Credit Acceptance (CACC): Assessing Valuation After Extension and Rate Cut on Warehouse Credit Facility

If you have Credit Acceptance (CACC) in your portfolio or are thinking about jumping in, today's extension of the company's $200 million revolving secured warehouse facility is worth a closer look. Management not only stretched the maturity by another two years, pushing it out to September 2028, but also successfully negotiated a lower interest rate on future borrowings. Even with no current balance on the facility, this adds runway for funding and trims future borrowing costs, which is rarely bad news for investors keeping an eye on financial strength.

With this move, Credit Acceptance continues to reinforce its liquidity position while navigating a period of gradual share price gains. Over the past year, CACC's stock has climbed 12%, and shares have added around 9% since the start of the year. While there haven't been big swings, the market appears to be gradually warming to the company after modest three-year returns and comparatively strong five-year performance. The steady upward momentum, paired with annual revenue growth of 37% and profit growth north of 7%, suggests the business is still building on a solid foundation.

So is Credit Acceptance quietly setting up for further gains, or has the market already accounted for this flexibility and future growth in the current share price?

Most Popular Narrative: 8.5% Overvalued

The consensus narrative currently sees Credit Acceptance as trading above its fair value. The stock is priced at a modest premium compared to what analysts estimate based on future earnings and risk factors.

Ongoing growth in the non-prime borrower segment and persistent income inequality in the U.S. are likely to support stable or increasing demand for Credit Acceptance's auto loan products. This could expand the company's addressable market and sustain long-term revenue growth.

Curious how much future demand and bold financial projections shape analyst targets? This narrative builds its valuation on forecasts that might surprise you. Want insight into what drives these numbers and why analysts are confident in their outlook? The answer lies in specific margin expectations and aggressive assumptions about future growth rates. Dig deeper to uncover what could be fueling or limiting Credit Acceptance’s next act.

Result: Fair Value of $467.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, any ongoing decline in loan performance or tougher competition could quickly challenge analyst optimism and put pressure on both revenue growth and future profits.

Find out about the key risks to this Credit Acceptance narrative.Another View: Our DCF Model's Perspective

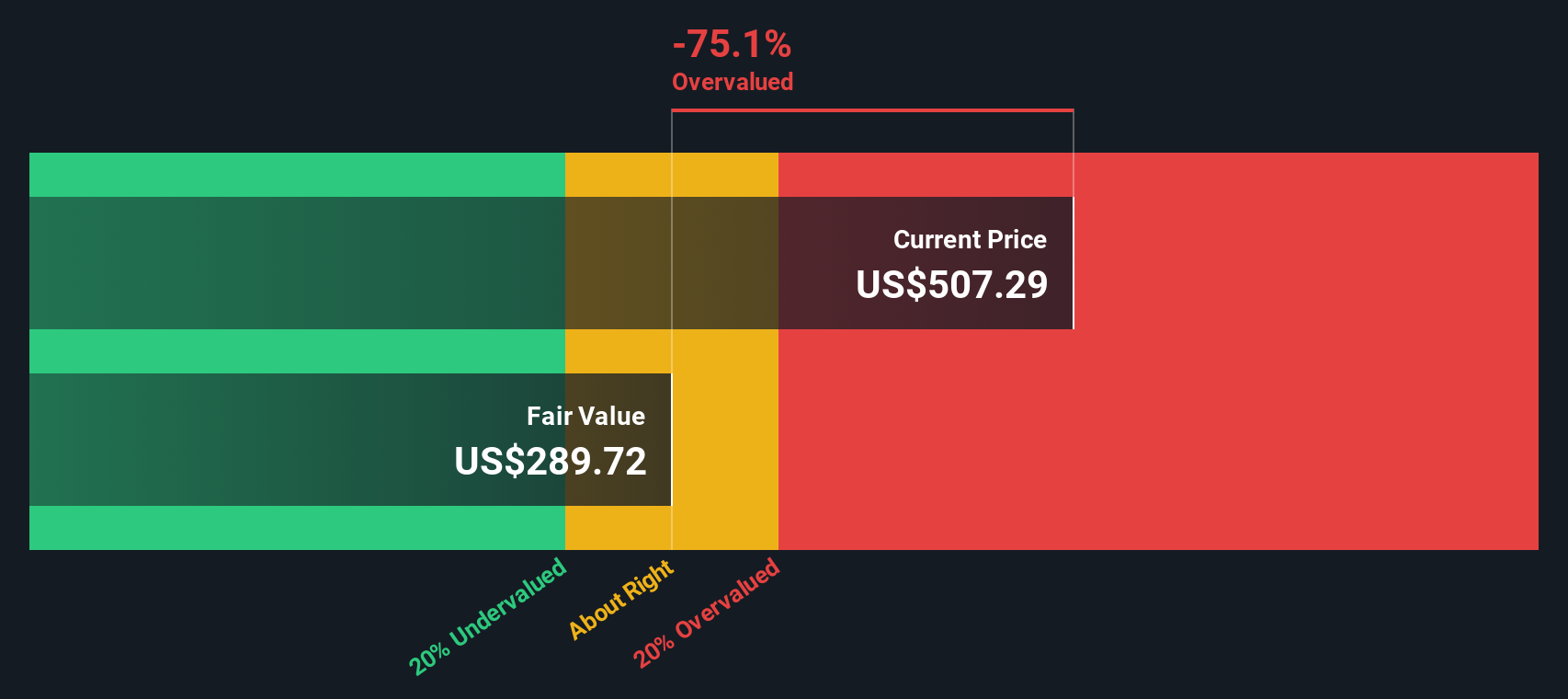

While analysts see the stock as slightly overvalued based on their earnings outlook, our DCF model suggests a more significant gap between the current share price and underlying value. Could this wider disconnect reveal hidden risks or untapped opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Credit Acceptance Narrative

If you have a different perspective or want to examine the numbers yourself, you can build your own story in just a few minutes. Do it your way.

A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one pick. Take your strategy further by targeting fresh opportunities in sectors gaining momentum. Don’t risk missing the next big winner.

- Uncover hidden gems in fast-growing industries by scanning a lineup of penny stocks with strong financials built on strong financials and upward momentum.

- Tap into game-changing advancements with AI penny stocks focused on companies at the forefront of artificial intelligence innovation.

- Collect reliable income and steady growth with dividend stocks with yields > 3% that highlights businesses offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal