Beyond The Numbers: 13 Analysts Discuss Delek US Hldgs Stock

Delek US Hldgs (NYSE:DK) has been analyzed by 13 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 7 | 2 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 3 | 1 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 2 | 2 | 1 | 0 |

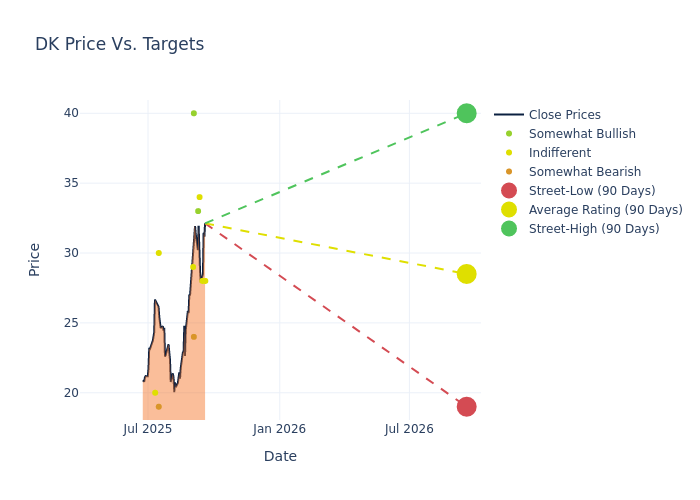

Insights from analysts' 12-month price targets are revealed, presenting an average target of $27.92, a high estimate of $40.00, and a low estimate of $19.00. This current average has increased by 40.16% from the previous average price target of $19.92.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Delek US Hldgs. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jason Gabelman | TD Cowen | Raises | Hold | $28.00 | $15.00 |

| Neil Mehta | Goldman Sachs | Raises | Neutral | $28.00 | $25.00 |

| Ryan Todd | Piper Sandler | Raises | Neutral | $34.00 | $29.00 |

| Justin Jenkins | Raymond James | Raises | Outperform | $33.00 | $26.00 |

| Jean Ann Salisbury | B of A Securities | Raises | Underperform | $24.00 | $14.00 |

| Doug Leggate | Wolfe Research | Announces | Outperform | $40.00 | - |

| Manav Gupta | UBS | Raises | Neutral | $29.00 | $24.00 |

| Ryan Todd | Piper Sandler | Raises | Neutral | $27.00 | $17.00 |

| Prashant Rao | Citigroup | Raises | Neutral | $30.00 | $15.00 |

| Connor Lynagh | Morgan Stanley | Raises | Underweight | $19.00 | $15.00 |

| Justin Jenkins | Raymond James | Raises | Outperform | $28.00 | $23.00 |

| Paul Cheng | Scotiabank | Raises | Sector Perform | $20.00 | $14.00 |

| Justin Jenkins | Raymond James | Raises | Outperform | $23.00 | $22.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Delek US Hldgs. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Delek US Hldgs compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Delek US Hldgs's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

To gain a panoramic view of Delek US Hldgs's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Delek US Hldgs analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Delek US Hldgs: A Closer Look

Delek US Holdings Inc is an integrated energy business focused on petroleum refining, transportation and storage; wholesale crude oil, intermediate, and refined products, and convenience stores retailing. The company owns and operates independent refineries that produce a variety of petroleum products for transportation and industrial markets in the United States. It has two segments: Refining segment and Logistics segment. The logistics segment generates revenue through gathering, transporting, and storing crude oil and intermediate products, as well as by marketing, storing, and distributing refined products. The company also offers a collection of retail fuel and convenience stores operating in the Southeast region of the United States.

Delek US Hldgs: Financial Performance Dissected

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Negative Revenue Trend: Examining Delek US Hldgs's financials over 3M reveals challenges. As of 30 June, 2025, the company experienced a decline of approximately -16.43% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Energy sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Delek US Hldgs's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -3.85%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -117.31%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Delek US Hldgs's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -1.53%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 122.58, caution is advised due to increased financial risk.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal