Stride (LRN) Valuation in Focus Following Major School District Lawsuit Alleging Fraud and Compliance Violations

If you’ve been watching Stride (LRN) lately, you probably noticed the waves caused by a newly filed lawsuit. The Gallup-McKinley County Schools Board of Education is taking Stride to court over a sweeping set of allegations, including fraud, deceptive practices, and violating public education laws. The details are sharp: claims that Stride allegedly inflated enrollment numbers, cut corners on staffing, ignored compliance, and put profit before students, all resulting in worsening educational outcomes. Legal risk is hardly new for companies in the education space, but the seriousness and specificity of these claims make this event tough to ignore.

For investors, it’s a moment to pause and recalibrate. Stride’s stock had built up significant gains over the past year, with a total return of nearly 67% and momentum still strong since January despite some volatility in recent months. That said, this lawsuit lands squarely amid investor optimism about continuing growth, so it’s no surprise to see some traders getting cautious, even as longer-term performance remains compelling. Other recent news has taken a back seat for now as the market absorbs the potential impact of this fresh legal risk.

The big question is whether this new legal overhang is an opportunity for patient buyers, or if the market has already factored in higher risk and the growth story is due for a reset.

Most Popular Narrative: 13.5% Undervalued

According to the most widely followed narrative, Stride is currently undervalued by 13.5% compared to its fair value estimate. The assessment hinges on strong analyst consensus and detailed forecasts about the company’s path ahead.

Ongoing investments in proprietary technology platforms, including AI and data-driven engagement tools, are expected to yield both educational outcomes and operational efficiencies. This supports further improvement in net margins. A favorable funding environment, combined with expanding and diversified state partnerships, enhances revenue predictability and geographic reach. It also helps mitigate concentration risk and creates opportunities for scalable earnings growth.

Curious what is powering the bullish outlook for Stride? The engine behind this valuation involves a blend of future profit margins, ambitious growth assumptions, and a multiple that suggests premium expectations. Want to uncover which critical levers in Stride’s business model could justify this price? The details inside these projections just might surprise you.

Result: Fair Value of $163.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory caps that limit enrollment growth, or renewed political pressure on public funding, could quickly challenge the optimistic view for Stride’s future.

Find out about the key risks to this Stride narrative.Another View: Market Comparison

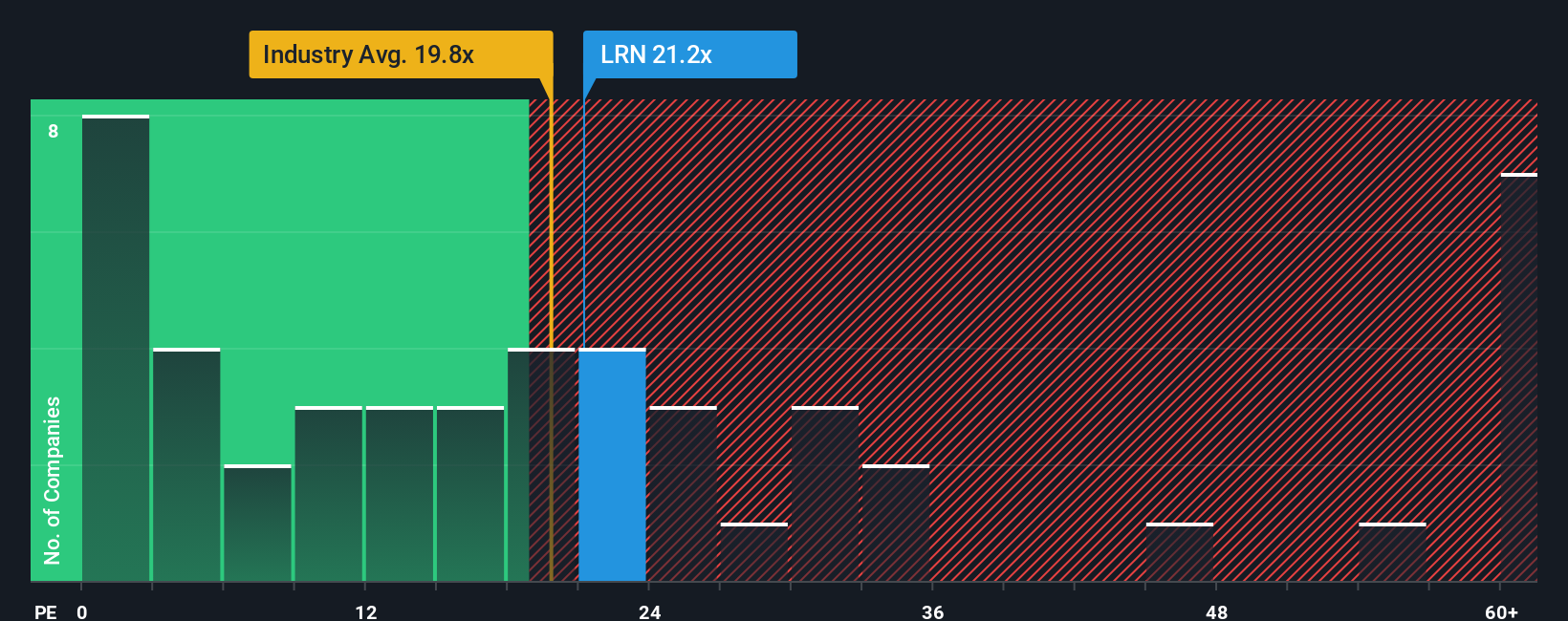

Looking from a different angle, Stride trades at a higher earnings multiple than the overall US Consumer Services industry. While this could signal market confidence, it also raises the debate over whether growth is being overestimated. Which side of the story will play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stride Narrative

If your take on Stride’s outlook is different or if you like to dive into the numbers yourself, you can put together your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Stride.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. If you're hungry for more, tap into these powerful themes and position yourself ahead of the curve with some of the market's most compelling stories:

- Capture high yields by focusing on market leaders offering reliable income with dividend stocks with yields > 3%.

- Target overlooked bargains and find potential breakout winners among penny stocks with strong financials.

- Tap into the digital future with companies revolutionizing blockchain finance through cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal