Cactus (WHD): Assessing Valuation After New Expansion Moves and Industry Headwinds

If you’ve been following Cactus (WHD), you know things haven’t been exactly smooth lately. The latest company updates flagged some challenges, such as rising steel tariffs and cooling demand for frac work, which have started to squeeze margins. However, management remains confident in their financial strength, with solid liquidity and a strong focus on keeping operations lean. In addition, the Baker Hughes partnership and initiatives in fast-growing areas like spoolable pipe, carbon capture, and hydrogen show that Cactus is not just hunkering down. They are looking ahead to new opportunities.

All this comes during a year where Cactus shares have slid 37% and momentum has faded further over the past few months. After several years of growth, recent months saw the stock drift lower as investors react to both near-term margin pressure and larger strategic changes. Still, with management emphasizing cost controls and new avenues for expansion, the conversation is shifting from just weathering the storm to considering recovery potential and long-term value.

So is this stretch of weakness laying the groundwork for a bargain, or are markets simply reflecting realistic prospects for future earnings growth?

Most Popular Narrative: 20.4% Undervalued

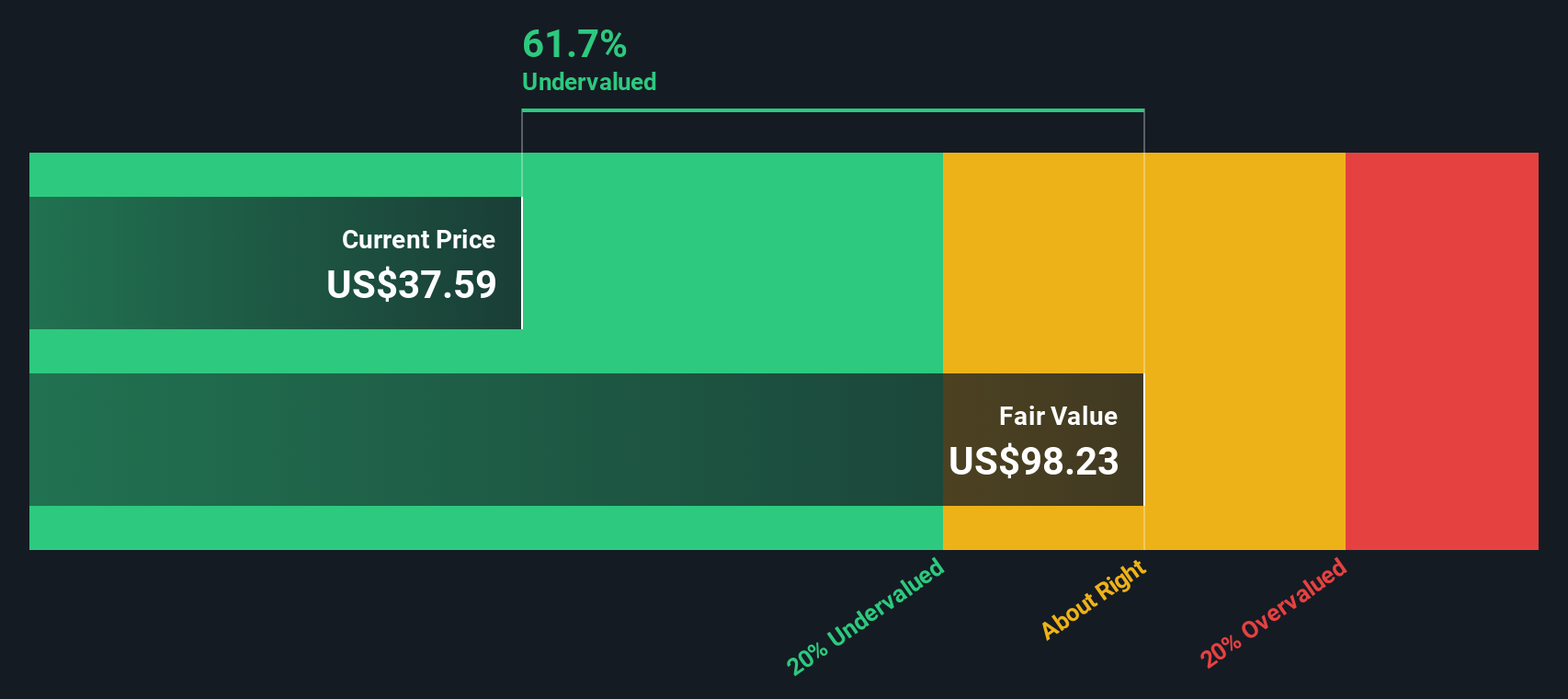

According to the most popular narrative, Cactus shares are trading notably below a consensus estimate of fair value. The valuation is grounded in forward-looking assumptions about earnings growth, revenue expansion, and margin shifts projected by industry analysts.

"The acquisition of a majority interest in Baker Hughes' Surface Pressure Control business will significantly expand Cactus' geographic footprint and customer base into the Middle East, an area poised for long-term energy infrastructure investment and supply security. This is likely to drive sustained revenue growth and higher earnings resiliency."

What is really behind this undervalued call? The analysts’ math is driven by ambitious forecasts about how much Cactus can boost its top and bottom line, along with a confidence-worthy future profit multiple. The secret sauce behind this narrative? You’ll want to see the full breakdown and the numbers that analysts believe will power a comeback for this stock.

Result: Fair Value of $49.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising steel tariffs and persistent weak demand remain significant risks. These factors could further pressure Cactus' margins and limit near-term recovery.

Find out about the key risks to this Cactus narrative.Another View: What Do the Numbers Say?

Taking a look through our DCF model, the story remains compelling. This approach suggests Cactus could be trading below its intrinsic value, which supports the undervalued case. Does this change the conversation about opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cactus Narrative

If you’d rather see the story for yourself or think a different view is worth exploring, it only takes a couple of minutes to build your own perspective. Do it your way.

A great starting point for your Cactus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Ideas?

Broaden your portfolio and stay ahead by acting on strategies other investors might miss. Smart choices now can mean real opportunity for your financial future.

- Spot tomorrow’s tech disruptors by checking out AI penny stocks, pushing the boundaries in artificial intelligence and redefining entire industries.

- Build lasting income for your future by seeing which companies are delivering with reliable dividend stocks with yields > 3% that consistently yield above 3%.

- Capitalize on under-the-radar potential by reviewing undervalued stocks based on cash flows, where overlooked bargains could lead to your next big win.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal