lowers Amkor’s borrowing costs, but it does not materially affect its core near-term catalyst, winning and executing high-volume contracts for advanced packaging, as well as the most significant ongoing risk: underutilization and consolidation of legacy capacity, which could still pressure margins until fully addressed.

The company’s announcement in late August about securing land for a major semiconductor packaging and test facility in Peoria, Arizona, fits squarely into its strategy to expand U.S. operations and deepen ties to large customers like Apple. This site, supported by the new financing, also positions Amkor to capture incentives from the U.S. CHIPS Act and helps strengthen its ability to deliver on key advanced packaging projects tied to high-growth markets.

By contrast, investors should be aware that even as Amkor adds new debt and expands, the pressure of legacy underutilization remains unresolved in the background...

Read the full narrative on Amkor Technology (it's free!)

Amkor Technology's narrative projects $7.8 billion revenue and $569.6 million earnings by 2028. This requires 7.0% yearly revenue growth and a $265.8 million earnings increase from $303.8 million today.

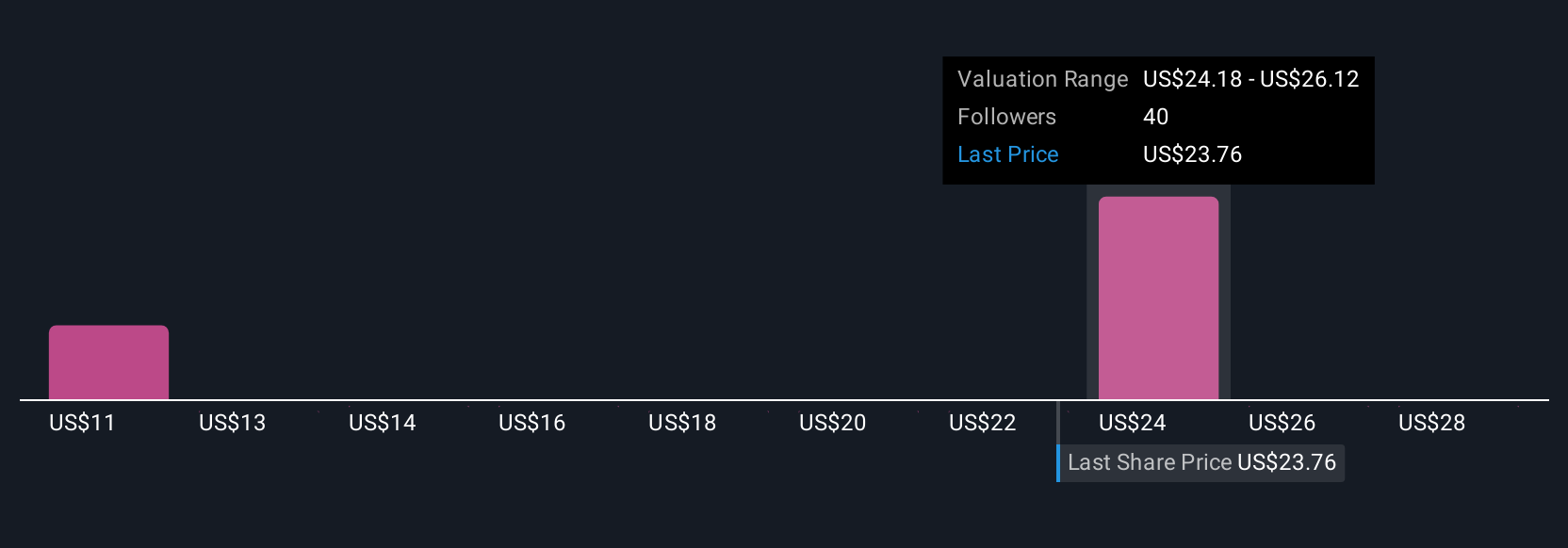

Uncover how Amkor Technology's forecasts yield a $24.88 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community estimate Amkor’s fair value from US$7.81 to US$30 per share. As Amkor pursues higher-margin advanced packaging while managing persistent legacy constraints, the divergence in these views highlights the importance of considering multiple possible outcomes.

Explore 6 other fair value estimates on Amkor Technology - why the stock might be worth as much as 6% more than the current price!

Build Your Own Amkor Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amkor Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amkor Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amkor Technology's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal