Will Antero Midstream's (AM) $650 Million Refinancing Shift Its Risk Profile and Investment Narrative?

- Earlier this month, Antero Midstream Corporation completed an upsized private placement of US$650 million in 5.75% senior unsecured notes due 2033, with net proceeds earmarked for the full redemption of its 2027 notes.

- This refinancing extends the company's debt maturity profile and could enhance financial flexibility through lower near-term refinancing risk.

- We'll explore how replacing 2027 notes with new, longer-dated debt could impact Antero Midstream's investment outlook and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Antero Midstream Investment Narrative Recap

To invest in Antero Midstream, you have to believe that stable, fee-based revenues from Appalachia's natural gas production and long-term contracts with Antero Resources will outweigh risks tied to concentration, evolving energy trends, and regulatory hurdles. The recent debt refinancing extends maturities and reduces near-term refinancing risk, but does not materially impact the company’s biggest short-term catalyst, higher natural gas volumes from U.S. LNG export growth, or the main risk, which remains exposure to changes in regional drilling activity.

Among Antero Midstream’s recent announcements, the consistently affirmed $0.90 per share annual dividend stands out. For yield-focused investors, this recurring payout targets income stability, even as the company seeks to enhance its debt profile, serving as a counterpoint to the ongoing need for financial flexibility if market or regulatory pressures increase.

Yet, despite these positives, investors should be aware that Antero Midstream’s heavy reliance on a single region and customer could suddenly shift if…

Read the full narrative on Antero Midstream (it's free!)

Antero Midstream's outlook anticipates $1.3 billion in revenue and $655.5 million in earnings by 2028. Achieving these targets implies a 1.3% annual revenue growth rate and a $199.9 million increase in earnings from the current $455.6 million.

Uncover how Antero Midstream's forecasts yield a $18.07 fair value, a 3% downside to its current price.

Exploring Other Perspectives

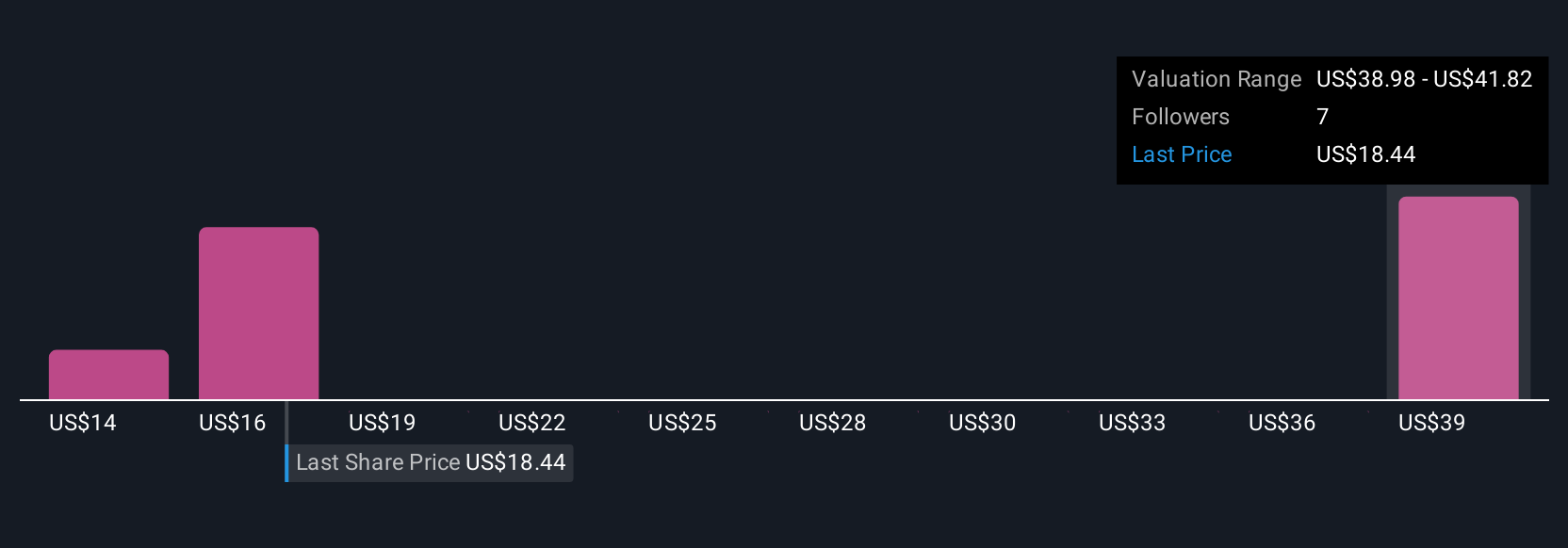

Fair value estimates from four Simply Wall St Community members range widely from US$13.50 to US$40.33 per share. With refinancing extending debt maturities, financial flexibility remains important for future earnings and market resilience; explore several views to see what others anticipate.

Explore 4 other fair value estimates on Antero Midstream - why the stock might be worth over 2x more than the current price!

Build Your Own Antero Midstream Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Antero Midstream research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Antero Midstream research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Antero Midstream's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal