How Woodward's US$200 Million South Carolina Facility Investment Has Changed Its Investment Story (WWD)

- Woodward, Inc. recently announced plans to invest nearly US$200 million in a new 300,000-square-foot precision manufacturing facility in Spartanburg County, South Carolina, focused on producing servo-hydraulic actuation systems for the Airbus A350 and future aerospace projects, with operations expected to begin in 2027.

- This development underscores both Woodward’s commitment to expanding its aerospace capabilities and its selection of a region known for advanced manufacturing talent and infrastructure following a nationwide site search.

- We'll explore how Woodward's major manufacturing investment could shift its long-term aerospace positioning and earnings outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Woodward Investment Narrative Recap

To be a shareholder in Woodward, you need to believe in the company's ability to expand its leadership in advanced aerospace actuation systems while carefully managing risks from large-scale capital investments. The new US$200 million facility for the Airbus A350 is a clear commitment to this vision, but given the project's long ramp-up and 2027 operational timeline, it does not materially change the most important short-term catalyst, which remains strong OEM and aftermarket demand in commercial aerospace. The largest risk continues to be execution and margin pressure from heightened capital spending and integration challenges.

Among the recent announcements, Woodward’s board reaffirmed its quarterly dividend of US$0.28 per share, underlining financial stability and management's confidence in ongoing cash generation. Consistent dividends also support the current earnings power and shareholder value thesis, even as the company channels significant resources into facility buildouts and next-generation projects.

However, investors should be aware that, in contrast to the optimism around future growth, any delays or cost overruns at the new South Carolina plant could...

Read the full narrative on Woodward (it's free!)

Woodward's outlook anticipates $4.1 billion in revenue and $561.5 million in earnings by 2028. This is based on a forecast 6.5% annual revenue growth rate and a $173.7 million increase in earnings from the current $387.8 million level.

Uncover how Woodward's forecasts yield a $291.25 fair value, a 22% upside to its current price.

Exploring Other Perspectives

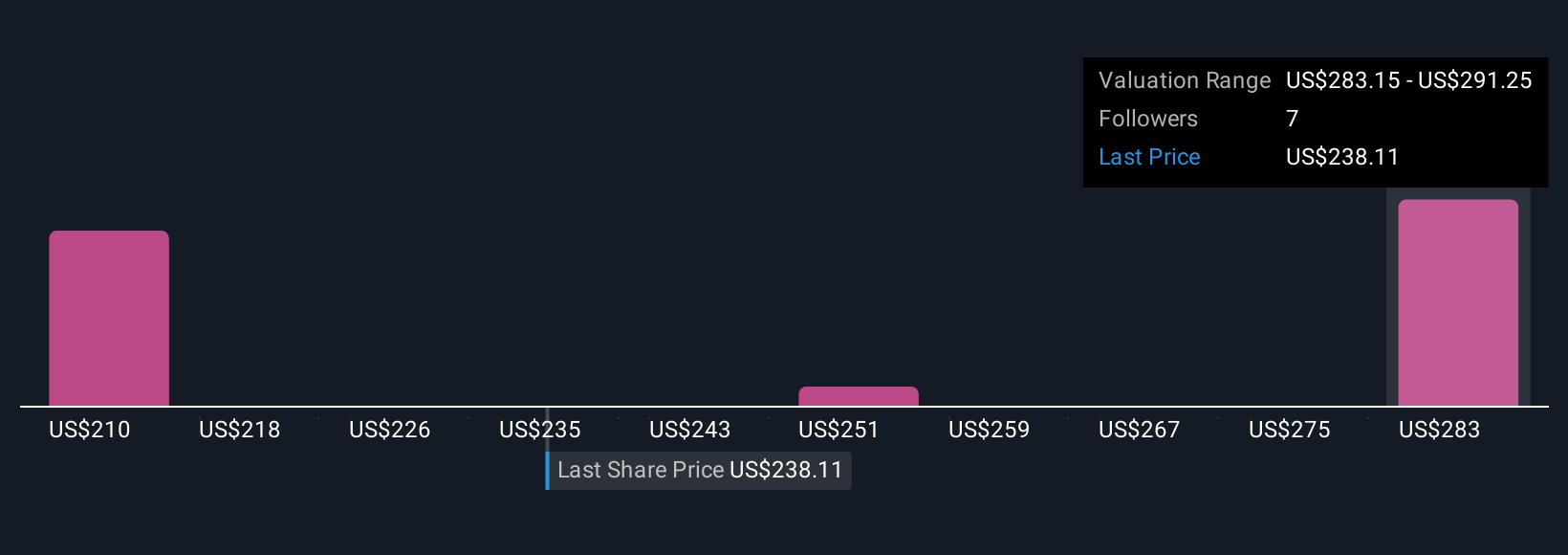

Fair value estimates from the Simply Wall St Community range from US$210.23 to US$291.25 across four perspectives, reflecting widely differing growth assumptions. As you weigh these divergent views, keep in mind that Woodward’s rising capital spending heightens execution risk and could influence future earnings if the new facility faces setbacks.

Explore 4 other fair value estimates on Woodward - why the stock might be worth 12% less than the current price!

Build Your Own Woodward Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Woodward research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Woodward research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Woodward's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal