Carlisle Companies (CSL): Assessing Valuation After J.P.Morgan Downgrade and Softer Growth Outlook

When a major firm like J.P.Morgan publicly revises its outlook for Carlisle Companies (CSL), investors tend to pay close attention, and for good reason. Earlier this week, J.P.Morgan downgraded Carlisle, pointing to ongoing weakness in residential demand and slimmer distributor inventories. While Carlisle’s management remains relatively optimistic, projecting low-single-digit organic growth for 2025, the investment bank expects much flatter trends and even a possible drop toward the end of the year. This more cautious stance quickly sent the stock down nearly 4% during afternoon trading, marking it as a development those holding or watching CSL cannot ignore.

Zooming out, this latest move comes after a tough run for Carlisle Companies. Over the past year, CSL shares have fallen around 22%, despite steady revenue and net income growth within the business. The company has continued to engage with investors at industry conferences and caught the attention of some asset managers who see long-term potential. Still, it is clear momentum has faded, making this a moment for a valuation check rather than riding the trends of years past.

So with Carlisle’s shares pulling back, is today’s pricing opening a long-term opportunity, or are the market’s concerns about future growth fully justified?

Most Popular Narrative: 18.7% Undervalued

The current narrative positions Carlisle Companies as undervalued, with its fair value estimated to be nearly 19% higher than the present share price. Analysts point to both the company's recurring revenue streams and its strategic initiatives aimed at long-term growth as key drivers behind this outlook.

Continued investment in automation, digital transformation, and operational efficiency programs (for example, Carlisle Operating System) are driving productivity improvements and significant cost savings. These measures are expected to result in at least 200 or more basis points of long-term margin expansion for underperforming segments, positively impacting net margins and free cash flow.

Curious about what makes analysts so bullish on Carlisle's future? There is an inside playbook shaping this valuation, with ambitious financial targets and some bold margin projections. Want to discover which growth assumptions are moving the needle? Dive into the narrative to find out exactly which numbers underpin the double-digit upside potential.

Result: Fair Value of $415.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing softness in end markets and limited pricing power for Carlisle could quickly derail these optimistic scenarios if conditions worsen further.

Find out about the key risks to this Carlisle Companies narrative.Another View: What Does Our DCF Model Say?

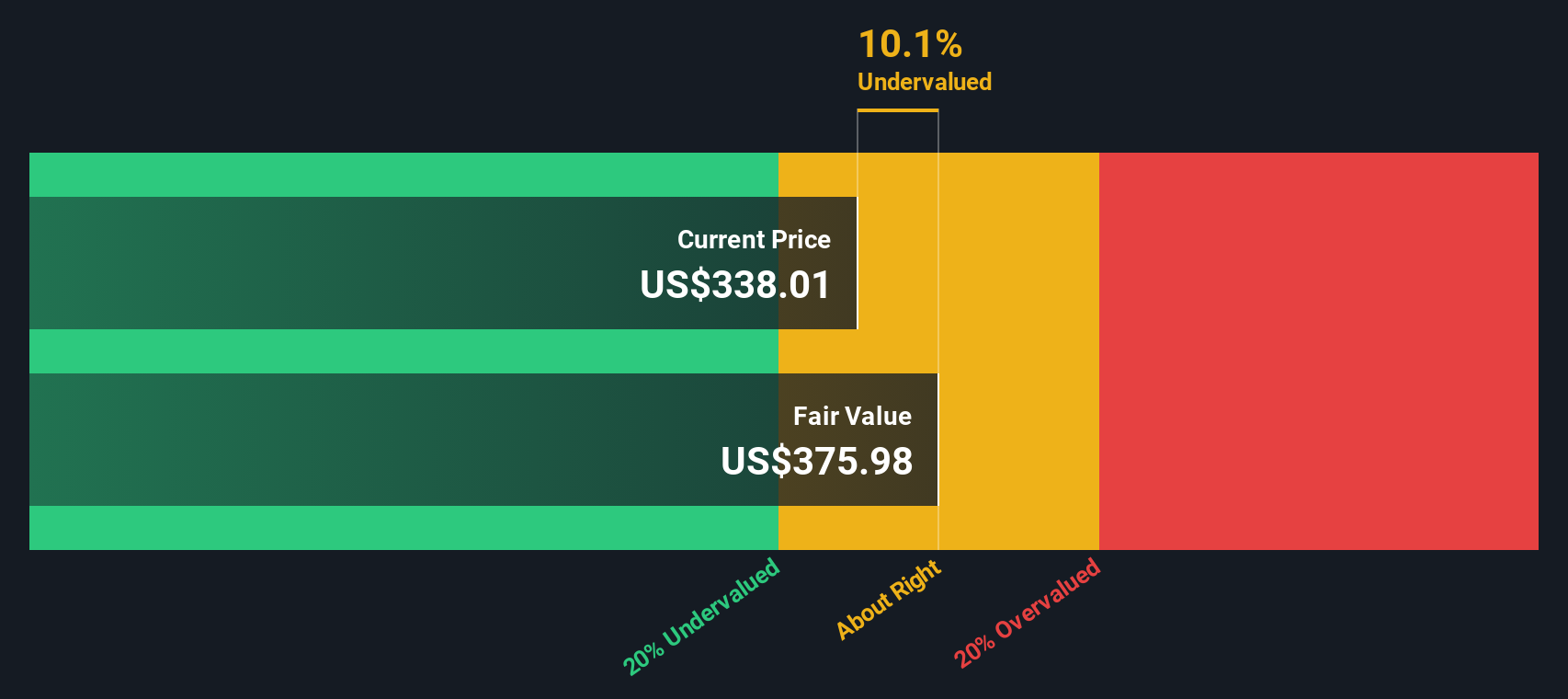

Our SWS DCF model takes a different approach than the typical market multiples. It analyzes Carlisle’s cash flows rather than just earnings ratios, and currently suggests the shares remain undervalued. Could cash generation be the real story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Carlisle Companies Narrative

If you see things differently, want to dig into the numbers on your own, or simply trust your own research instincts, you can shape your own narrative in just a few minutes with our platform. Do it your way.

A great starting point for your Carlisle Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Thousands of investors are finding hidden gems, powerful trends, and steady income streams using new data from the Simply Wall Street Screener. Do not miss out on other opportunities while focusing on just one stock.

- Unlock growth by finding penny stocks with strong financials that could be tomorrow’s market leaders using the penny stocks with strong financials tool.

- Target consistent income and stability by checking out dividend stocks with yields above 3% through our dividend stocks with yields > 3% selection.

- Seize the advantage in cutting-edge industries by searching for AI-powered penny stocks driving innovation with our AI penny stocks picks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal