Korn Ferry (KFY): Assessing Valuation Following Strong Earnings, Dividend Announcement, and Updated Outlook

Most Popular Narrative: 12.8% Undervalued

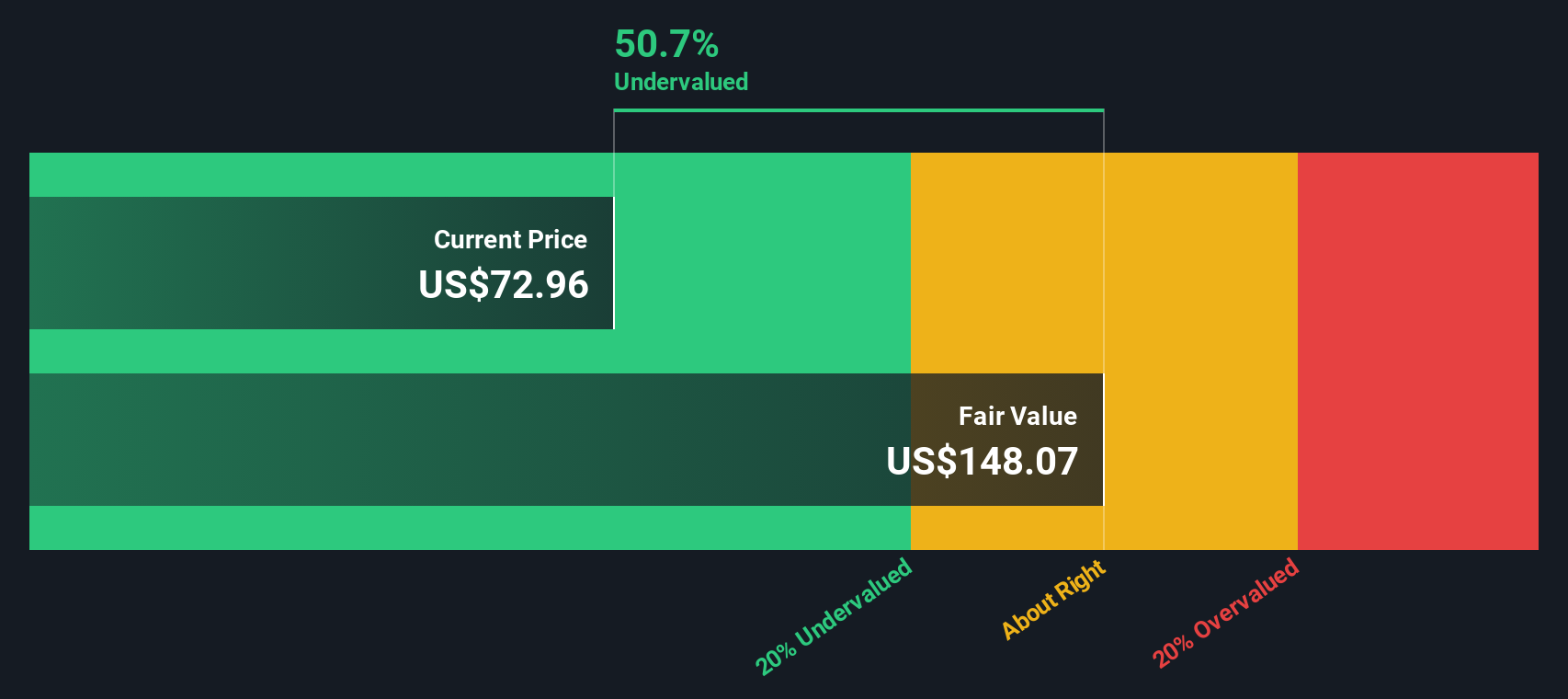

According to the most widely followed narrative, Korn Ferry is trading at a discount to its estimated fair value, suggesting potential room for upside if projections play out as expected.

“Korn Ferry has secured significant transformation engagements with major global companies, indicating a strong demand for their services in strategic transformation and workforce transformation, which can drive future revenue growth. The company's strategy of diversifying and expanding into larger addressable markets with a wide range of organizational and talent solutions is expected to enhance revenue predictability and sustainability, potentially improving net margins.”

Curious what’s powering this bullish outlook? The narrative relies on a mix of ambitious revenue, margin, and earnings projections that could reshape how investors view the stock. There is a hidden formula behind this fair value: it involves big assumptions and shifting market dynamics, crafted for anyone seeking the real numbers behind Korn Ferry’s price target.

Result: Fair Value of $83.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unpredictable macroeconomic conditions or delays in converting new projects into revenue could challenge this upbeat outlook for Korn Ferry.

Find out about the key risks to this Korn Ferry narrative.Another View: What Does a Cash Flow Model Say?

While the analyst consensus highlights upside based on earnings projections, our SWS DCF model paints an even more optimistic picture. This suggests Korn Ferry could be trading further below its intrinsic value. Could the true opportunity be even greater?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Korn Ferry Narrative

If you have a different angle or want to test your own ideas, you can craft a Korn Ferry narrative using our tools in just minutes. Do it your way

A great starting point for your Korn Ferry research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know opportunities stretch well beyond a single stock. Make your research count by scouting other promising companies that could boost your returns and put you ahead of the crowd.

- Pinpoint value opportunities by scanning for undervalued stocks based on cash flows with strong fundamentals and attractive pricing in any market.

- Catch the wave of technology disruption by focusing on tomorrow’s breakthroughs using our guide to AI penny stocks.

- Lock in reliable income streams by exploring dividend stocks with yields > 3% that offer dividend yields above 3% and have a record of strong financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal