Can Onto Innovation’s (ONTO) Latest Metrology Launch Strengthen Its Edge in Advanced Chip Manufacturing?

- Earlier this month, Onto Innovation introduced the Atlas G6 optical critical dimension metrology system and exhibited its latest process control innovations at SEMICON West, focusing on advanced semiconductor nodes, AI device manufacturing, and automotive applications.

- A distinctive insight is the Atlas G6 system's adoption by leading manufacturers for advanced gate-all-around logic and high-bandwidth memory, highlighting Onto Innovation’s increasing influence in the next generation of chip technologies.

- We'll examine how the Atlas G6’s production adoption shapes Onto Innovation's investment narrative and its outlook in advanced semiconductor markets.

Find companies with promising cash flow potential yet trading below their fair value.

Onto Innovation Investment Narrative Recap

To own Onto Innovation stock, an investor needs confidence in the continued growth of advanced semiconductor manufacturing, particularly in AI device packaging, high-bandwidth memory, and gate-all-around logic. The recent launch of the Atlas G6 system, with its adoption by major chipmakers, reinforces Onto's positioning in next-gen nodes, but doesn't immediately reduce the biggest risk: a possible delay in the anticipated rebound in customer demand, which remains the main near-term catalyst and challenge.

Among recent announcements, the Atlas G6 introduction best highlights how Onto is enabling tighter process control in leading-edge chip fabrication, directly linking the company’s innovations to the same high-growth markets that underpin its recovery prospects in late 2025 and 2026. This system’s multiple production wins address technical pain points as chip architectures become more complex, but the magnitude and timing of demand recovery among major customers still matter most.

However, investors should also be mindful of ongoing risks around customer concentration and volatility in end-market spending...

Read the full narrative on Onto Innovation (it's free!)

Onto Innovation's narrative projects $1.4 billion revenue and $311.2 million earnings by 2028. This requires 11.0% yearly revenue growth and a $111.3 million earnings increase from $199.9 million today.

Uncover how Onto Innovation's forecasts yield a $125.00 fair value, in line with its current price.

Exploring Other Perspectives

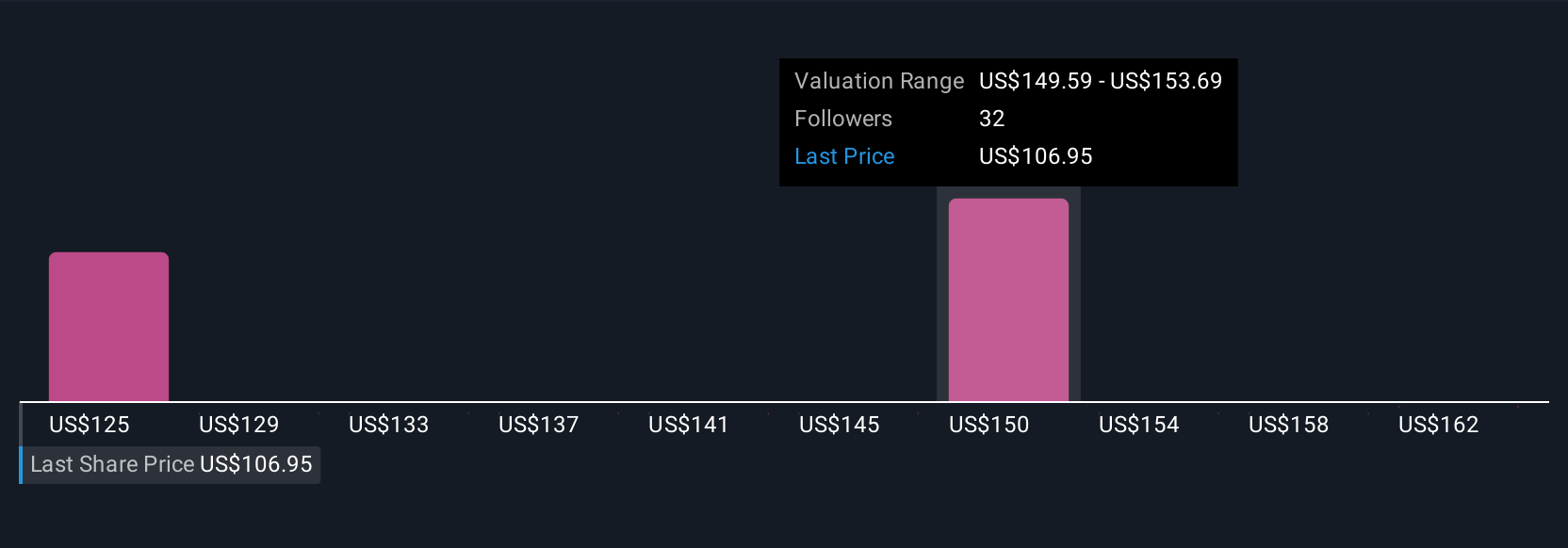

Four members of the Simply Wall St Community estimated Onto’s fair value from US$125 up to US$165.99. While many focus on growth opportunities from Atlas G6’s success in advanced semiconductors, the outlook can shift quickly if customer demand falls short, so compare multiple viewpoints before making conclusions.

Explore 4 other fair value estimates on Onto Innovation - why the stock might be worth just $125.00!

Build Your Own Onto Innovation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Onto Innovation research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Onto Innovation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Onto Innovation's overall financial health at a glance.

No Opportunity In Onto Innovation?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal