How Kimbell’s Low Capital Needs and Strong Balance Sheet (KRP) Are Shaping Its Investment Story

- In recent news, Kimbell Royalty Partners was highlighted for its low capital intensity business model, strong balance sheet, and attractive valuation, all supporting potential for further acquisitions and cash distributions.

- An interesting insight from this update is that Kimbell’s solid financial footing may enable it to capitalize on emerging opportunities in the natural gas market.

- To assess the implications of Kimbell's robust balance sheet, we will explore how this supports and possibly enhances its current investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Kimbell Royalty Partners Investment Narrative Recap

At its core, Kimbell Royalty Partners appeals to investors who believe in the value of an asset-light, acquisition-driven business model that benefits from steady cash flows and a disciplined approach to capital deployment. The recent news highlighting Kimbell’s strong balance sheet and low capital intensity supports its ability to pursue further acquisitions, but in the short term does not significantly alter the key catalyst of successful asset acquisitions or the primary risk of natural production declines in core basins.

Among recent announcements, the increase in Kimbell’s credit facility from US$550 million to US$625 million in May 2025 stands out as particularly relevant. This expanded borrowing capacity closely aligns with the thesis that Kimbell is well-positioned to seek out new royalty interests, potentially countering the impact of asset decline and supporting the company’s ongoing acquisition strategy.

However, investors should also keep in mind that as competition for high-quality mineral assets intensifies…

Read the full narrative on Kimbell Royalty Partners (it's free!)

Kimbell Royalty Partners is projected to reach $379.9 million in revenue and $80.8 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 6.7% and an increase in earnings of $81.4 million from current earnings of -$548.7 thousand.

Uncover how Kimbell Royalty Partners' forecasts yield a $17.20 fair value, a 29% upside to its current price.

Exploring Other Perspectives

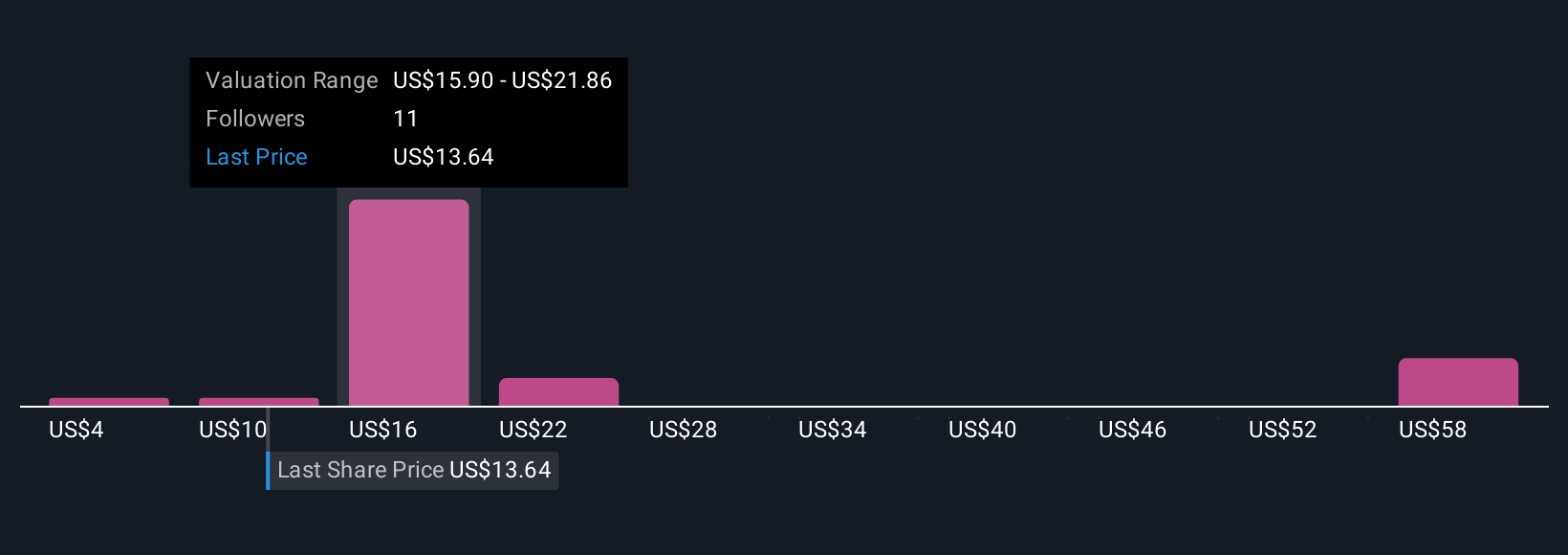

Private fair value estimates for Kimbell range from US$4 to nearly US$60, with five different analyses from the Simply Wall St Community. As more competition puts upward pressure on acquisition prices, understanding these differences could be key to forming your own outlook.

Explore 5 other fair value estimates on Kimbell Royalty Partners - why the stock might be worth less than half the current price!

Build Your Own Kimbell Royalty Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kimbell Royalty Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kimbell Royalty Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kimbell Royalty Partners' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal