A Closer Look at Dow’s Valuation as Investors Await Strategic Updates from Leadership

Dow (NYSE:DOW) is in the spotlight as the company gears up for a presentation at Morgan Stanley’s 13th Annual Laguna Conference, with Chair & CEO Jim Fitterling set to speak. Industry conferences like this often become inflection points, giving investors a rare opportunity to glean insight directly from leadership about future plans and the company's strategic positioning. With renewed attention on the stock ahead of this event, many are watching closely to see if Dow’s management can instill fresh confidence or clarify the path forward.

This conference appearance lands at a moment when Dow’s stock has been under pressure for much of the past year. The share price has been declining steadily and investor sentiment appears to hinge on questions about earnings power and market dynamics. Over the past year, the stock has fallen over 51 percent and momentum in recent months has not reversed that trajectory. Though there has been slight revenue growth, net income remains negative, highlighting both near-term challenges and longer-term uncertainties for the business.

With all eyes on the upcoming conference, it is fair to ask if the current price reflects hidden value in Dow, or if the market is already factoring in everything the company might reveal.

Most Popular Narrative: 18% Undervalued

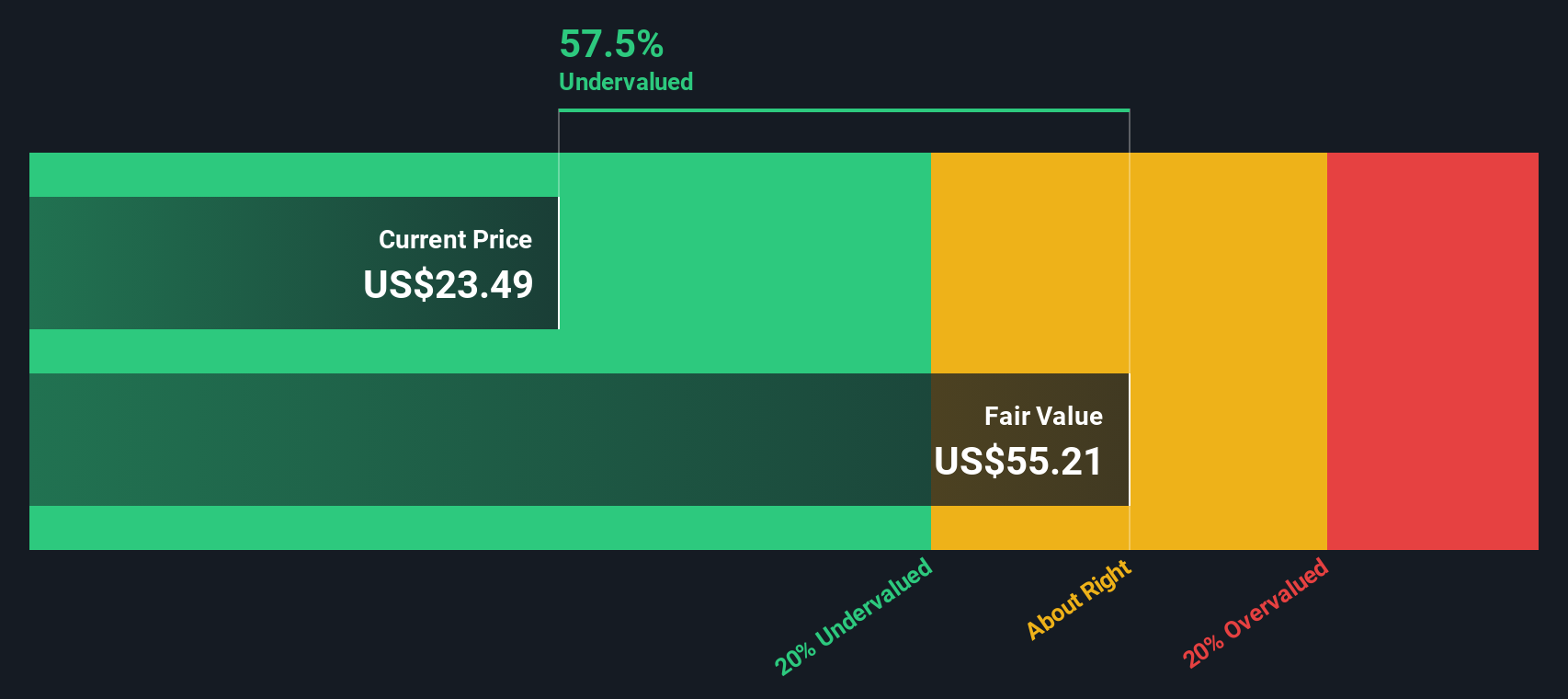

According to the most widely followed valuation narrative, Dow is currently trading well below its estimated fair value. Analysts see meaningful upside potential based on the company's future earnings and cash flow prospects.

"Dow expects a $2.4 billion influx from the sale of their minority stake in select U.S. Gulf Coast infrastructure assets, which will bolster cash reserves and improve financial flexibility. This provides a potential boost to earnings. A final ruling on pending Nova litigation is anticipated, with expected proceeds exceeding $1 billion. This offers a significant cash inflow that can support capital allocation strategies and influence earnings positively."

Wondering why the valuation is so bullish despite recent headwinds? The answer lies in bold projections about earnings recovery and margin expansion, built on management’s strategic steps and some pivotal future catalysts. Which specific numbers tip this balance and how do analysts get to that fair value? The big reveal is in the full narrative.

Result: Fair Value of $28.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressures and prolonged weak demand could undermine the bullish outlook and affect Dow’s recovery prospects in the coming quarters.

Find out about the key risks to this Dow narrative.Another View: What Does Our DCF Model Suggest?

Looking at Dow through the lens of our SWS DCF model offers a different take compared to the first valuation. This approach also points to the shares being undervalued, but each method relies on its own assumptions. Are these models capturing the full picture, or is something being missed?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dow Narrative

If you think there is more to the story or want to run the numbers yourself, you can craft your own take in just a few minutes. Do it your way.

A great starting point for your Dow research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity. Take charge and seek out stocks shaping the future or rewarding investors today. Unlock your next smart move by checking out these high-potential ideas:

- Uncover high potential by scanning for companies with strong financials and robust yields through our dividend stocks with yields > 3%.

- Spot tomorrow’s game changers in artificial intelligence by exploring our unique AI penny stocks.

- Get ahead of the crowd by targeting industries transforming healthcare with top picks from our curated healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal