Does LEG’s Georgetown Plant Closure Signal a Shift in Operational Efficiency Strategy?

- Leggett & Platt recently announced it will permanently close its Georgetown Adjustable Bed operation by early 2026, resulting in phased layoffs of approximately 100 to 122 employees due to difficult business conditions and a focus on operational efficiency.

- This decision marks a significant move in the company’s ongoing operational restructuring efforts and reflects management’s response to ongoing market and cost challenges.

- We’ll explore how the Georgetown facility closure and associated job cuts influence Leggett & Platt’s cost structure and future investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Leggett & Platt Investment Narrative Recap

Leggett & Platt’s investment story centers on faith in an eventual rebound in bedding demand, successful cost controls, and operational streamlining to support earnings stability. The Georgetown facility closure represents a tactical move within this broader restructuring, but it does not materially change the most immediate catalyst for the business, tariff enforcement offering pricing relief for domestic producers, or mute the ongoing risk of weak residential bedding sales dragging on growth in the near term. Among recent company developments, the most relevant to these operational changes is Leggett & Platt’s updated earnings guidance issued in late August, which signals improved margin expectations despite lower sales forecasts. This context frames the Georgetown closure as part of a larger effort to embed cost savings and efficiency across the business rather than an isolated event. However, investors should keep in mind that even with efficiency gains, persistent softness in bedding demand remains a risk if...

Read the full narrative on Leggett & Platt (it's free!)

Leggett & Platt's outlook forecasts $4.3 billion in revenue and $200.1 million in earnings by 2028. This assumes a 0.7% annual revenue decline and a $57.9 million increase in earnings from the current $142.2 million level.

Uncover how Leggett & Platt's forecasts yield a $9.67 fair value, a 3% upside to its current price.

Exploring Other Perspectives

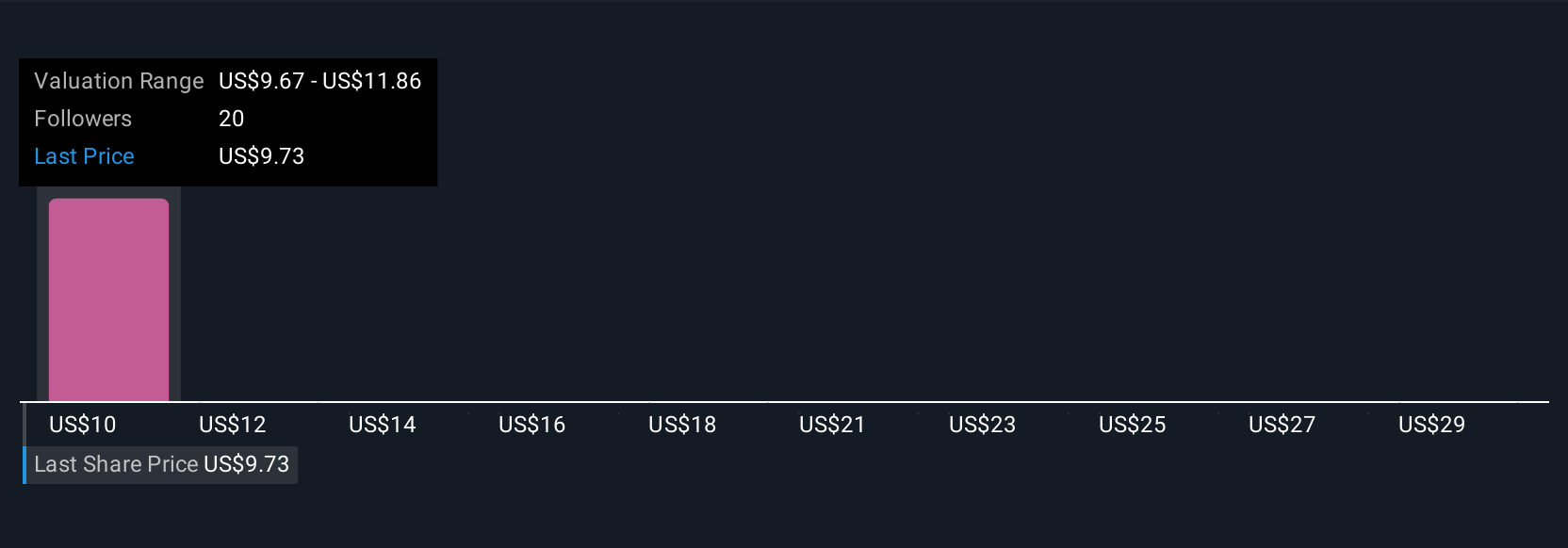

Seven community members on Simply Wall St valued Leggett & Platt between US$9.67 and US$31.63 per share. With this range in mind, consider how ongoing residential bedding demand uncertainty could sway future expectations and invite you to explore diverse viewpoints on the company’s outlook.

Explore 7 other fair value estimates on Leggett & Platt - why the stock might be worth just $9.67!

Build Your Own Leggett & Platt Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leggett & Platt research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Leggett & Platt research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leggett & Platt's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal