Broadcom (AVGO): A Fresh Look at Valuation After Recent Steady Market Moves

Something just happened with Broadcom (AVGO) that has investors pausing to wonder what might come next. The latest market movement appears to have arrived without a flashy event. That in itself is often what gets seasoned investors leaning in, as minor ripples can sometimes reveal more about big shifts in risk appetite or market sentiment than the headline-grabbing news.

Looking at Broadcom’s momentum, shares have advanced substantially over the past year, with a steady climb that reflects both strong business results and a generally favorable market. The stock is up over 103% in the past year and has gained 49% since the start of this year alone, suggesting confidence is still strong in Broadcom’s growth story. Even in the absence of dramatic headlines, this pattern says plenty about how investors see the company’s future.

So, is Broadcom trading at a level that leaves room for further upside, or has the market already priced in future growth expectations?

Most Popular Narrative: 5.9% Undervalued

According to the prevailing narrative, Broadcom shares are currently undervalued by just under 6% relative to fair value based on analysts’ expectations for rapid future growth and margin expansion. This suggests that there could still be moderate upside potential left in the stock, even after substantial recent gains.

*Broadcom is experiencing accelerating demand for custom AI accelerators (XPUs) from hyperscale and large language model customers, highlighted by the addition of a major fourth customer and a strengthened backlog. This indicates robust multi-year revenue growth in the AI semiconductor segment.*

Broadcom’s fair value hinges on bold expectations for its future. Interested in discovering what specific assumptions drive the analysis? This narrative highlights remarkable revenue, earnings, and margin expansion as the key factors behind the undervaluation call. Looking to see the numbers behind the optimism? Explore the notable forecasts that define this outlook.

Result: Fair Value of $366.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in non-AI businesses or increased customer concentration could quickly challenge the optimistic case that underpins Broadcom’s growth outlook.

Find out about the key risks to this Broadcom narrative.Another View: What Do Market Ratios Suggest?

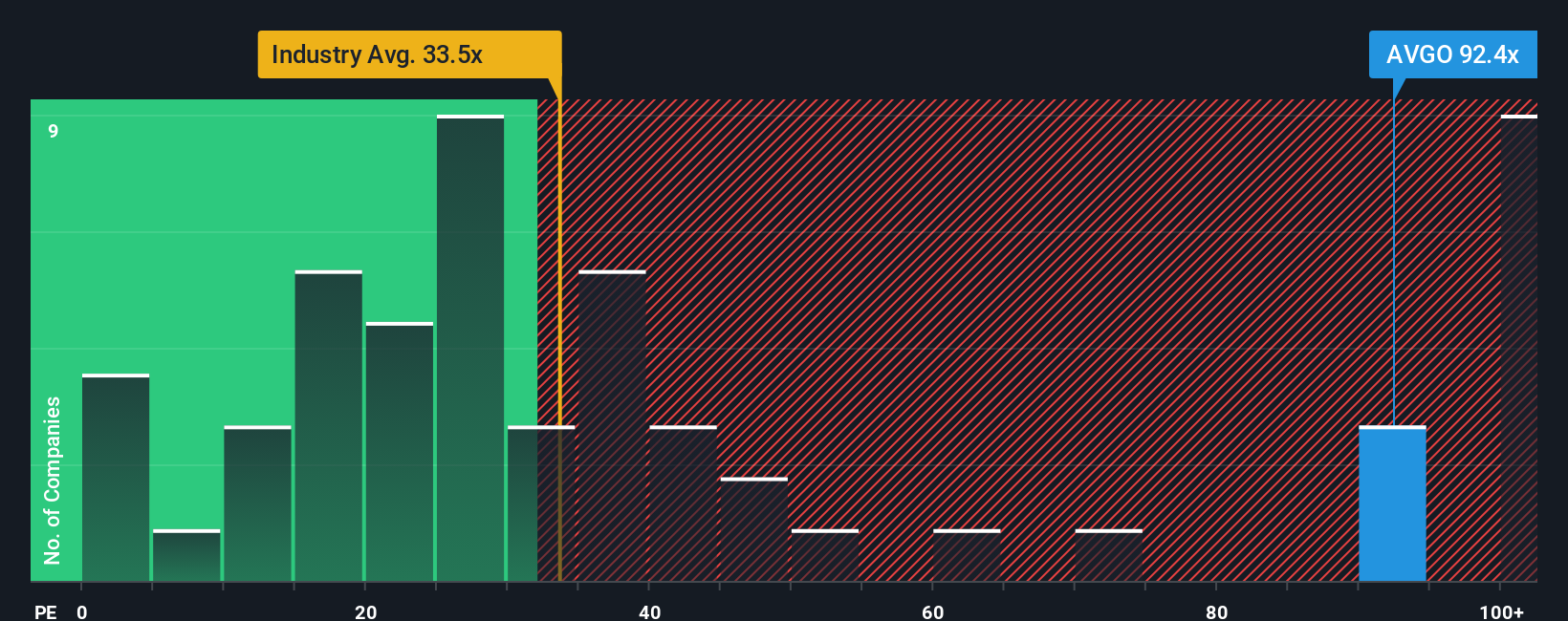

While many see upside from future growth, a glance at Broadcom’s current market ratio compared to the broader semiconductor industry tells a different story. This suggests that investors may already be paying a premium. Could optimism be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadcom Narrative

If you're interested in seeing how the numbers add up for yourself, you can explore the data and create a personalized view of Broadcom's story in just a few minutes. Do it your way

A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your search stop at Broadcom. Gain the edge and spot market opportunities by using the unique screeners below to uncover fresh investment angles.

- Tap into bold income opportunities by targeting stocks offering impressive yields and financial strength with our dividend stocks with yields > 3%.

- Get ahead of the curve by scouting promising companies powering the next wave of AI advancement through the AI penny stocks.

- Catch hidden gems trading at a discount and position yourself for potential market-beating gains via the undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal