Why Boise Cascade (BCC) Is Down 7.2% After Cutting Q3 Profit Outlook on Weak Wood Products Demand

- Earlier this week, Boise Cascade lowered its third-quarter profit forecast, citing weaker-than-expected volumes and pricing in its Wood Products segment amid difficult conditions across the building materials sector.

- This update has led several analysts to revise earnings estimates for the company, reflecting concerns about near-term demand and pricing power in engineered wood products.

- We'll explore how the soft volumes and pricing in Boise Cascade's Wood Products business may reshape the company's investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Boise Cascade Investment Narrative Recap

To own shares in Boise Cascade, one has to believe that demand for new housing and remodeling in the US will ultimately drive sustained volumes and earnings for engineered wood products, despite sector cycles. However, Boise Cascade’s recent earnings warning, caused by weak volumes and pricing in its Wood Products segment, highlights that near-term demand and pricing power remain the most important catalyst and the biggest risk for the stock. For now, this news is a material headwind that could overshadow any rebound in the short term.

Among recent company announcements, the August update on share buybacks stands out, with Boise Cascade repurchasing 471,652 shares for US$42.13 million between April and July 2025. This ongoing capital return program could support shareholder value, but its significance is lessened when earnings and cash flows are under pressure from weak market conditions.

In contrast, investors should be aware that ongoing competitive pricing pressure in engineered wood remains a lingering risk...

Read the full narrative on Boise Cascade (it's free!)

Boise Cascade's narrative projects $7.0 billion in revenue and $285.8 million in earnings by 2028. This requires 2.4% annual revenue growth and a $23.5 million earnings increase from $262.3 million currently.

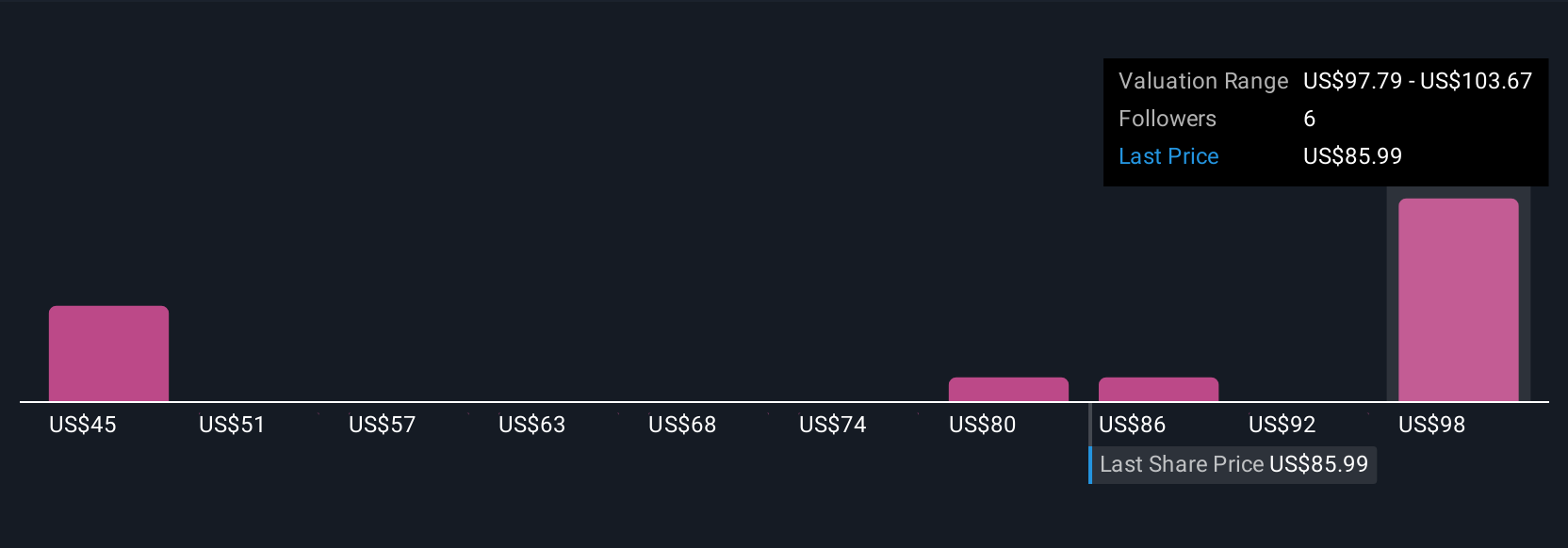

Uncover how Boise Cascade's forecasts yield a $99.83 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community put Boise Cascade’s fair value between US$81 and US$123.36 per share, reflecting wide-ranging views. Many see operational pressures and weak pricing as critical to watch, and you can explore a variety of investor opinions here.

Explore 4 other fair value estimates on Boise Cascade - why the stock might be worth as much as 55% more than the current price!

Build Your Own Boise Cascade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boise Cascade research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Boise Cascade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boise Cascade's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal