Can Concentrix's (CNXC) New AI Framework Mark a Turning Point in Its Customer Experience Strategy?

- Concentrix recently announced the launch of its Agentic Operating Framework, a comprehensive AI solution built to help enterprises overcome common failures in AI adoption by integrating advanced technologies with consulting expertise and industry partnerships.

- This launch highlights Concentrix's emphasis on moving AI beyond pilots to produce operational impact, with early results including significant revenue and cost-saving potential for clients leveraging AI-driven customer experience transformation.

- We'll assess how the rollout of Concentrix's end-to-end Agentic Operating Framework could influence its outlook for AI-driven growth and profitability.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Concentrix Investment Narrative Recap

To be a shareholder in Concentrix, you need to believe in its ability to use AI-powered offerings and consulting to deliver sustainable customer experience innovation, moving from pilots to fully integrated, revenue-generating solutions. The launch of the Agentic Operating Framework strengthens the company's short-term catalyst by addressing a key client need: moving AI initiatives beyond failed pilots to accomplish tangible operational results. That said, the integration of new technologies adds complexity, and the largest current risk remains the challenge of harmonizing Webhelp’s operations and realizing cost synergies on schedule.

The recent Agentic Operating Framework announcement is especially relevant, but the updated iX Hero product, featuring enhancements in speech clarity and communication quality, has also shown measurable benefit to client outcomes. Both developments tie directly to Concentrix’s focus on scaling AI and digital solutions for deeper customer relationships, which underpins its growth catalysts and path to improved profitability in a changing market.

In contrast, investors should be aware of the potential impact if integration of Webhelp’s operations does not proceed as efficiently as planned, especially...

Read the full narrative on Concentrix (it's free!)

Concentrix's narrative projects $10.6 billion in revenue and $509.6 million in earnings by 2028. This requires 3.2% yearly revenue growth and a $275.3 million earnings increase from the current $234.3 million.

Uncover how Concentrix's forecasts yield a $67.67 fair value, a 19% upside to its current price.

Exploring Other Perspectives

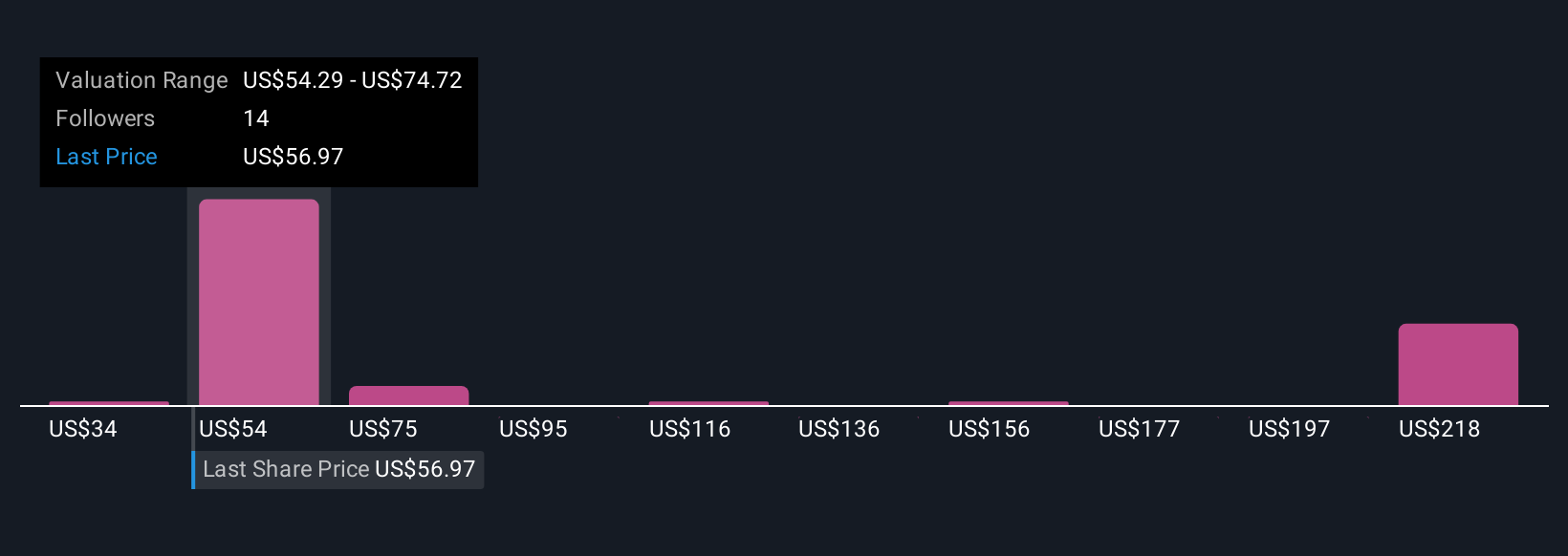

Six individual fair value estimates from the Simply Wall St Community range widely from US$33.87 up to US$238.12 per share. These diverse outlooks come as market participants weigh execution risks from digital transformation and operational integration, making it essential to consider alternative perspectives when evaluating Concentrix.

Explore 6 other fair value estimates on Concentrix - why the stock might be worth 41% less than the current price!

Build Your Own Concentrix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Concentrix research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Concentrix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Concentrix's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal