Robinhood (HOOD): Assessing Valuation After Russell Index Exclusion and Market Shakeup

If you follow Robinhood Markets (HOOD), the past week has brought an event you cannot ignore: the company was dropped from both the Russell Small Cap Value and Growth indexes. For investors, index removals like this matter because they can trigger a wave of selling by funds forced to rebalance, change perceptions around liquidity, and send a new signal about where the market places Robinhood.

This reshuffling lands during a year of high momentum for HOOD. The stock is up over 540% over the past year, with gains accelerating across the year, including a striking 14% jump in the past month and more than 63% over the past 3 months. Despite the index drop, Robinhood’s trajectory has been fueled by solid annual growth in both revenue and net income, building attention as a comeback story after earlier volatility.

Now the question is front and center: does the index exclusion open a rare opportunity for those thinking long term, or is the recent rally already baking future growth into HOOD’s price?

Most Popular Narrative: 8.5% Overvalued

The most popular analyst narrative suggests that Robinhood Markets is currently trading above its estimated fair value, with recent momentum yet lingering questions about the sustainability of such growth.

Product launches at global events, such as the crypto user event in France and HOOD Summit, have demonstrated rapid feature rollout, geographic expansion in the EU, and new products like U.S. stock tokens and perpetual futures. These initiatives have substantially broadened Robinhood’s addressable market.

Curious how these headline-grabbing product debuts and an ambitious international expansion tie into one of the boldest fair value calls on Wall Street? The narrative’s calculations hinge on unusually aggressive assumptions for revenue gains and margin stability. These are numbers you probably have not seen outside of tech giants. Want to discover just how much future growth analysts are baking in to justify Robinhood’s current price premium? You will not believe the financial stretch it takes. Dive in to learn the story behind this valuation.

Result: Fair Value of $114.99 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, robust growth in recurring revenues and rapid user adoption of new products could challenge current assumptions and fuel further upside for Robinhood.

Find out about the key risks to this Robinhood Markets narrative.Another View: SWS DCF Model Paints a Different Picture

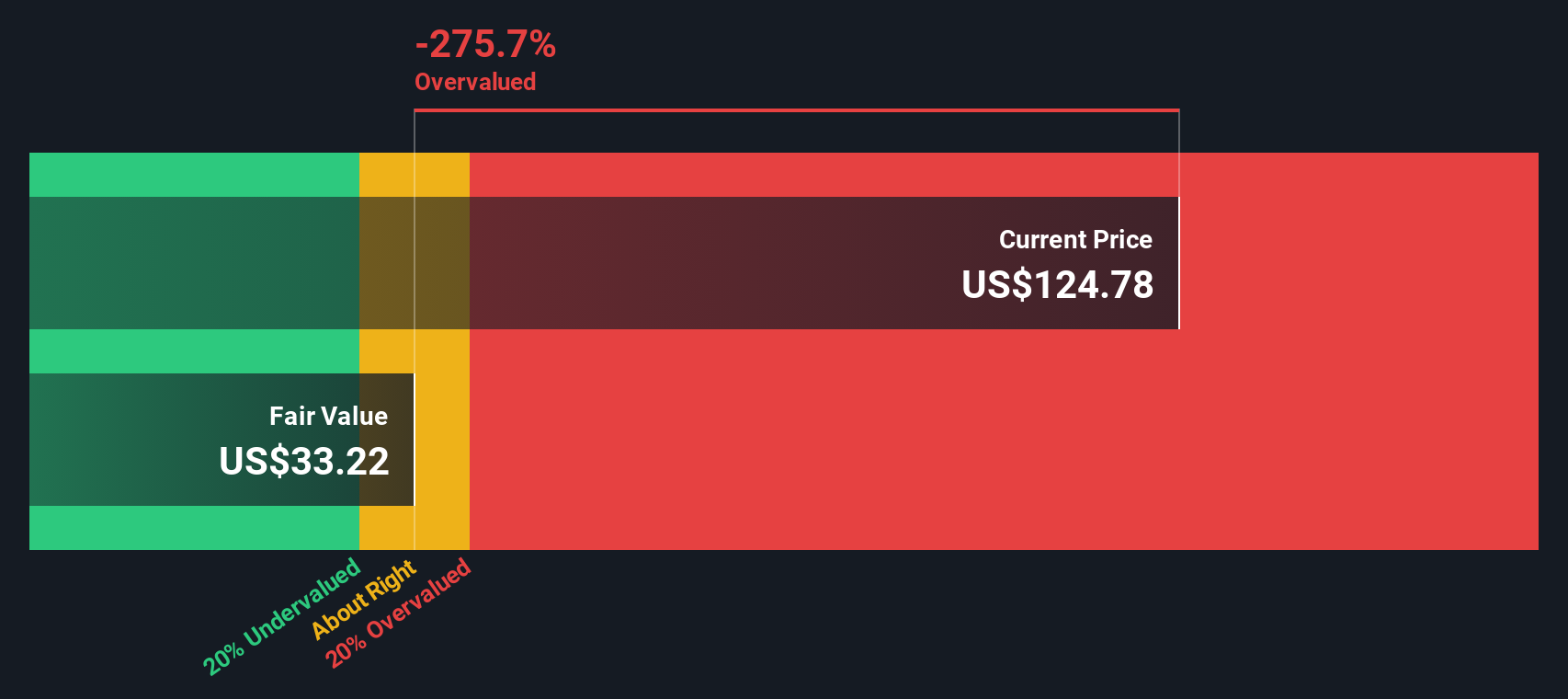

While analyst price targets suggest Robinhood is only slightly overvalued, our DCF model comes to a starker conclusion. This approach points to a much lower fair value, raising questions about just how much optimism is priced in today. Could market momentum be running ahead of true underlying potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Robinhood Markets Narrative

If you see things differently or want to dig into the numbers on your own terms, you can craft your own Robinhood story in just a few minutes. Do it your way.

A great starting point for your Robinhood Markets research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit yourself to just one opportunity. Take control of your portfolio and zero in on stocks with serious potential using the Simply Wall Street Screener. These handpicked ideas could put you ahead of the crowd. Let yourself in before others catch on.

- Target companies quietly building value and get ahead with undervalued stocks based on cash flows that outpace their peers based on future cash flows.

- Unlock opportunities in tomorrow’s healthcare breakthrough leaders by starting your search with healthcare AI stocks making waves at the intersection of medicine and artificial intelligence.

- Find stocks holding strong even at bargain prices by checking out penny stocks with strong financials showing solid financials and the potential for big market moves.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal