GlobalFoundries (NasdaqGS:GFS) Valuation: Exploring the Impact of Global Lighthouse Network Recognition on Growth Prospects

Most Popular Narrative: 16.6% Undervalued

According to the prevailing analyst consensus, GlobalFoundries is trading below its estimated fair value, with analysts projecting considerable upside from current share price levels.

Growing demand for automotive and communications infrastructure chips, driven by secular industry shifts such as vehicle electrification and increased chip content per vehicle, is leading to accelerating design wins and strong multi-year revenue growth in high-margin markets for GlobalFoundries. This trend is expected to support revenue and net margin expansion.

How did they reach this bold valuation? The narrative hinges on a handful of aggressive growth bets for both revenue and profits. Want to see what confident analysts believe could rewrite the outlook for this global chipmaker? High expectations conceal some powerful financial moves. Discover what really powers this bullish valuation.

Result: Fair Value of $39.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant risks remain, including GlobalFoundries' limited exposure to advanced process nodes as well as the unpredictable impact of ongoing global trade uncertainties.

Find out about the key risks to this GlobalFoundries narrative.Another View: DCF Tells a Different Story

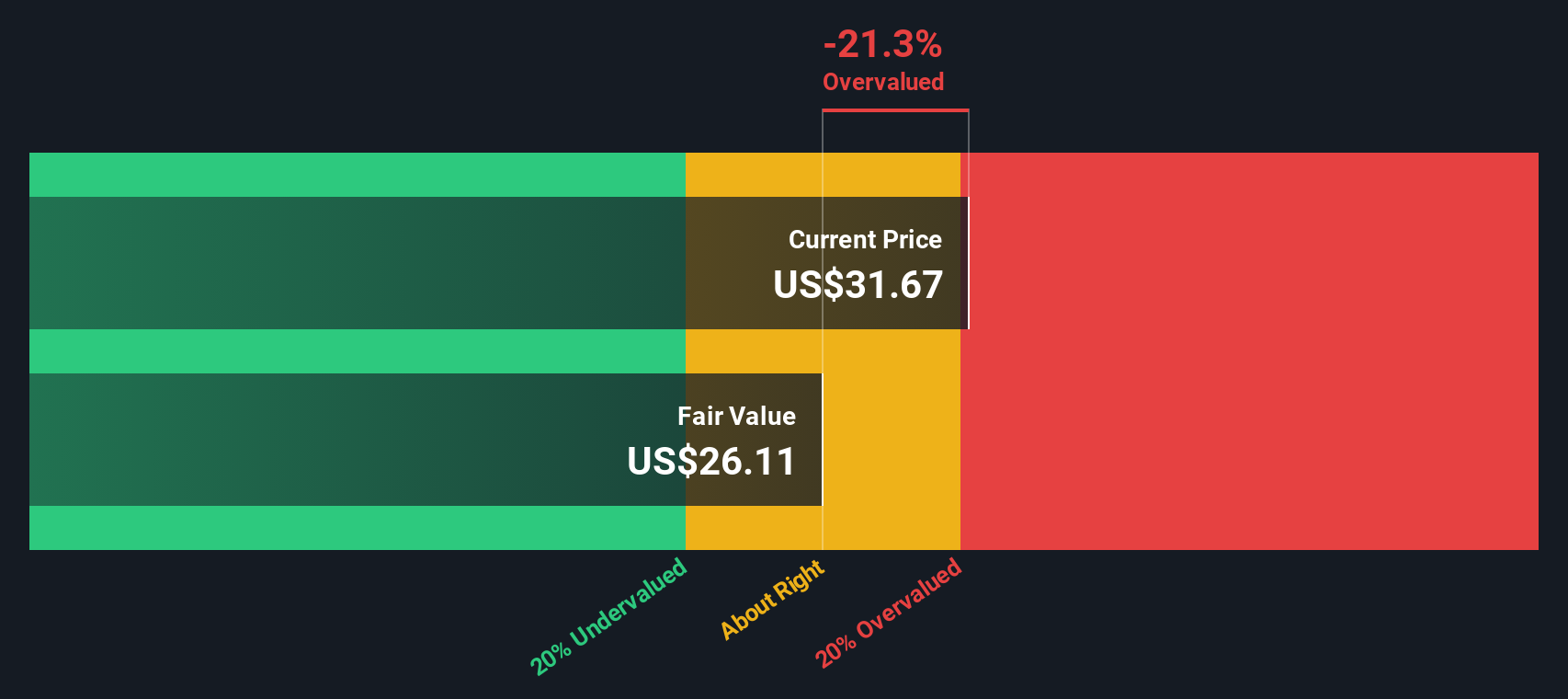

While analyst multiples paint GlobalFoundries as undervalued, the SWS DCF model offers a more cautious perspective and suggests the current share price sits above its estimated fair value. Which view captures the real opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own GlobalFoundries Narrative

If you see the story differently, or want to dig into the numbers on your own terms, you can craft a custom narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding GlobalFoundries.

Looking for More Investment Ideas?

Don’t just stop at GlobalFoundries. Uncover tomorrow’s winning investments with screener-powered ideas that reveal fresh opportunities you might otherwise miss.

- Unlock potential in AI innovation by browsing AI penny stocks. See which companies are changing the world through automation, smart tech, and next-level intelligence.

- Capture undervalued gems before the crowd spots them with the help of undervalued stocks based on cash flows. Watch how overlooked businesses can fuel your portfolio.

- Put your portfolio at the heart of the crypto revolution by checking out cryptocurrency and blockchain stocks. Uncover companies pioneering blockchain solutions and digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal