Hawkins (HWKN) Valuation in Focus After Earning America's Greatest Companies 2025 Recognition

Hawkins (HWKN) just landed on Newsweek’s list of America’s Greatest Companies for 2025, stacking up new honors like the Great Place to Work Certification and a spot in Fortune’s Top Workplaces in Manufacturing and Production. These awards are not just shiny badges; they reflect Hawkins’ focus on workplace culture, sustainability, and a steady record of growth. For investors, news like this can be a signal that the market is paying fresh attention to the company’s reputation and its operational momentum.

If you look at the past year, Hawkins’ stock has returned about 44%, comfortably outpacing the broader market. Momentum has actually built up in recent months, with a nearly 24% climb over the past quarter alone. While the latest recognitions grabbed headlines, Hawkins has already been on an upward trend and consistently delivered in its key sectors, including water treatment, food and health sciences, and industrial solutions.

The real question for investors now is whether Hawkins’ recent gains mark the start of a new leg higher or whether the current price already reflects the company’s potential for future growth. Is there still value left to uncover?

Price-to-Earnings of 42.9x: Is it justified?

Based on the current price-to-earnings (P/E) ratio, Hawkins stock appears expensive relative to both the US Chemicals industry average and its peer group, as well as compared to its own estimated fair P/E ratio. This suggests a premium is being placed on the stock by the market.

The price-to-earnings ratio measures how much investors are willing to pay per dollar of earnings. For a company like Hawkins, which has enjoyed strong share price gains, a higher P/E could reflect optimism about future earnings growth or the company’s quality. However, when the P/E stands significantly above industry and peer benchmarks, it raises the question of whether future profit growth can justify the current price.

Analysts and investors may be anticipating continued operational momentum and sector leadership. However, the elevated multiple means much of the good news could already be reflected in the stock price. Unless Hawkins can deliver exceptional growth, the current valuation may be tough to sustain.

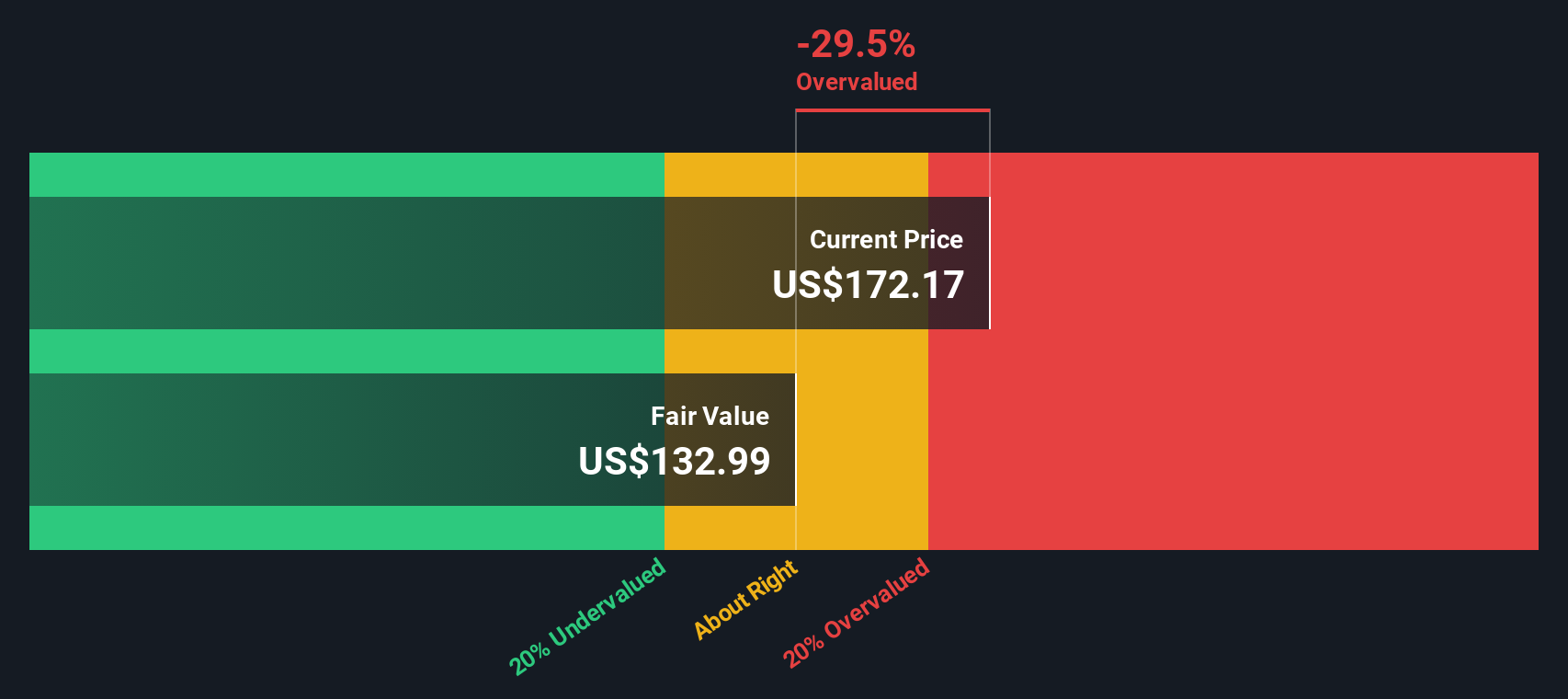

Result: Fair Value of $132.98 (OVERVALUED)

See our latest analysis for Hawkins.However, downside risks remain, including potential earnings disappointments and a recent share price that already trades above analyst targets.

Find out about the key risks to this Hawkins narrative.Another View: What Does Our DCF Model Say?

While the market is pricing Hawkins at a premium, our SWS DCF model offers another perspective. This approach currently points to the stock being overvalued as well, but does it capture all the momentum Hawkins has shown?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hawkins Narrative

If you want to dig deeper or come to your own conclusions, you can put together your own analysis and narrative in just a few minutes. Do it your way.

A great starting point for your Hawkins research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act now to spot the next opportunity. Don’t limit your research to just one stock when these innovative trends are moving the markets.

- Uncover potential bargains before the crowd by searching for undervalued standout stocks using our undervalued stocks based on cash flows.

- Target steady returns with established companies offering yields above 3% through our dividend stocks with yields > 3%.

- Catch the latest wave in artificial intelligence as you browse forward-thinking companies with our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal