JPMorgan Chase (JPM): Evaluating Valuation After Renewed Plaid Partnership Highlights Open Banking Commitment

JPMorgan Chase (JPM) and Plaid are in the headlines again, this time for renewing their long-standing data access agreement. If you have been weighing what to do with JPMorgan shares, this latest move is designed to reinforce the bank’s commitment to safe, seamless fintech partnerships and consumer data privacy. As open banking becomes central to how financial professionals and consumers manage money, JPMorgan’s choice to double down on security and collaboration could reshape how investors see its position in the evolving financial landscape.

This agreement comes as JPMorgan’s stock has steadily climbed. The share price is up over 52% in the past year and has recorded a 13% return across the past three months, suggesting bullish momentum. The bank has also announced a quarterly dividend hike and continued to raise capital through new bond offerings, all while making executive moves and updating bylaws. In short, JPMorgan seems determined to keep pace with changes in tech and finance while rewarding shareholders along the way.

After such a strong run, the real question is whether JPMorgan’s current pricing reflects all this innovation and growth or if there is an opportunity to buy in before the market fully catches up.

Most Popular Narrative: 2.8% Overvalued

According to the most widely followed narrative, JPMorgan Chase shares are currently trading slightly above fair value when compared to analysts’ consensus expectations for the company's future performance.

The firm's diversified model, marked by balanced growth across CIB, Card, Asset/Wealth Management, and international expansion, along with robust deal pipelines, positions it to gain share and demonstrate resilience across macro cycles. This should underpin stable or increasing earnings even as economic conditions shift.

Curious about the hidden math driving this valuation? The narrative depends on critical projections about JPMorgan’s future profitability, sales momentum, and the profit multiples investors may be willing to pay years from now. If you want to uncover which pivotal forecasts give JPMorgan its current price edge, the answers are hiding just below the surface.

Result: Fair Value of $306.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying fintech competition and tighter regulations could quickly shift the outlook and challenge JPMorgan's ability to sustain margins and growth.

Find out about the key risks to this JPMorgan Chase narrative.Another View: DCF Flips the Script

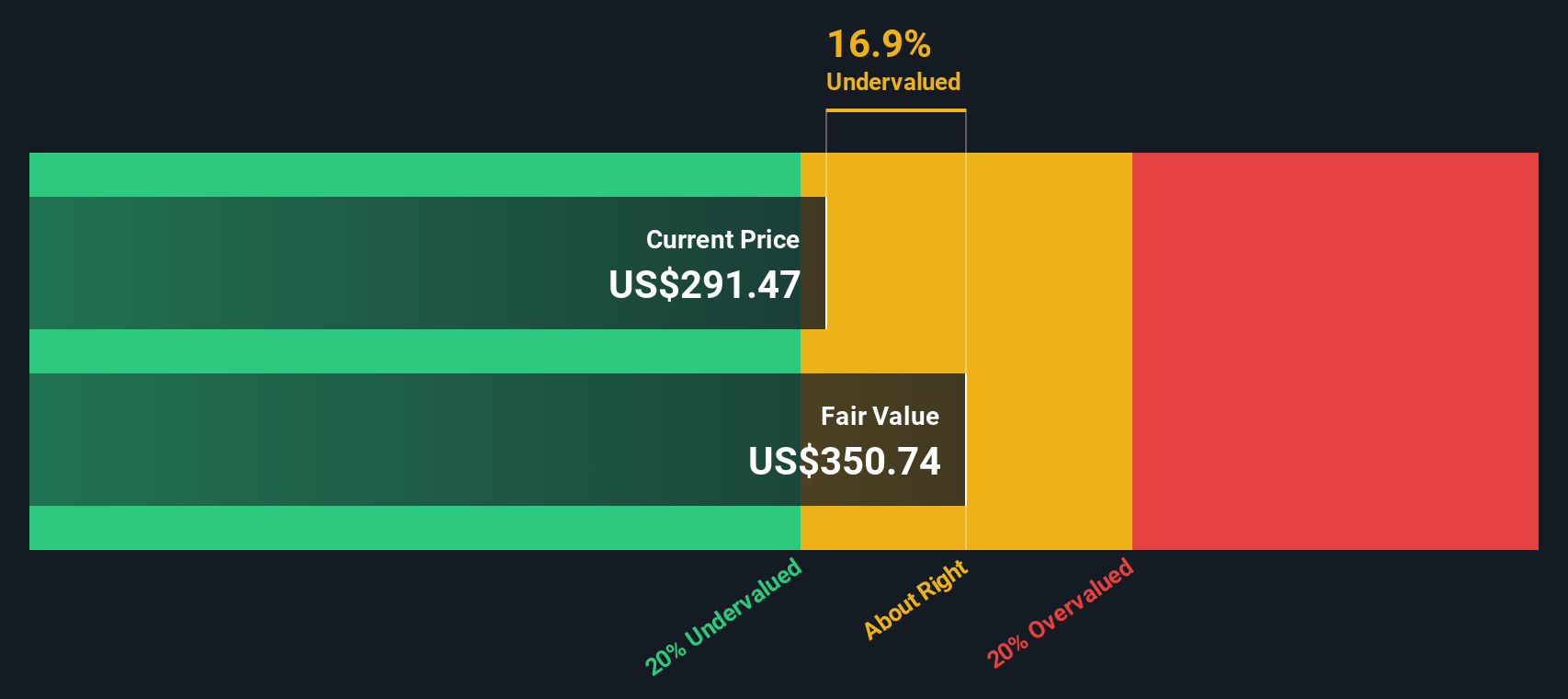

While analyst price targets suggest JPMorgan shares are slightly overvalued, our SWS DCF model tells a different story. The model suggests the stock is trading below its fair value. Could this be a hidden opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own JPMorgan Chase Narrative

If you believe there is more to JPMorgan’s story or want to dig deeper into the numbers yourself, you can build your own analysis and narrative in just a few minutes. Do it your way

A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Expand your watchlist with high-potential companies that can energize your portfolio using our unique stock screens and tailored research tools.

- Turbocharge your passive income by targeting companies offering yields above 3% right through our dividend stocks with yields > 3%.

- Spot tomorrow’s artificial intelligence leaders early by hunting for growth champions in our AI penny stocks.

- Seize undervalued winners poised for a market rebound using insights from our exclusive undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal