Universal Health Services (UHS): Assessing Valuation After New Investor Relations Leadership and Analyst Reaffirmations

Most Popular Narrative: 13.6% Undervalued

According to the most widely followed analysis, Universal Health Services is currently trading at a notable discount versus its estimated fair value. This undervaluation is driven by expectations of steady financial performance, upcoming growth initiatives, and resilient operating margins.

The company's aggressive buildout of outpatient behavioral health facilities positions it to capture a greater share of rising demand for mental and behavioral health services. This trend is driven by increased societal awareness and destigmatization, which is expected to support long-term revenue and EBITDA growth as the mix shifts toward higher-margin, lower-cost care settings.

Want to know what underpins this bullish target? Analysts are banking on a future business mix, improved financial efficiency, and sector-leading profit multiples. Wondering which bold growth and earnings assumptions make this price target add up? You’ll be surprised at the ambitious projections that drive this contrarian valuation.

Result: Fair Value of $218.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent labor shortages and regulatory shifts in Medicaid payments could quickly undermine the bullish case for Universal Health Services as outlined above.

Find out about the key risks to this Universal Health Services narrative.Another View: How Does the DCF Model Stack Up?

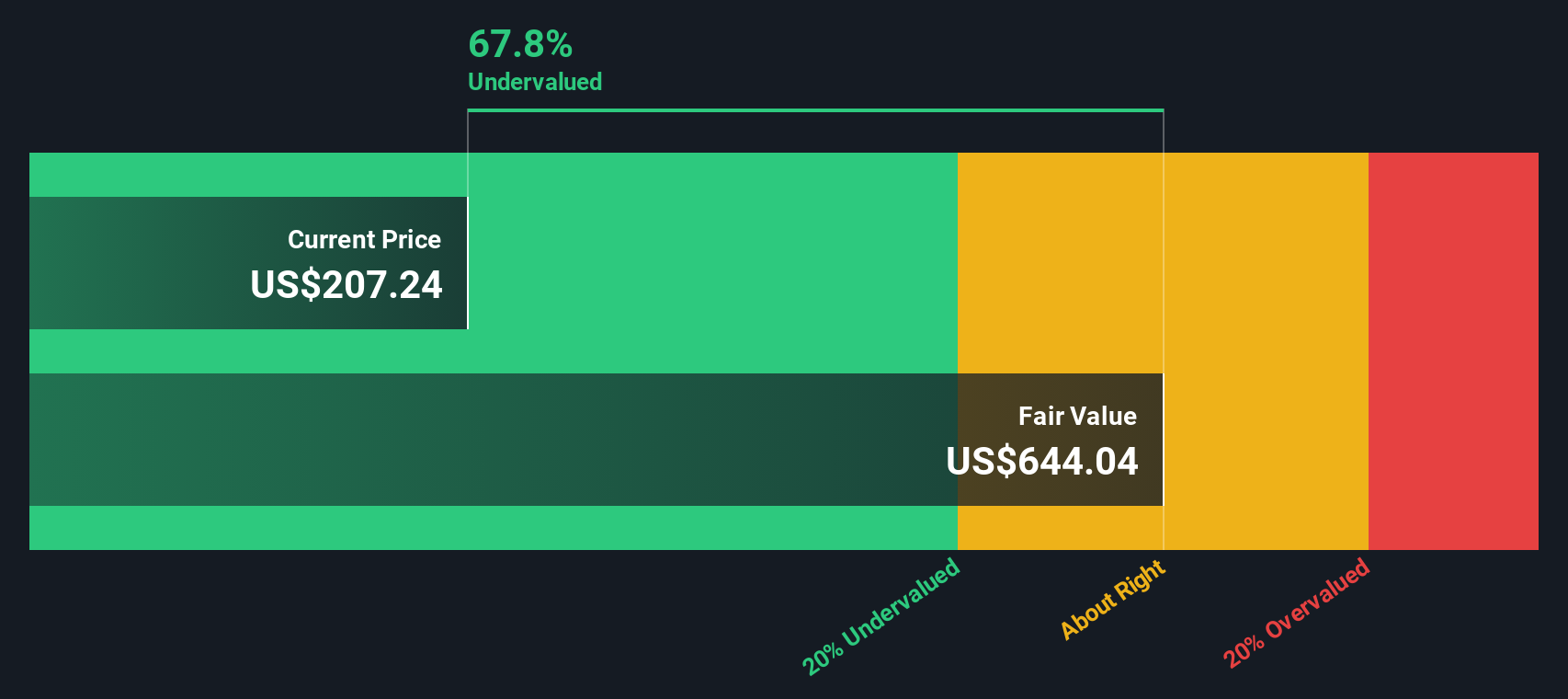

Looking beyond market-based valuations, our SWS DCF model also rates Universal Health Services as deeply discounted. This supports the idea that the shares are undervalued. However, could these discount estimates be too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Universal Health Services Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Universal Health Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors look beyond today’s headlines to uncover tomorrow’s winners. If you want to get ahead, seize the chance to tap into these standout market trends below.

- Tap into tomorrow’s hottest trends by checking out fast-growing companies riding the artificial intelligence wave with our AI penny stocks.

- Power up your portfolio with consistent income. See which high-yield opportunities are currently offering over 3% returns using dividend stocks with yields > 3%.

- Catch game-changing opportunities early and target undervalued stocks ripe for a comeback with our tailored undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal