Frontier Communications (FYBR): Assessing the Valuation Behind Recent Quiet Momentum

If you have been following Frontier Communications Parent (FYBR), you may have noticed that its stock movement lately could raise some eyebrows. There hasn’t been a single headline-grabbing event to explain the trend, but the share’s steady shift is prompting investors to consider whether something is brewing beneath the surface. It’s the kind of situation where you might pause and wonder if the current price tells the full story, or if the market is hinting at a change in sentiment.

Looking at the past year, Frontier Communications Parent has delivered a 4% total return, but the pace has picked up in recent months, with the stock climbing over the past quarter and since the start of the year. There have been no dramatic announcements, yet gentle momentum is building, leaving investors curious whether the company’s improving fundamentals or expectations for future growth are behind the quiet rally.

With steady but unspectacular gains on the chart, is Frontier Communications Parent offering investors an undervalued growth story, or is the market already factoring in everything it knows?

Price-to-Sales Ratio of 1.5x: Is It Justified?

Frontier Communications Parent is currently trading at a Price-to-Sales (P/S) ratio of 1.5x, which is higher than both its peer average and the broader US Telecom industry average of 1.3x. This figure suggests the market is attaching a premium to each dollar of FYBR's revenues compared to its competitors.

The Price-to-Sales ratio is commonly used to assess how much investors are willing to pay per dollar of sales. In capital-intensive sectors like telecom, where profitability can fluctuate, the P/S ratio can provide a different perspective on valuation. It is especially relevant for companies that have yet to achieve consistent profits, such as FYBR.

This implies that investors may be betting on future growth, turnaround prospects, or some unique quality in FYBR that warrants a premium, despite the company's current unprofitability and slower-than-market revenue growth. However, current multiples suggest the stock could be seen as overvalued based on this measure unless future operating performance improves significantly.

Result: Fair Value of $24.80 (OVERVALUED)

See our latest analysis for Frontier Communications Parent.However, continued losses and reliance on future growth could become concerns if revenue momentum stalls or if market sentiment shifts unexpectedly.

Find out about the key risks to this Frontier Communications Parent narrative.Another View: What Does the SWS DCF Model Suggest?

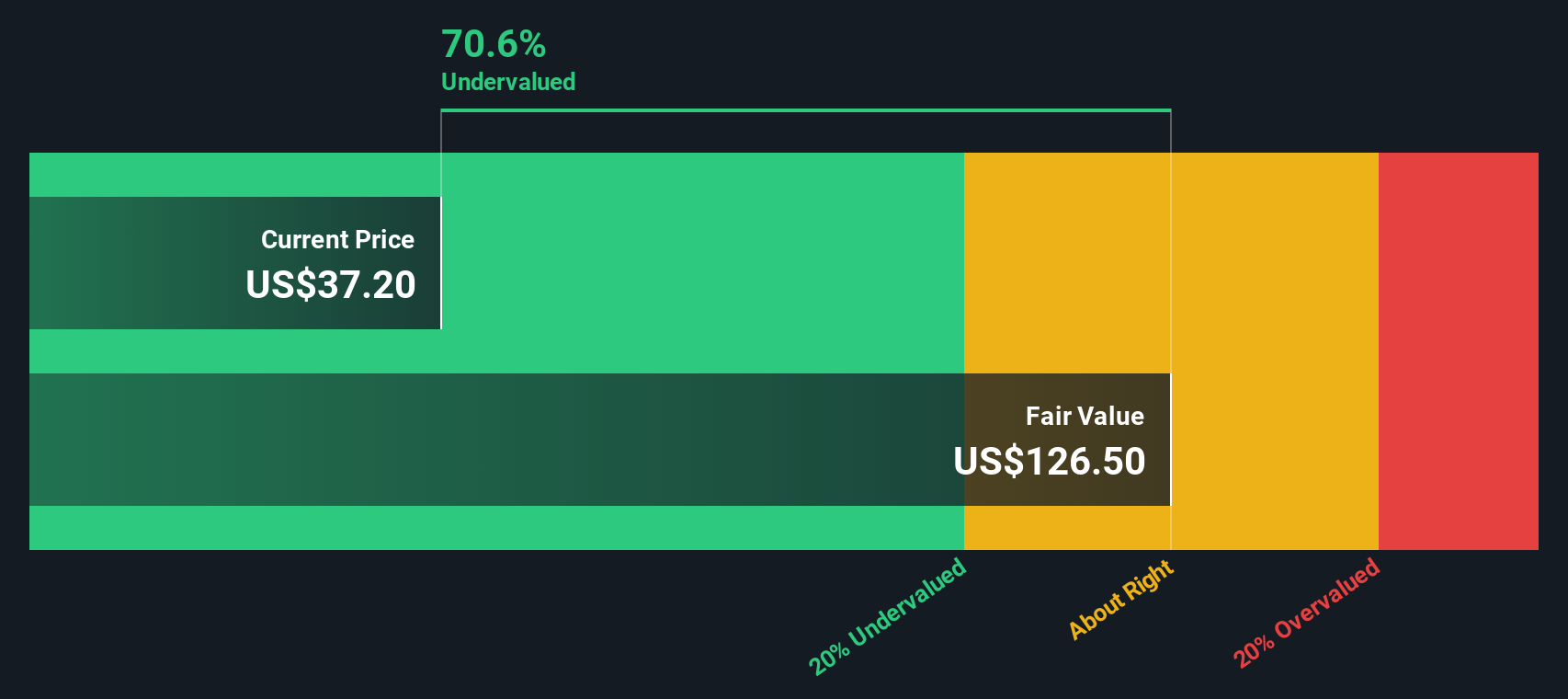

While the current market price appears high when compared to revenues, our SWS DCF model presents a completely different perspective. It indicates the stock might actually be undervalued based on future cash flows. Could the long-term outlook be more optimistic than the surface suggests?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Frontier Communications Parent Narrative

If you have a different perspective on Frontier Communications Parent or want to dig deeper into the numbers yourself, try building your own story around the data. It only takes a few minutes. Do it your way

A great starting point for your Frontier Communications Parent research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for Your Next Investment Move?

Don’t let a single stock define your strategy. The smartest investors constantly look for new opportunities, and you could uncover tomorrow’s winners today.

- Supercharge your search for overlooked gems with penny stocks with strong financials to uncover up-and-comers with real financial strength before the crowd catches on.

- Tap into the AI revolution by finding tomorrow’s tech trailblazers through AI penny stocks, which are pushing boundaries in artificial intelligence innovation.

- Get a head start on value by screening for market underdogs using undervalued stocks based on cash flows and see which companies could be seriously mispriced right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal