Can Macy's Recent 29% Rally Continue After Takeover Offer Boosts Shares?

If you are considering what to do with Macy's stock, you are not alone. Many investors are looking at the retailer's recent rally and wondering if now is the time to buy, hold, or cash out. Over the past thirty days, Macy's stock has surged 29.2%, pushing its one-year return to an impressive 20.6%. Even more striking is the five-year gain of 243.6%, showing that this classic department store has rewarded shareholders through ups and downs. Such strong performance recently can be linked in part to shifting market sentiment, with investors believing that traditional retailers like Macy's may be adapting better than expected to the changing retail landscape.

Of course, any discussion about what comes next for Macy's has to address the question of valuation. Is this run supported by fundamentals, or have things gotten stretched? By running the numbers through six widely used valuation checks, Macy's passes four, which earns the company a value score of 4 out of 6. That is a strong result, but what actually goes into those checks? Could there be a better way to assess the stock's true value?

Why Macy's is lagging behind its peersApproach 1: Macy's Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model aims to figure out what a business is really worth by forecasting its future cash flows and then discounting them back to their present value using a chosen rate. This approach provides a grounded estimate of a company's intrinsic value based on expected real-world performance.

For Macy's, the most recent Free Cash Flow (FCF) stands at $457.7 Million, with analysts projecting growth in the coming years. Based on analyst and Simply Wall St estimates, FCF is expected to rise, reaching about $441.8 Million by 2035 after peaking above $650 Million in 2026. These projections factor in both optimistic analyst opinions for the near term and more conservative, extrapolated estimates for later years.

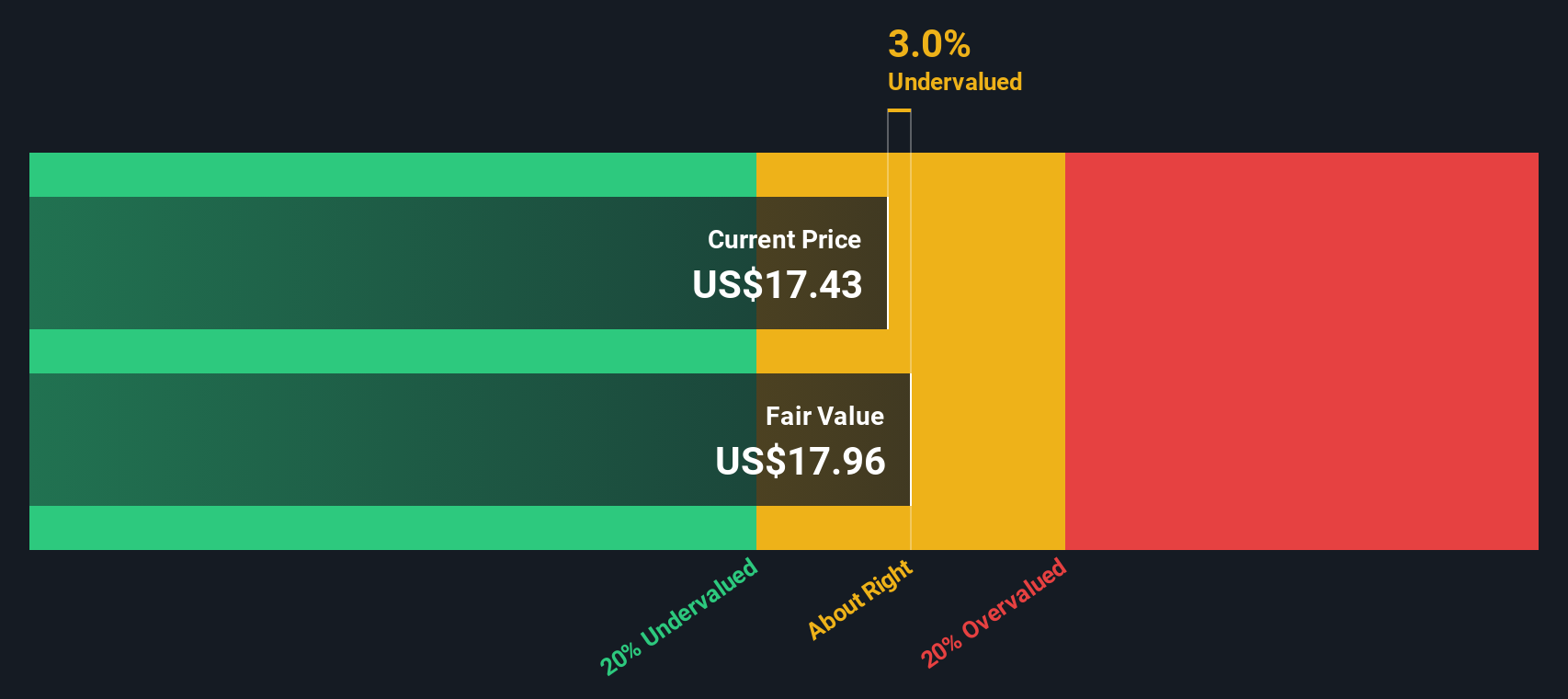

Applying the DCF model, Macy's fair value is calculated at $18.00 per share. Compared to the current market price, this figure implies the stock is trading at a 2.5% discount. This suggests shares are about in line with what the fundamentals suggest they are worth.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Macy's.

Approach 2: Macy's Price vs Earnings (PE Ratio)

The price-to-earnings (PE) ratio is widely regarded as a valuable measure for assessing profitable companies because it directly relates a company’s market price to its bottom-line earnings. For investors, the PE ratio tells you how much you are paying for one dollar of current earnings and is a quick barometer for market sentiment about a company's future.

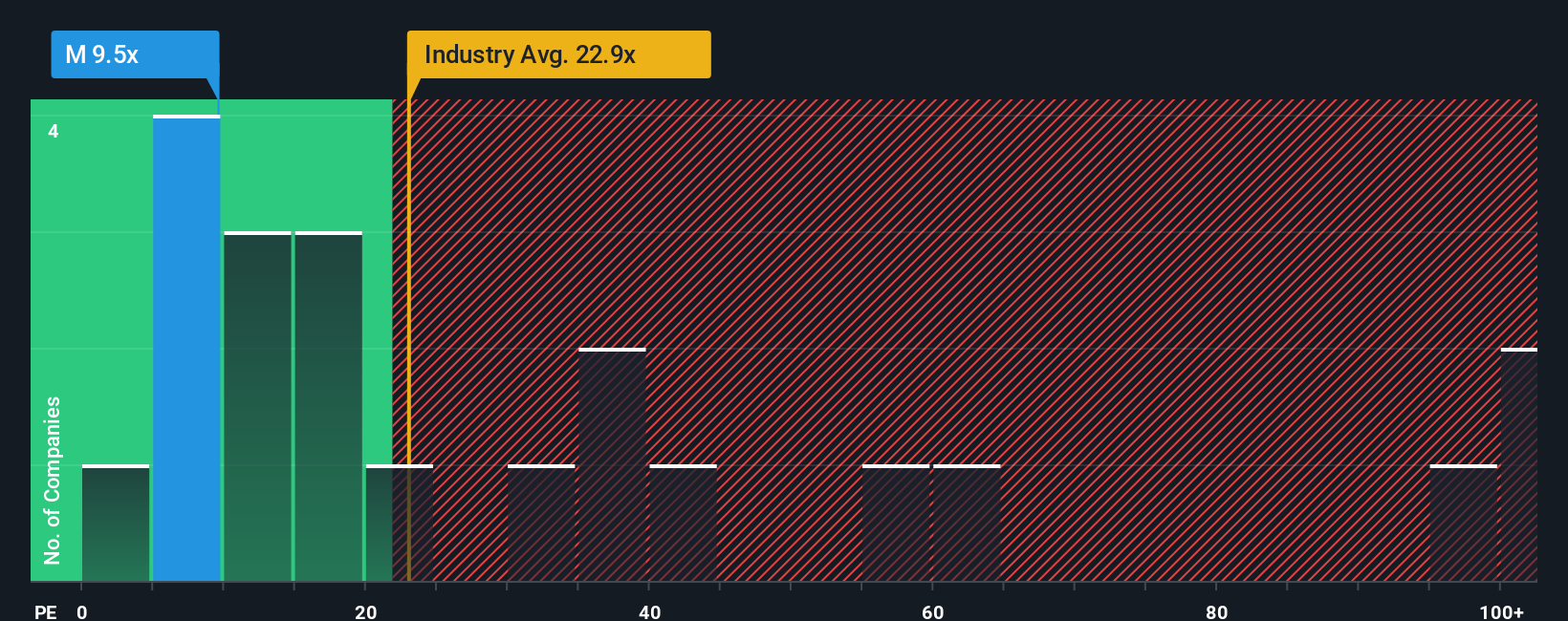

The "right" PE ratio can vary depending on expectations for future growth and the risk profile of the business. Higher growth companies typically command higher PE ratios, while companies with more uncertainty or risk tend to have lower ones. For Macy's, the current PE stands at 9.54x, which is markedly lower than both the industry average of 22.90x and the typical peer at 18.52x. On the surface, this could make Macy's look cheap relative to its competitors.

To provide a more nuanced perspective, Simply Wall St calculates a “Fair Ratio” in this case, 16.24x which factors in Macy’s growth outlook, profit margins, market capitalization, industry landscape, and risk profile. Unlike a straightforward peer or industry comparison, the Fair Ratio is designed to capture Macy’s unique situation, offering a more tailored benchmark for valuation.

Since Macy’s actual PE is lower than its Fair Ratio, the stock appears to be undervalued by this metric, suggesting room for upside if market sentiment improves.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Macy's Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful way for investors to express their view of Macy’s future by building a story around the numbers: your assumptions about future revenue, earnings, margins, and ultimately, a fair value for the stock.

Narratives link the company’s story, such as real estate sales or digital growth, directly to a financial forecast and then calculate a fair value. This approach makes it easy to move from big-picture thinking to concrete investment decisions.

On Simply Wall St’s Community page, millions of investors are using Narratives as an accessible tool to capture their own outlooks and instantly compare their “fair value” estimates to the current price. This helps guide decisions on whether to buy, hold, or sell.

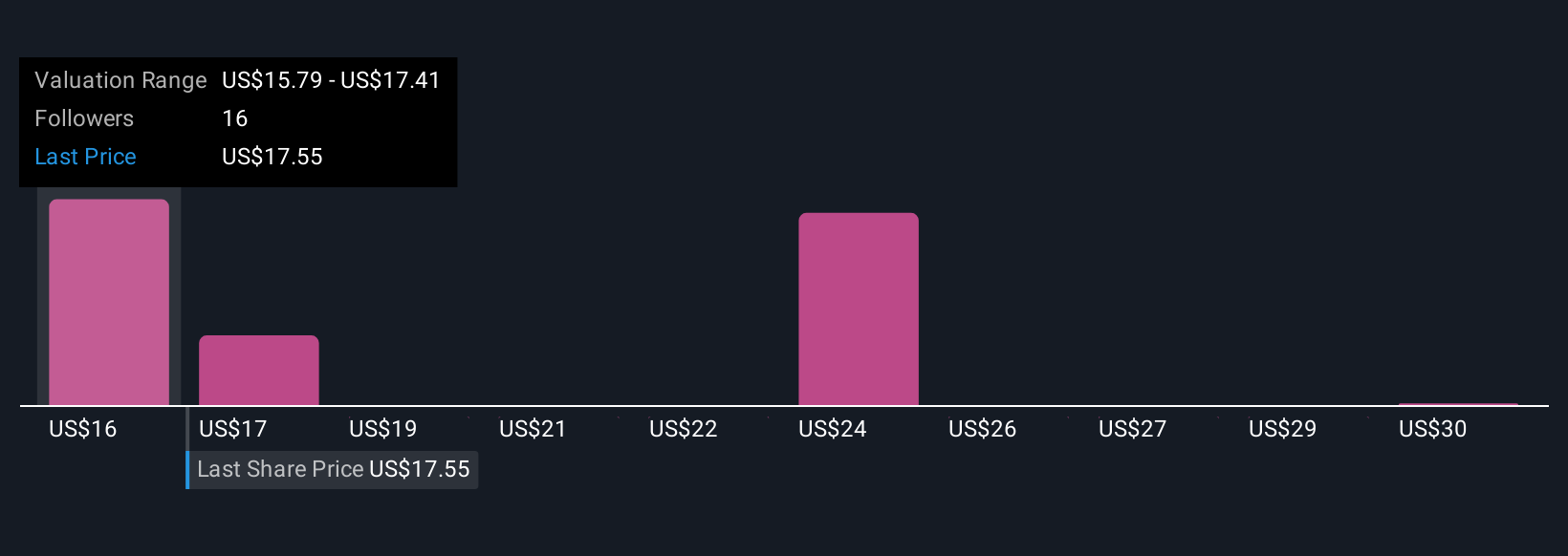

Importantly, Narratives are dynamic. When new information like earnings, guidance, or major news comes in, forecasts and fair values update automatically, giving you the latest view without any extra work. For example, some investors currently see Macy’s fair value as high as $24.43 per share, reflecting optimism about real estate and e-commerce potential. Others put it closer to $15.79, highlighting ongoing challenges in retail and store closures.

For Macy's, however, we'll make it really easy for you with previews of two leading Macy's Narratives:

🐂 Macy's Bull CaseFair Value: $24.43

Current price is 28.1% below this fair value

Assumed Revenue Growth Rate: 5.57%

- Macy’s owns valuable real estate and aims to raise $600 million to $750 million from sales, which will support debt repayment and investments.

- Its $7+ billion in annual digital sales make it a top US e-commerce player, with new efforts to monetize online traffic.

- Bear risks include years of store closures without clear business recovery, as well as declining sales and profit margins, with share prices vulnerable to takeover disappointments.

Fair Value: $15.79

Current price is 11.1% above this fair value

Assumed Revenue Growth Rate: -6.11%

- Omni-channel investments and store optimization should improve margins, efficiency, and broaden Macy’s customer base, especially through luxury and off-price brands.

- Success depends on continued modernization and productivity gains, but Macy’s faces strong e-commerce competition and relies on discretionary spending.

- According to analysts, the current price is just over fair value, assuming future revenue and margin improvement, but risks include greater margin pressures and falling behind online rivals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal