KLA (KLAC): Revisiting Valuation After Major Capital Infusions Into Semiconductor Manufacturing

If you’ve been keeping an eye on KLA (KLAC), the recent wave of investments flowing into Intel—such as $5 billion from Nvidia, nearly $9 billion from the federal government, and billions more from other players—should definitely be on your radar. While KLA isn’t directly pocketing these funds, it plays a crucial behind-the-scenes role in providing the process control and yield management tools that make chip manufacturing possible. The big picture is clear: as chipmakers get fresh capital and ramp up production, KLA’s growth prospects could benefit from the industry-wide boost.

This sense of momentum is already showing up in KLA’s stock performance. Over the past month, shares have jumped 20%, continuing a year where the stock is up 39% and extending a staggering five-year gain of nearly 5x. Recent announcements and the overall bullish tone in semiconductor capital equipment are fueling confidence, with trading strategies reflecting optimism about further upside. For investors, the rally doesn’t feel speculative but tied to anticipated real-world demand as industry giants gear up for large-scale expansion projects.

So, with a sharp move higher and strong industry currents propelling KLA, the key question is whether the market is underestimating future growth, or if the stock price already captures all this excitement. What’s your move?

Most Popular Narrative: 12% Overvalued

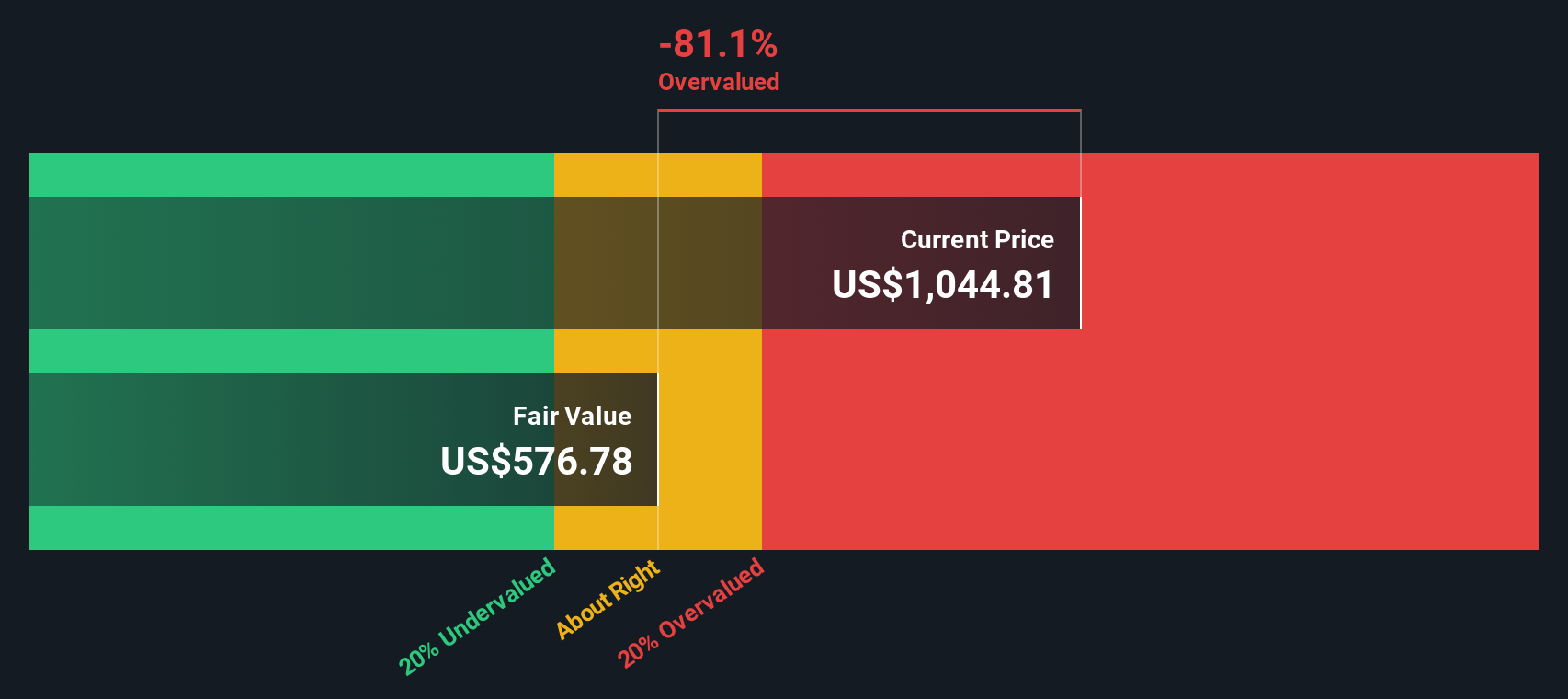

According to the most widely followed narrative, KLA’s current stock price is trading above what analysts consider its fair value, based on the expected growth trajectory, profit margins, and sector risks.

Market share gains are accelerating, with KLA's share of overall wafer fab equipment approaching 8%, up from the prior 7.25% assumption, and further boosted by packaging outperformance. These gains are powered by customer adoption of KLA's differentiated inspection platforms and should amplify both top-line growth and operating leverage. As a result, EPS growth is expected to outpace revenue growth.

Curious about the logic that explains this premium pricing? The narrative is fueled by bullish forecasts for margin expansion, accelerating customer adoption, and operating momentum. Discover which critical numbers and bold assumptions about the next three years are behind the headline fair value and where analysts see the real upside for KLA.

Result: Fair Value of $929.68 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as escalating global tariffs or further weakness in China could disrupt KLA’s strong outlook and challenge the current optimism.

Find out about the key risks to this KLA narrative.Another View: Discounted Cash Flow Check

While analysts relying on earnings and market multiples see KLA as overvalued, our DCF model takes a different approach and also flags the stock as trading above fair value. Does this second angle reinforce the caution, or is something missing from the story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own KLA Narrative

If you see things differently or want to follow your own research path, you can build your own perspective in under three minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding KLA.

Looking for More Investment Ideas?

Don’t settle for just one opportunity. The right strategy means scouting ahead and grabbing the full advantage, so put these high-potential ideas to use now.

- Capture income streams and build wealth with companies featured in dividend stocks with yields > 3%. Each is chosen for their standout yields above 3% and financial strength.

- Ride the momentum of innovation and find emerging leaders in smart healthcare using healthcare AI stocks. This screener spotlights firms transforming patient care with artificial intelligence.

- Spot tomorrow’s sector giants early by pursuing penny stocks with strong financials, where robust financials and rapid growth potential set the stage for big moves.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal