CF Industries (CF): Evaluating Valuation Following CEO Succession Announcement

If you’re holding shares of CF Industries Holdings (CF), or considering whether now is the right time to invest, the company’s latest announcement is likely front and center. After more than a decade leading the company, CEO and president W. Anthony Will has officially set a January 2026 retirement date. Current executive vice president and chief operating officer Christopher D. Bohn is preparing to assume leadership. Leadership changes of this scale are uncommon, and markets tend to take notice, particularly when the outgoing executive has been closely tied to the company’s strategic direction and track record for delivering shareholder value.

This news arrives during a period when CF Industries has experienced a mix of short-term volatility and longer-term resilience. Over the past year, the stock has returned 7%. However, in the past three months, shares have declined 12%, indicating some recent momentum has diminished even as multi-year returns remain notable. It is worth noting that this transition follows other significant events for the company, including updates to its debt structure and new strategic initiatives in clean energy. These factors are shaping investor sentiment regarding the stock’s outlook and risk profile.

With these leadership changes and a recent pullback in share price, investors are considering whether this executive transition provides an opportunity to invest, or if the market has already accounted for any future growth CF Industries may achieve.

Most Popular Narrative: 9% Undervalued

The prevailing narrative views CF Industries Holdings as currently undervalued, suggesting room for upside if key assumptions hold true.

Substantial capital allocation to shareholder returns, with $2 billion in buybacks over 12 months and an additional $2.4 billion authorized, has inflated EPS and ROE. This may cause investors to overvalue shares based on recent financial engineering rather than sustainable operating profit trends.

Curious about why analysts think the market might be missing the real story? One critical set of projections quietly shapes this bullish fair value: forecasted shifts in profitability, shrinking margins, and a future price multiple lower than most industry peers. Want to uncover which numbers analysts believe set CF apart from other chemical stocks? Dive into the narrative to unveil the financial levers behind this apparent bargain.

Result: Fair Value of $93.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.Still, robust global food demand or faster adoption of low-carbon ammonia could bolster CF’s fundamentals. This could challenge more cautious views around valuation risk.

Find out about the key risks to this CF Industries Holdings narrative.Another View: Our DCF Model Weighs In

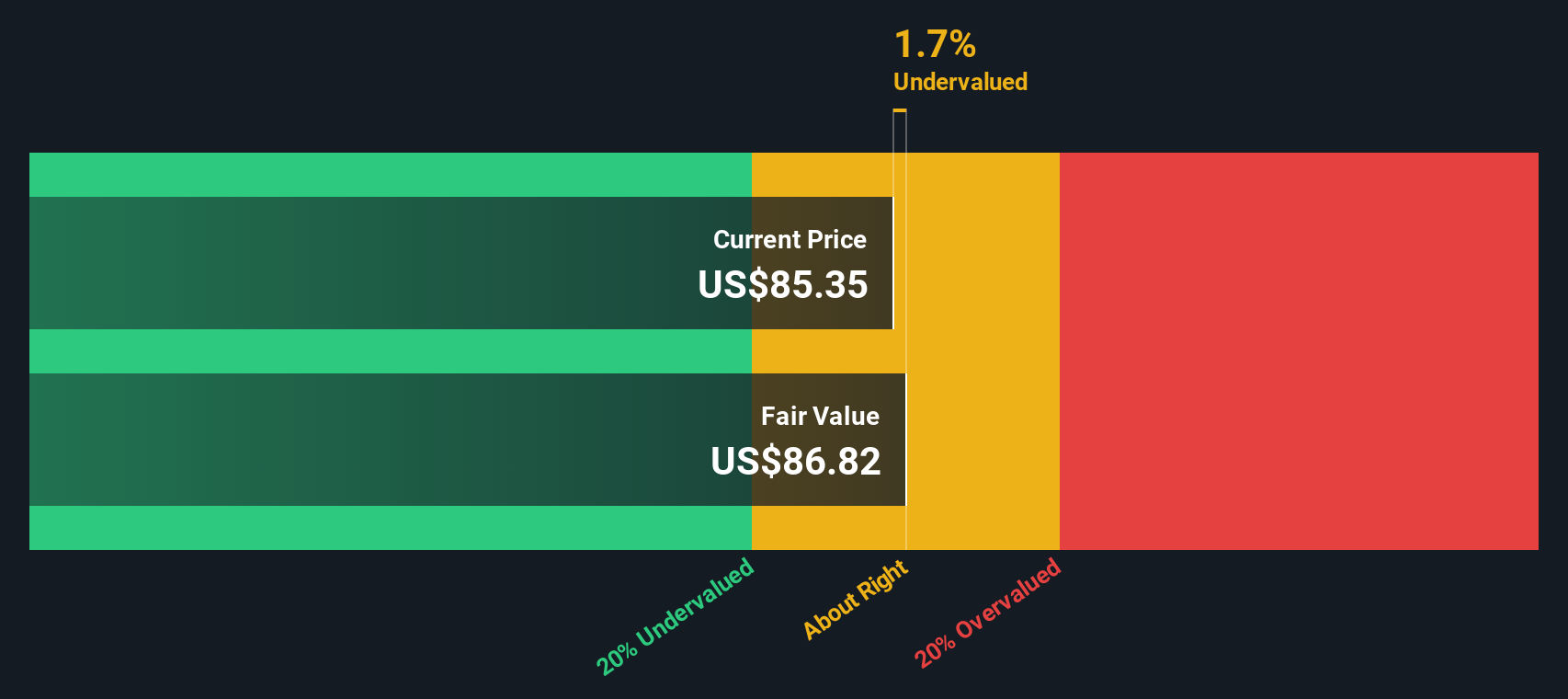

While the consensus price target suggests CF Industries is trading below fair value, our SWS DCF model takes a closer look at expected future cash flows. This approach currently also points to the shares being undervalued. But do both methods see the same upside, or are they capturing different risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CF Industries Holdings Narrative

If you have a different outlook, or simply prefer to rely on your own analysis, you can build your personalized view in just a few minutes. Do it your way.

A great starting point for your CF Industries Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Ideas?

Don’t let your next big opportunity slip by. Take action now and use these handpicked stock screens to spot the sectors and companies shaping tomorrow’s market leaders.

- Seize the potential of small caps making major moves with penny stocks with strong financials and catch emerging businesses before they hit the headlines.

- Boost your passive income by finding companies offering strong yields. Get started with dividend stocks with yields > 3% for reliable dividend opportunities above 3%.

- Tap into the future of medicine and technology by targeting innovators using healthcare AI stocks, where healthcare meets the latest breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal