How HPE’s Juniper Acquisition and AI Server Momentum Could Shape the Company’s Growth Prospects

- Hewlett Packard Enterprise recently reported fiscal Q3 results that surpassed expectations, highlighted by robust growth in AI-optimized server and networking revenue and the completed acquisition of Juniper Networks.

- The leadership transition, with Phil Mottram appointed as Chief Sales Officer following Heiko Meyer's retirement, underscores a broader shift as HPE integrates Juniper and sharpens its focus on AI and hybrid cloud markets.

- To see how the completed Juniper acquisition and leadership change may influence HPE’s investment case, we'll examine the implications for future growth.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

Hewlett Packard Enterprise Investment Narrative Recap

Owning shares in Hewlett Packard Enterprise means believing in its push toward AI and hybrid cloud as growth drivers, alongside its ability to integrate Juniper Networks and execute in an evolving IT infrastructure market. The appointment of Phil Mottram as Chief Sales Officer brings experienced leadership but does not materially alter the near-term catalyst, the successful integration of Juniper, which remains the central focus. The biggest current risk continues to be execution surrounding this integration and realizing anticipated synergies, as these could impact profitability and momentum if mismanaged.

The recent $2.9 billion multi-tranche debt offering is particularly relevant, as it supports HPE’s balance sheet post-acquisition and provides liquidity for ongoing operations and investment. This announcement speaks directly to HPE’s challenge of balancing growth funding with prudent risk management, especially as increased leverage heightens the need for reliable cash flow to service debt and deliver expected value from recent acquisitions.

However, investors should also be mindful that, as integration risk comes to the forefront, ...

Read the full narrative on Hewlett Packard Enterprise (it's free!)

Hewlett Packard Enterprise is projected to achieve $44.4 billion in revenue and $2.7 billion in earnings by 2028. This outcome assumes a 10.3% annual revenue growth rate and a $1.6 billion increase in earnings from the current $1.1 billion level.

Uncover how Hewlett Packard Enterprise's forecasts yield a $25.82 fair value, a 3% upside to its current price.

Exploring Other Perspectives

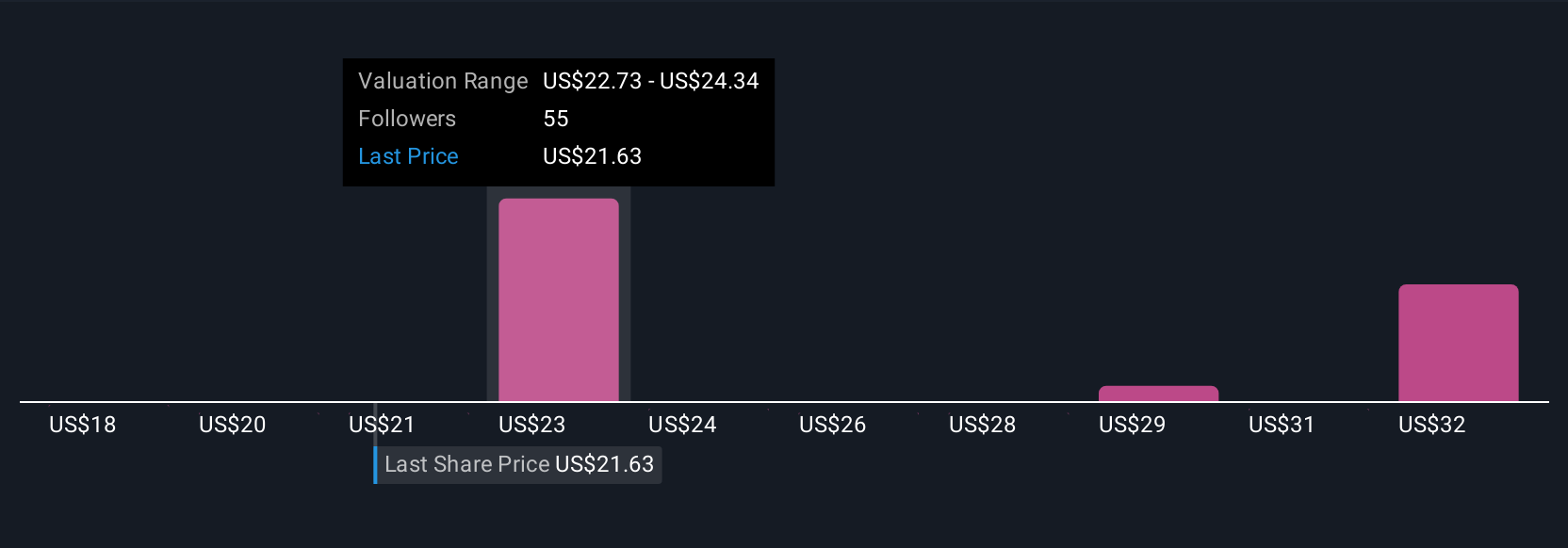

Seven fair value estimates from the Simply Wall St Community place HPE’s worth between US$17.90 and US$47.71 per share. With this wide range, the spotlight remains on whether Juniper’s integration will deliver the margin improvements essential for HPE’s next phase, explore these varied outlooks to weigh your own view.

Explore 7 other fair value estimates on Hewlett Packard Enterprise - why the stock might be worth as much as 91% more than the current price!

Build Your Own Hewlett Packard Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Hewlett Packard Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hewlett Packard Enterprise's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal