Goldman Sachs (GS) Valuation in Focus as Analyst Optimism Rises on Strong Earnings Momentum

If you’ve been tracking Goldman Sachs Group (GS) lately, you know the company has found its way back into the market spotlight. The real trigger this time is a fresh wave of optimism from Wall Street. Multiple analyst firms have reaffirmed their positive outlook and cited a stronger-than-expected earnings trajectory ahead. While some headlines have mentioned the recent partnership with T. Rowe Price, the consensus is that most of the momentum is coming from the improved sentiment around Goldman’s core businesses rather than any single headline deal.

This uptick in confidence isn’t just academic; the stock is up nearly 9% over the past month, comfortably beating both the Finance sector and the broader S&P 500 index. Looking at the bigger picture, this caps off a year where momentum has steadily accelerated, supported by Goldman’s knack for outperforming consensus estimates quarter after quarter. The market appears to be cheering on management’s ability to deliver stronger profitability and steady revenue growth, all while keeping risk in check amid a changing macro backdrop.

After a breakout stretch and widely anticipated earnings, investors have to ask if Goldman’s current price leaves room for further upside, or if all those positive expectations are already baked in.

Most Popular Narrative: 13% Overvalued

The most widely followed narrative currently sees Goldman Sachs as overvalued by about 13% based on its future earnings potential and risk factors, using a discount rate just below 10%.

Record growth and momentum in Asset & Wealth Management, including strong fee-based net inflows for 30 consecutive quarters and rising demand for alternative assets from high-net-worth and institutional clients, are shifting the revenue mix toward less volatile, high-margin streams. This is supporting higher and more durable net margins.

Curious why analysts think Goldman’s current price is running too hot? There is a bold set of financial assumptions behind the scenes. Discover which future profit drivers and margin shifts they are using to peg a value much lower than today’s trading price. Find out what analysts are really betting on with their sharper discount rate and sector-beating forecast assumptions.

Result: Fair Value of $710.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent geopolitical uncertainty and shifting regulatory requirements could quickly challenge these bullish assumptions. This may cause expectations to reset for Goldman Sachs.

Find out about the key risks to this Goldman Sachs Group narrative.Another View: Multiple-Based Valuation Tells a Different Story

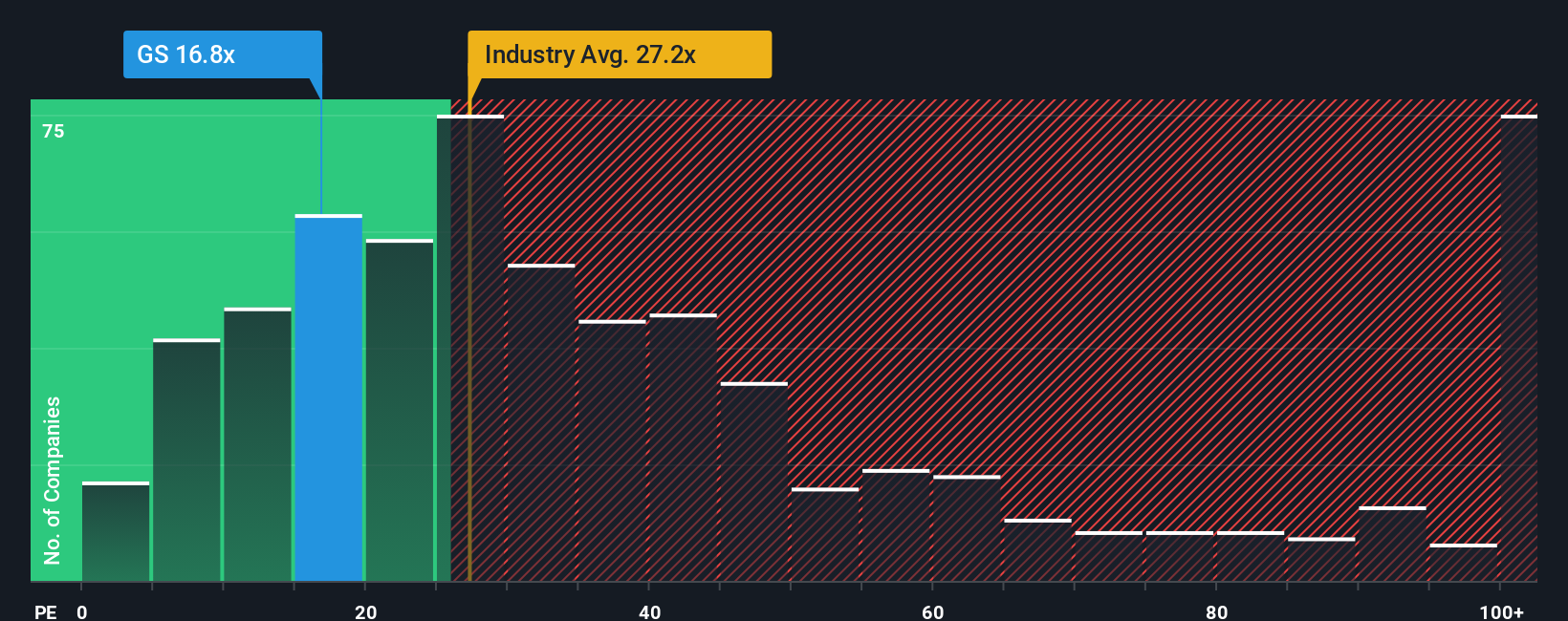

By comparing Goldman Sachs to the wider industry using a standard earnings measure, the picture shifts. This approach actually suggests the stock looks good value next to peers and challenges the more cautious outlook above. Which method will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Goldman Sachs Group Narrative

If you see things differently or want to build your own case from the data, you can shape a fresh perspective in just a few minutes. Do it your way.

A great starting point for your Goldman Sachs Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t wait for the next big story to hit the headlines. Get ahead now by tapping into unique opportunities using the Simply Wall Street Screener. The latest market leaders and hidden gems are just a click away, offering you a powerful edge.

- Supercharge your potential returns by scanning for undervalued companies primed for growth with our selection of undervalued stocks based on cash flows.

- Target strong cash flows and future-ready innovation with top picks in AI penny stocks leading the AI transformation in multiple sectors.

- Maximize your income stream and hedge market swings by focusing on companies known for reliable returns through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal