Will FTI Consulting's (FCN) Leadership Additions Reveal a Shift in Its Long-Term Growth Strategy?

- Earlier this month, FTI Consulting announced a series of senior leadership hires across its Cybersecurity and Healthcare Business Transformation practices, including André Reichow-Prehn and Keith Wojcieszek in cybersecurity and Dr. Shaun Rangappa in healthcare transformation.

- These appointments reflect FTI Consulting’s focus on expanding expertise in high-growth advisory segments where clients are facing increasingly complex risks.

- We'll now explore how the firm's investment in recognized cyber and healthcare leaders could reshape its growth outlook and market narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

FTI Consulting Investment Narrative Recap

FTI Consulting shareholders are typically buying into a story of long-term global demand for specialized, high-value advisory work, particularly in complex areas like cyber risk and healthcare transformation. The recent addition of seasoned experts in cybersecurity and healthcare underscores FTI’s commitment to areas with sustained client demand, but these hires alone are not likely to materially offset near-term catalysts or address the key risk of margin compression if elevated hiring costs persist.

Among the latest announcements, the appointment of Dr. Shaun Rangappa as Senior Managing Director in Healthcare Business Transformation stands out for its direct relevance to client-facing innovation and clinical expertise. This move may help FTI strengthen its offerings in healthcare advisory, a sector closely linked to some of the company’s enduring growth catalysts.

However, despite such industry-leading hires, investors should also pay close attention to the risk of ongoing margin pressure caused by...

Read the full narrative on FTI Consulting (it's free!)

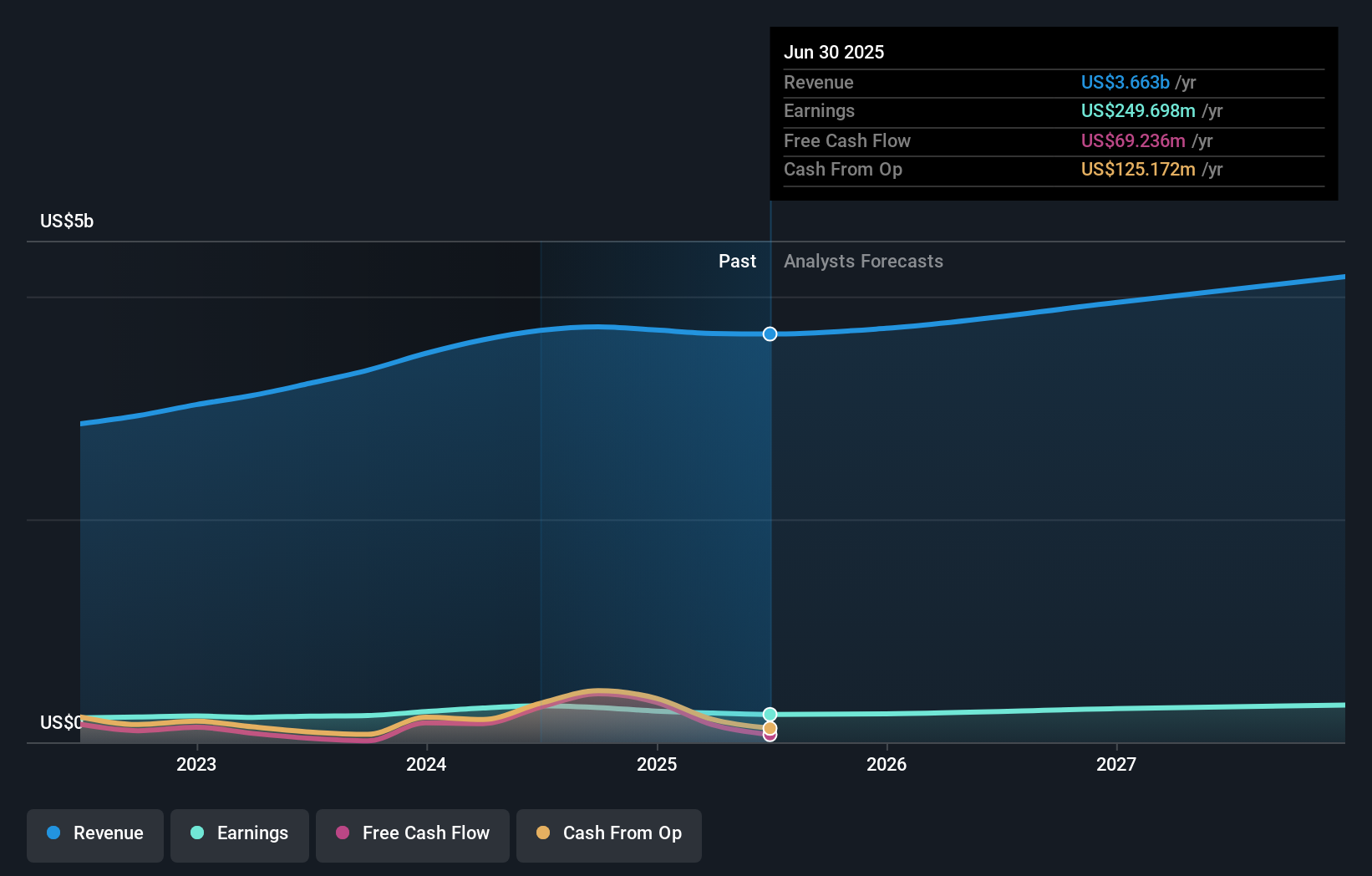

FTI Consulting's narrative projects $4.3 billion revenue and $358.3 million earnings by 2028. This requires 5.3% yearly revenue growth and a $108.6 million earnings increase from $249.7 million today.

Uncover how FTI Consulting's forecasts yield a $185.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

All Simply Wall St Community members providing a fair value estimate for FTI Consulting arrived at US$185, with just one perspective recorded. Consider how FTI’s ongoing investment in senior talent, while promising, must be weighed against persistent cost and margin risks as you explore more opinions.

Explore another fair value estimate on FTI Consulting - why the stock might be worth just $185.00!

Build Your Own FTI Consulting Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FTI Consulting research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free FTI Consulting research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FTI Consulting's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal