Applied Materials (AMAT): Analyzing Valuation After New Debt Raise and DRAM Growth Updates

If you have been following Applied Materials (AMAT) lately, you may have noticed a series of meaningful updates. The company just completed a billion-dollar unsecured notes offering, strengthening its balance sheet and expanding its options for future investments. However, the real attention-grabber for investors is not just financial engineering. Recent updates on the company’s DRAM and AI-related growth narrative have also come to the forefront, sparking debate about where the stock goes from here.

Applied Materials’ shares have climbed about 16% year to date, with a healthy 11% gain in the past three months, as interest in AI and high-performance computing filters through to demand for advanced chip equipment. Even so, the one-year total return is essentially flat. Recent management commentary highlights strong momentum in the DRAM segment, aiming for major growth, but there are also notes of caution from some quarters regarding exposure to China and near-term revenue guidance. Other company events, such as a routine board resignation and ongoing dividends, seem to have had little impact on sentiment.

So, after this year’s gains and the renewed AI-driven optimism, is Applied Materials setting up for a new leg higher, or is the market already factoring in all the good news about future growth?

Most Popular Narrative: 2% Undervalued

According to the prevailing narrative, Applied Materials is currently just below its assessed fair value, with expectations for robust growth ahead driven by the accelerating adoption of artificial intelligence and next-generation chip manufacturing needs.

Catalysts

Most Immediate Catalysts (1 to 2 Years):

• Semiconductor Equipment Demand: As AI, cloud computing, and automotive chips grow, chipmakers (TSMC, Intel, Samsung) are increasing fab capacity, boosting demand for AMAT’s semiconductor equipment.

• AI Boom & High-Performance Computing: AI chips (from Nvidia, AMD, and Intel) require advanced manufacturing tools, where AMAT is a key supplier.

How aggressive are the future growth assumptions behind this near fair value call? The calculations rely on strong top-line expansion and a healthy leap in operating profits. Curious which metrics could set a new benchmark for returns? Uncover the core financial bets driving this valuation and why they might surprise even seasoned semiconductor bulls.

Result: Fair Value of $194.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing U.S.-China trade tensions and the cyclical nature of semiconductor demand could quickly shift Applied Materials’ growth outlook in coming quarters.

Find out about the key risks to this Applied Materials narrative.Another View: SWS DCF Model Checks the Growth Story

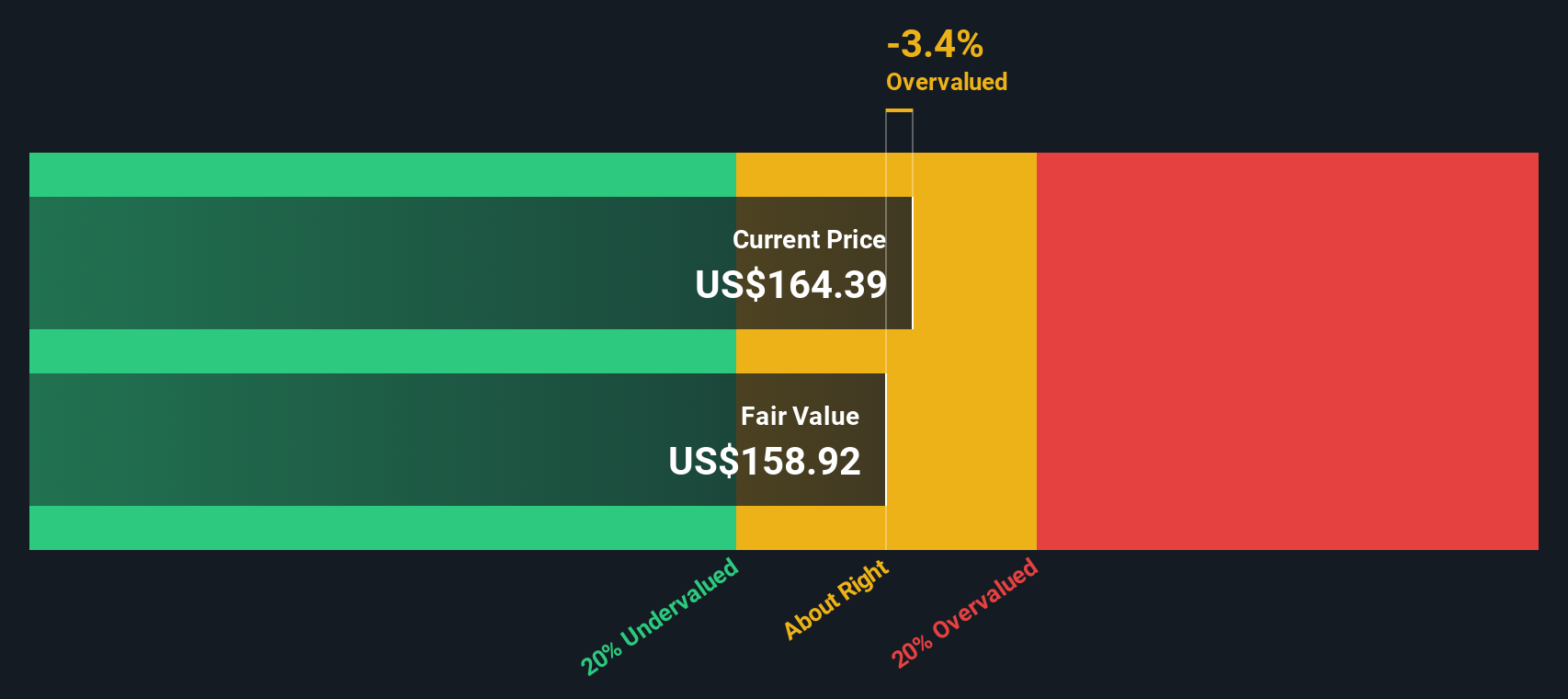

While the market sees Applied Materials as undervalued based on future growth and peer comparisons, the SWS DCF model offers a different perspective, suggesting the stock might in fact be overvalued. Could this model be missing the long-term industry tailwinds, or does it highlight risks not reflected in simple growth estimates?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Applied Materials Narrative

If you see the story unfolding differently or want to dig into the data yourself, you can shape your own analysis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Applied Materials.

Looking for More Smart Investment Opportunities?

Don’t stop with Applied Materials. Great strategies come from widening your search. Jump on these pre-screened ideas and see what other market winners you could be missing today.

- Unlock high-yield income by tracking companies with strong and reliable payouts through our list of dividend stocks with yields > 3%.

- Spot innovation early and ride the artificial intelligence wave with handpicked opportunities in the fast-growing sector, all in one place at AI penny stocks.

- Capture hidden value for your portfolio by focusing on stocks trading below their worth. Your next bargain awaits in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal