Is PennyMac Financial Services' (PFSI) Transparency Drive a New Signal for Management Credibility?

- Earlier this week, PennyMac Financial Services delivered an investor update at the Barclays Global Financial Services Conference, outlining recent company initiatives and performance drivers.

- This event drew renewed attention from major analysts, highlighting increased management engagement and ongoing transparency as factors supporting investor interest during economic uncertainty.

- We'll now explore how the company’s recent analyst meetings and investor updates may influence its longer-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

PennyMac Financial Services Investment Narrative Recap

To be a shareholder in PennyMac Financial Services, you generally need to believe in the company's ability to leverage its large servicing book and technology-driven efficiencies, even while navigating challenges in the mortgage market. The recent stock surge and positive analyst sentiment reaffirm strong investor confidence, but the most immediate catalyst, mortgage origination volume, remains closely linked to the macro interest rate environment, and this latest update does not materially reduce the risk from potential rate hikes or sustained high rates.

Among recent announcements, the launch of a new suite of non-qualified mortgage (non-QM) products stands out as most relevant for investors watching catalysts tied to growth. This expanded product offering targets borrowers not served by traditional mortgage products and aims to capture incremental market share, which could bolster origination volumes if market demand materializes.

However, in contrast to recent optimism, investors should also be aware that ongoing volatility in the value of mortgage servicing rights could quickly shift sentiment if...

Read the full narrative on PennyMac Financial Services (it's free!)

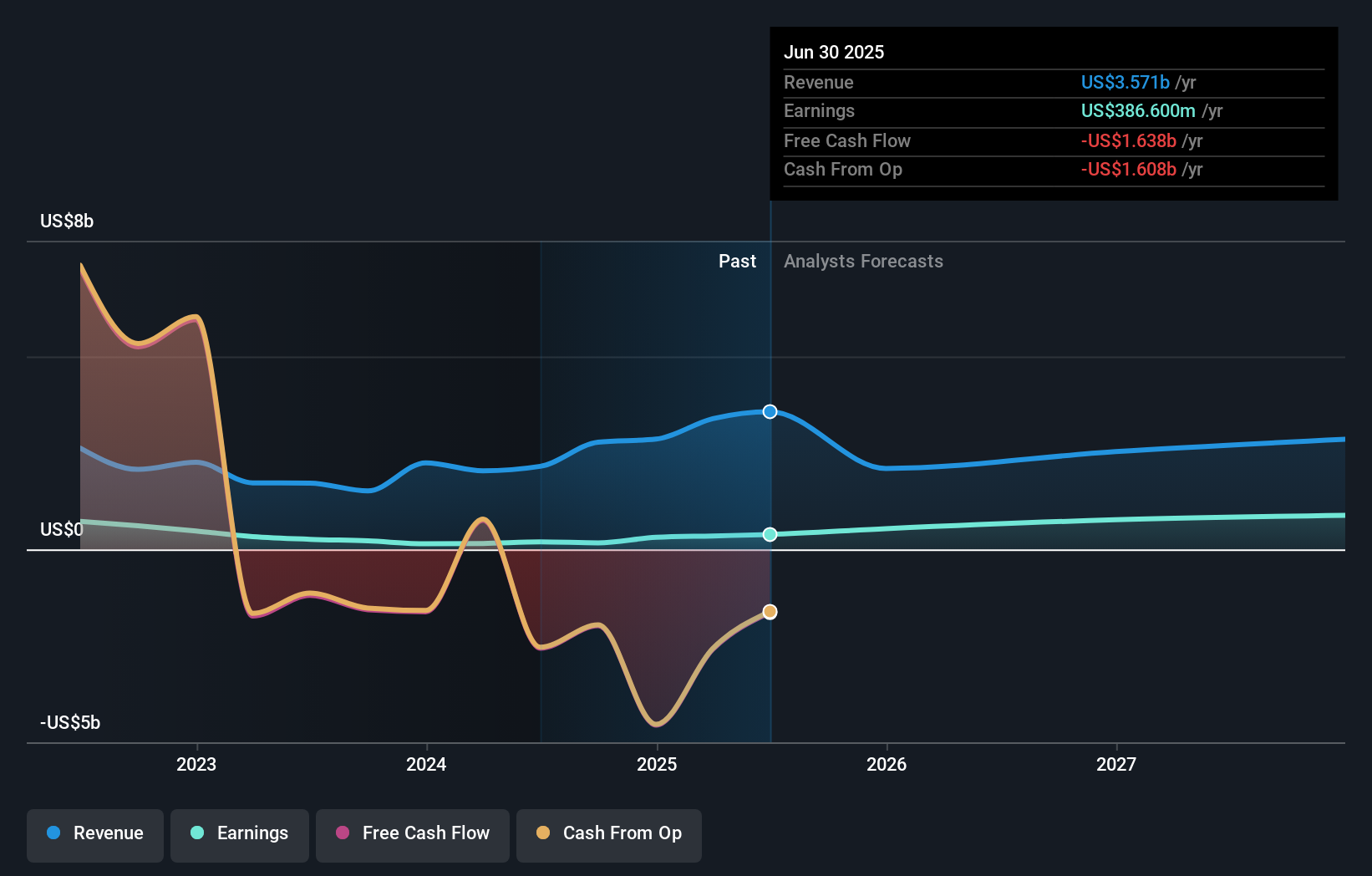

PennyMac Financial Services is projected to reach $2.5 billion in revenue and $1.1 billion in earnings by 2028. This outlook reflects an annual revenue decline of 11.0% and an earnings increase of $713.4 million from current earnings of $386.6 million.

Uncover how PennyMac Financial Services' forecasts yield a $122.29 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community offered just one fair value estimate at US$122.29 for PennyMac shares, before the recent news and price movement. While investor outlooks differ widely, it is worth considering the ongoing risk that persistent high interest rates may pressure future mortgage activity and influence financial stability.

Explore another fair value estimate on PennyMac Financial Services - why the stock might be worth as much as $122.29!

Build Your Own PennyMac Financial Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PennyMac Financial Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PennyMac Financial Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PennyMac Financial Services' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal