Could ADM’s (ADM) Regenerative Farming Push Signal a Shift in Its Competitive Positioning?

- ADM and Kellanova recently completed a two-year alliance supporting over 180 U.S. cotton farmers across Alabama, Florida, and Georgia, focusing on regenerative agriculture practices that improved soil health, biodiversity, and reduced greenhouse gas emissions.

- This initiative also expanded support to Black farmers through a partnership with the National Black Growers Council, helping almost maximize habitat potential and demonstrating a collaborative approach to agricultural resilience and community impact.

- We’ll examine how ADM’s Decatur East plant restart and cost-saving efforts may influence its outlook on earnings growth and margin recovery.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Archer-Daniels-Midland Investment Narrative Recap

To be a shareholder in Archer-Daniels-Midland, you need to believe in the company’s ability to adapt and thrive through agricultural cycles by balancing cost management, sustainability efforts, and efficient operations. While ADM’s new regenerative agriculture initiative strengthens its environmental profile and community impact, the most important short term catalyst remains the Decatur East plant restart, which is expected to address cost headwinds and aid margin recovery in the near term. However, persistent uncertainty around biofuel policy and regulatory clarity continues to pose the biggest risk to earnings stability, and the recent partnership does not materially alter that risk.

Among ADM’s recent announcements, the recommissioning of the Decatur East facility stands out as highly relevant. By eliminating a US$20 to US$25 million quarterly cost burden and enabling ADM to streamline its production network, this move reinforces the catalyst for near-term margin improvement and may help offset structural challenges in core business segments if volumes and costs stabilize.

But in contrast, investors should be aware that regulatory uncertainty around biofuel policies remains a key risk that could quickly...

Read the full narrative on Archer-Daniels-Midland (it's free!)

Archer-Daniels-Midland's outlook anticipates $88.6 billion in revenue and $2.1 billion in earnings by 2028. Achieving these targets implies a 2.3% annual revenue growth rate and a $1.0 billion increase in earnings from the current $1.1 billion.

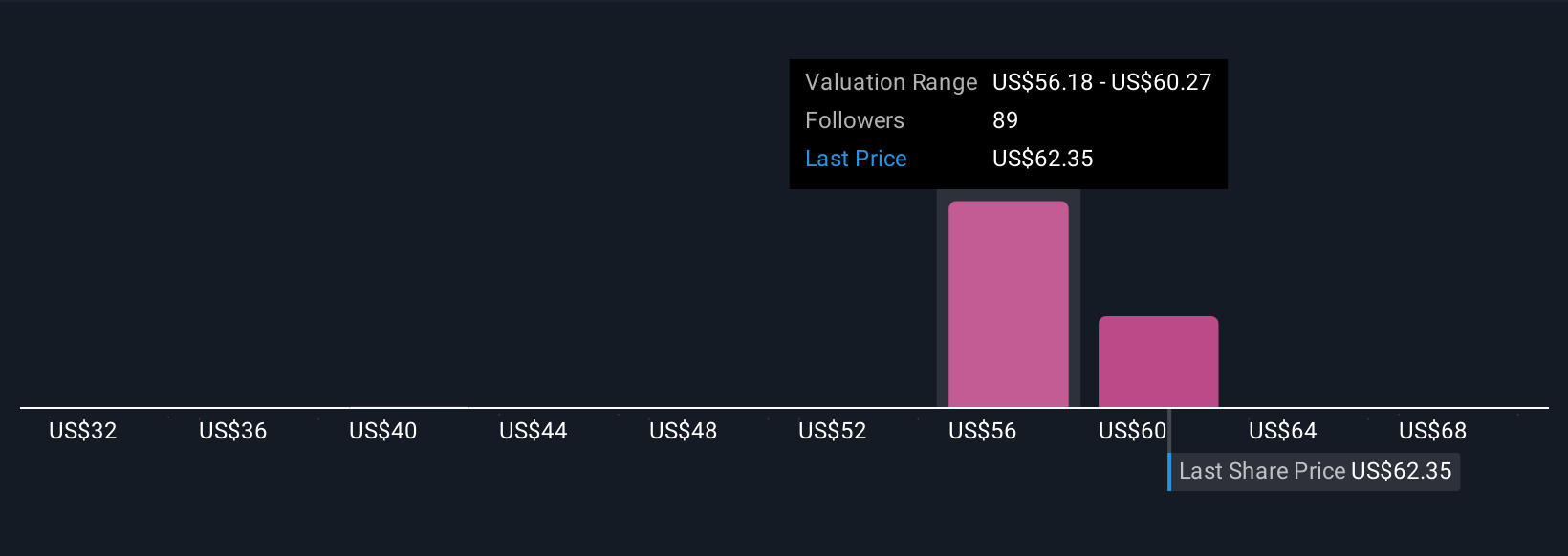

Uncover how Archer-Daniels-Midland's forecasts yield a $58.30 fair value, a 5% downside to its current price.

Exploring Other Perspectives

You’ll find 14 Community-sourced fair value estimates for ADM, ranging widely from US$31.64 up to US$72.54 per share. While some see strong value potential, persistent earnings volatility from shifting biofuel policies could weigh on longer-term outcomes, consider reviewing several viewpoints to assess your own position.

Explore 14 other fair value estimates on Archer-Daniels-Midland - why the stock might be worth as much as 18% more than the current price!

Build Your Own Archer-Daniels-Midland Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Archer-Daniels-Midland research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Archer-Daniels-Midland research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Archer-Daniels-Midland's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal