3 Gold Mining Stocks Shine As Prices Hit Records

Three gold mining stocks have marked significant improvements in their quality rankings, coinciding with gold prices reaching new highs this week.

These stocks have now entered the top 10% bracket for quality, a notable achievement that highlights their operational efficiency and financial health compared to industry peers.

What Does Quality Ranking Mean?

Benzinga Edge Stock Rankings‘ quality metric is a composite score that analyzes a company's operational efficiency and financial health, relying on historical profitability and fundamental strength indicators.

This score is expressed as a percentile, showing how a company measures up against its sector peers.

3 Gold Mining Stocks With Top-Notch Quality

Anglogold Ashanti PLC (NYSE:AU), Coeur Mining Inc. (NYSE:CDE), and New Gold Inc. (NYSE:NGD) achieved a place in the top 10th percentile, which signifies that these stocks are outperforming many of their competitors on these key metrics.

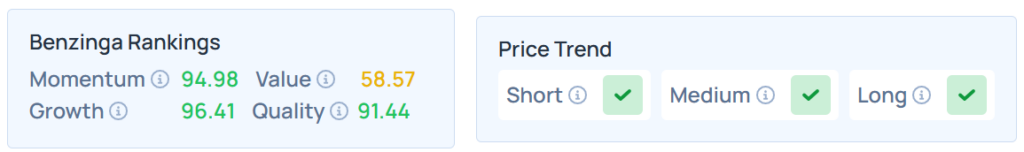

Anglogold Ashanti

- AU saw its quality percentile rise from 88.68 last week to the 91.44th percentile this week, a gain of 2.76 points. This move underscores the company's strengthening fundamentals just as the gold price surges.

- The stock has gained by 165.08% year-to-date and 136.60% over a year.

- It maintains a stronger price trend over the short, medium, and long terms with a strong growth ranking. Additional performance details are available here.

See Also: 3 Crypto ETFs Poised To Surge With Big Spikes In Momentum Ranking And Fund Scores

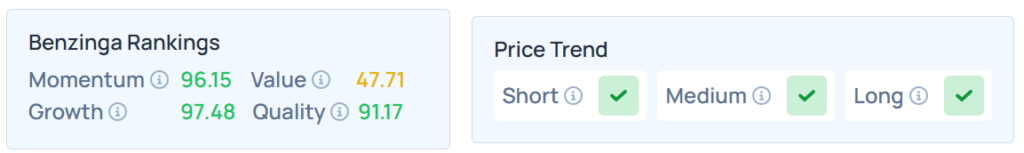

Coeur Mining

- CDE jumped from 89.21 to the 91.71th percentile, posting a week-on-week boost of 2.5 percentile points. CDE's inclusion in the top 10% reflects a marked improvement in profitability and operational metrics, aligning with the renewed investor focus on mining stocks.

- Higher by 158.06% YTD, the stock was up 137.04% over the year.

- With a moderate value ranking, this stock maintained a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

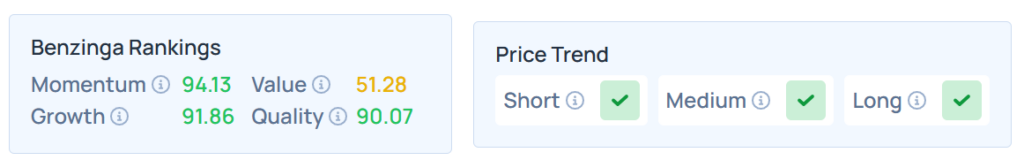

New Gold

- NGD climbed from 89.18 to the 90.07th percentile, with a positive change of 0.89 percentile points. NGD's ascent into the top quality bracket echoes broader sector tailwinds from rising gold prices.

- The stock advanced 146.56% YTD and 116.05% over the year.

- It had a stronger price trend in the short, medium, and long terms with a moderate value ranking. Additional performance details are available here.

Gold prices breaking fresh highs have prompted increased scrutiny and interest in leading gold miners. Investors are seeking quality as a differentiator, and these three stocks stand out for outperforming their peers on key financial and operational criteria. The percentile changes further validate their momentum, demonstrated by sharply improved rankings in a pivotal market moment.

Price Action

Gold Spot US Dollar rose 0.25% to hover around $3,669.12 per ounce. Its last record high stood at $3,707.70 per ounce. The prices have surged 19.93% over the last six months and 42.16% over the year.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Thursday. The SPY was up 0.86% at $664.86, while the QQQ advanced 1.03% to $596.07, according to Benzinga Pro data.

On Thursday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga

Image via Shutterstock

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal