Should M/I Homes' (MHO) Expanded Credit Facility Signal a Shift in Growth and Risk Strategy?

- On September 18, 2025, M/I Homes announced it amended its unsecured revolving credit facility, raising lender commitments to US$900 million from US$650 million and extending the maturity to September 18, 2030, while also lowering borrowing costs and increasing inventory advance rates.

- This expanded facility, combined with no outstanding borrowings and US$800 million in cash reserves, gives M/I Homes increased flexibility to fund growth initiatives and manage future market uncertainties.

- We’ll examine how this expanded borrowing capacity and improved credit terms may influence M/I Homes’ outlook for growth and risk management.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

M/I Homes Investment Narrative Recap

To be a shareholder in M/I Homes, you need to believe that U.S. housing demand will remain resilient, supporting the company’s community expansion strategy despite near-term pressures from higher interest rates and margin compression. The recent upsizing and extension of M/I Homes’ revolving credit facility strengthen the balance sheet, but these new borrowing capabilities do not materially offset the company’s short-term challenges, such as declining contract trends and ongoing margin pressures.

Among recent company announcements, the upcoming Q3 earnings release on October 22, 2025, stands out as particularly relevant. With forecasts calling for year-over-year declines in both earnings per share and revenue, it will provide a key data point for assessing whether enhanced financial flexibility from the expanded credit facility can help mitigate risks from weaker demand and margin headwinds.

However, investors should also be aware that growing reliance on inventory homes to drive near-term closings carries rising risks if absorption rates slow, potentially leading to...

Read the full narrative on M/I Homes (it's free!)

M/I Homes is projected to reach $4.9 billion in revenue and $470.5 million in earnings by 2028. This outlook is based on an anticipated 2.8% annual revenue growth rate, with earnings expected to decrease by $40.9 million from the current $511.4 million.

Uncover how M/I Homes' forecasts yield a $162.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

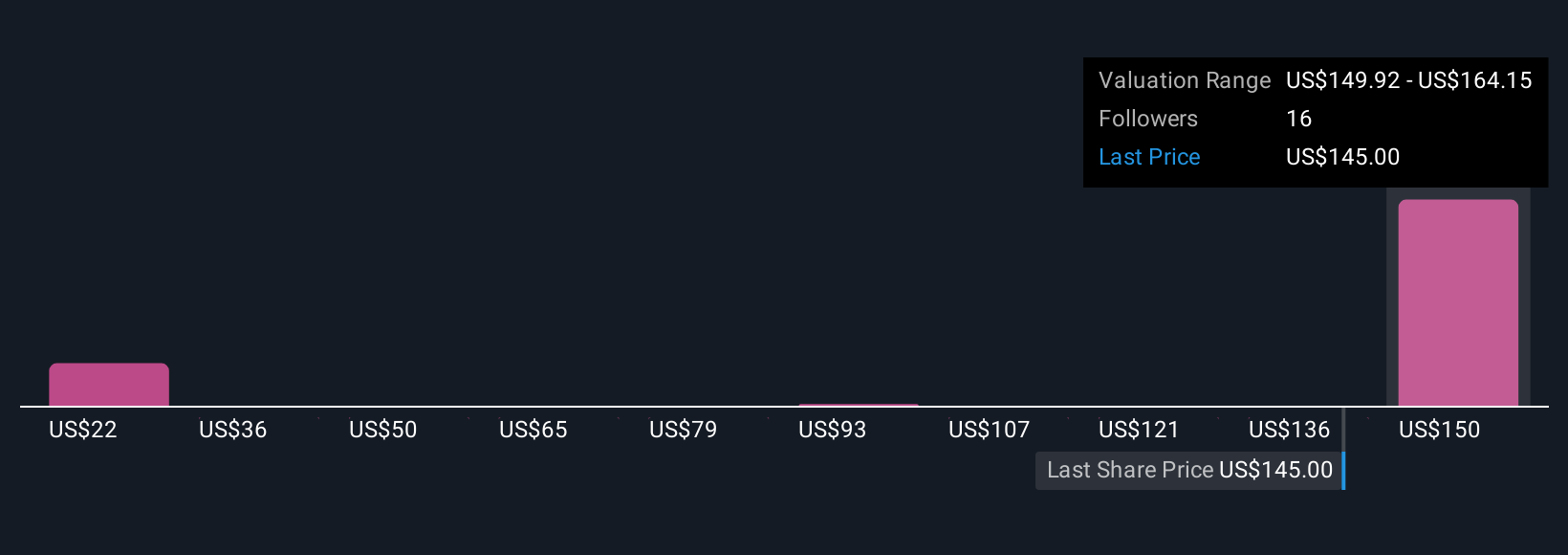

Four Simply Wall St Community fair value estimates for M/I Homes range widely from US$21.87 to US$164.15 per share. With concerns about margin compression and softening contract activity, readers can explore these differing viewpoints to better understand how such risks may affect share price outcomes.

Explore 4 other fair value estimates on M/I Homes - why the stock might be worth as much as 11% more than the current price!

Build Your Own M/I Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your M/I Homes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free M/I Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate M/I Homes' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal