Will Higher H-1B Visa Fees Force a Shift in H&R Block's (HRB) Workforce Strategy?

- On September 21, 2025, President Donald Trump enacted an executive order introducing an annual US$100,000 fee for each H-1B visa application or renewal, significantly raising costs for companies that depend on skilled foreign workers.

- This sweeping immigration change is driving some firms to contemplate relocating operations overseas and is expected to reshape hiring strategies for major players in technology, finance, and related sectors.

- We’ll examine how these heightened H-1B visa costs could influence H&R Block’s outlook, particularly given its technology workforce needs.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

H&R Block Investment Narrative Recap

To be a shareholder in H&R Block, you need to believe in the company’s ability to defend its market share, capitalize on ongoing tax code complexity, and expand digital offerings despite competitive threats and changing consumer preferences. The new US$100,000 H-1B visa fee may raise costs or disrupt technology staffing, but for now, the key short-term catalyst, growth in digital and hybrid tax solutions, remains largely unchanged, while persistent risk centers on losing share to digital-first competitors.

The appointment of Jason Lenhart as Chief Technology Officer in August is particularly relevant as H&R Block continues to enhance its digital tax platforms and AI-powered features. This announcement signals an ongoing commitment to digital transformation, which is critical in the face of both industry competition and increased labor challenges brought on by recent visa policy changes.

However, while these digital initiatives are promising, investors should be mindful that, unlike rising tech workforce investment, H&R Block’s fixed costs and brick-and-mortar model could limit flexibility if...

Read the full narrative on H&R Block (it's free!)

H&R Block's outlook forecasts $4.1 billion in revenue and $653.0 million in earnings by 2028. This is based on an expected 3.0% annual revenue growth rate and a $46.3 million increase in earnings from the current $606.7 million.

Uncover how H&R Block's forecasts yield a $55.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

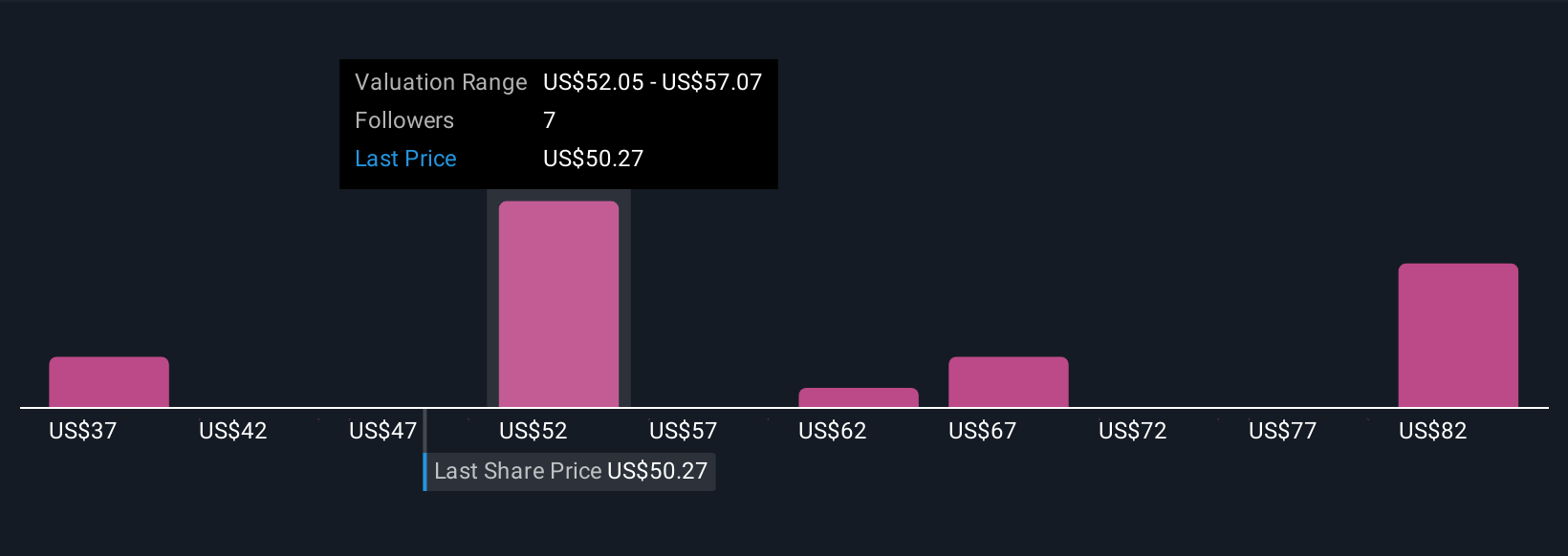

Seven private investors in the Simply Wall St Community estimate H&R Block’s fair value from US$37.00 to US$87.17 per share. As competition from digital-first disruptors intensifies, you should compare these wide-ranging views to your own analysis of H&R Block’s resilience and future prospects.

Explore 7 other fair value estimates on H&R Block - why the stock might be worth 26% less than the current price!

Build Your Own H&R Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H&R Block research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free H&R Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H&R Block's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal