What Himax Technologies (HIMX)'s Aerospace Imaging Collaboration Means for Shareholders

- Himax Technologies and Liqxtal Technology recently unveiled a suite of next-generation imaging integration solutions for aerospace and defense at the Taipei Aerospace & Defense Technology Exhibition, highlighting advancements in AI-powered sensing, drone vision, and virtual displays.

- This collaboration signals Himax’s intent to broaden its reach beyond traditional markets and leverage its technological expertise to access high-value sectors with specialized requirements.

- We'll examine how this joint debut of advanced imaging solutions could influence Himax’s outlook, particularly as it targets aerospace and defense growth.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Himax Technologies Investment Narrative Recap

To hold Himax Technologies, investors need to believe that the company's established value in display ICs and its push into high-growth sectors like aerospace and defense can help offset near-term headwinds from demand volatility and margin pressure. While the unveiling of advanced imaging solutions with Liqxtal showcases Himax's innovation capacity, this move does not immediately alter the most pressing short-term catalyst: sustained recovery in orders from automotive and consumer electronics, nor the material risk of weak visibility on customer demand and operating margin pressure.

Among recent announcements, the September 5 automotive display showcase stands out as especially relevant, reinforcing Himax’s core strength in the fast-evolving market for vehicle displays. This supports the company’s biggest near-term catalyst, as automotive ICs remain a primary revenue driver and a window into Himax's broader diversification efforts.

Yet, while the company expands its technology horizon, the risk of continued order delays and weak demand visibility remains an important point investors should consider, especially if...

Read the full narrative on Himax Technologies (it's free!)

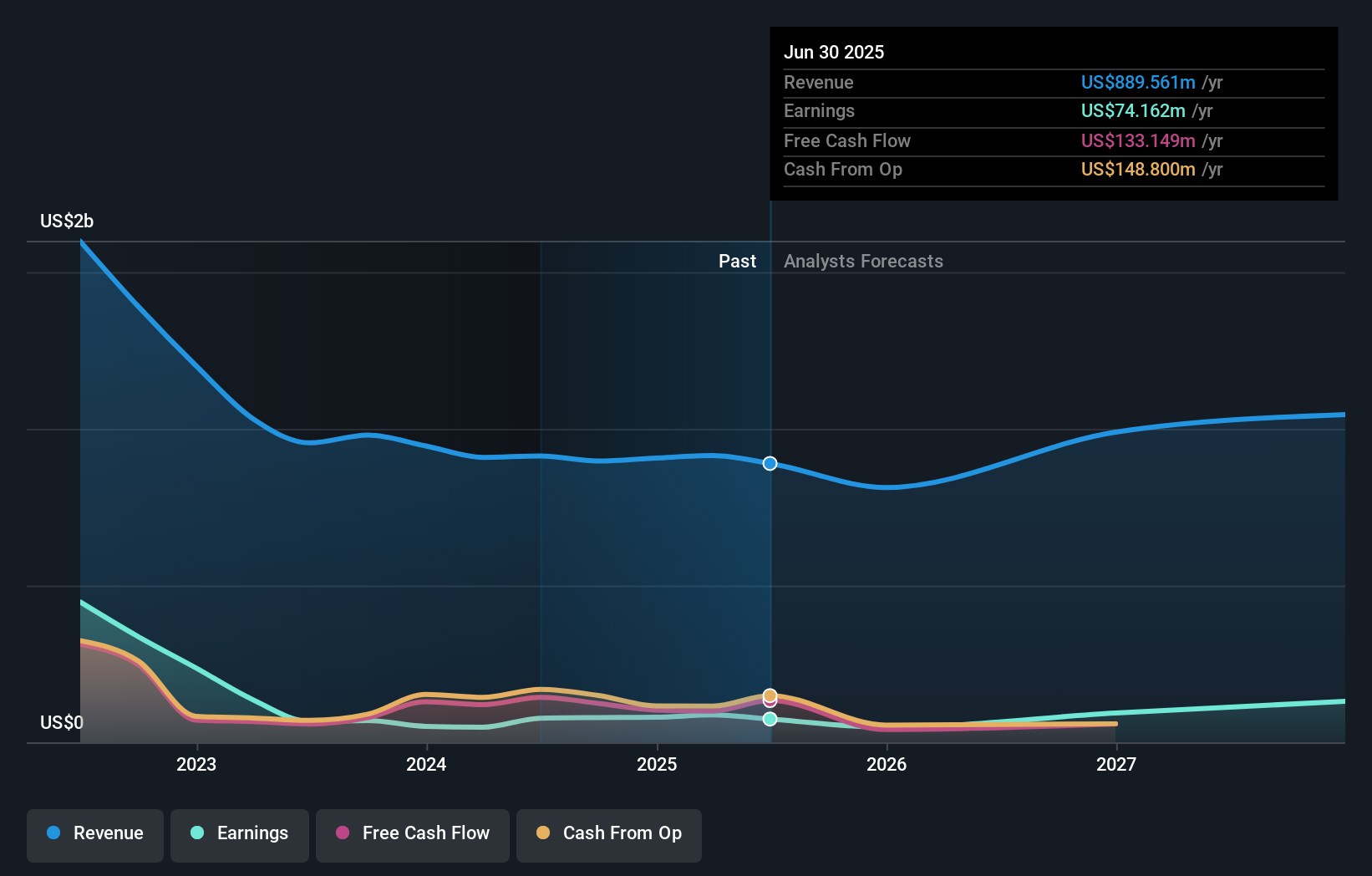

Himax Technologies' narrative projects $1.1 billion revenue and $139.3 million earnings by 2028. This requires 7.4% yearly revenue growth and a $65.1 million earnings increase from $74.2 million today.

Uncover how Himax Technologies' forecasts yield a $9.31 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have estimated Himax’s fair value from US$1.55 up to US$91.18 across 8 diverse forecasts. With order visibility still under pressure, these widely varying opinions highlight the importance of comparing different valuation and risk perspectives before deciding on Himax’s longer-term potential.

Explore 8 other fair value estimates on Himax Technologies - why the stock might be worth over 10x more than the current price!

Build Your Own Himax Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Himax Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Himax Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal