Will S&P 500 Inclusion and Strong Growth Momentum Change Interactive Brokers' (IBKR) Investment Narrative?

- Interactive Brokers Group was recently confirmed for inclusion in the S&P 500 index and reported strong earnings momentum, with revenue growth surpassing estimates and an optimistic forecast for continued business expansion.

- The company’s ongoing global expansion and innovative product rollouts reflect efforts to broaden market reach and enhance its competitive position in the financial services industry.

- We'll explore how S&P 500 index inclusion may amplify structural demand for Interactive Brokers and impact its investment outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Interactive Brokers Group Investment Narrative Recap

To be a shareholder of Interactive Brokers Group, you need to believe in the company's ability to continue expanding its global footprint and enhancing its product lineup to capture long-term growth in the online brokerage industry. The recent S&P 500 inclusion may offer a short-term catalyst by increasing structural demand from index-tracking funds, while the biggest risk remains the company's sensitivity to shifts in trading volumes, should global market conditions become less favorable, revenue growth could be impacted.

Among recent announcements, Interactive Brokers' launch of commission-free IBKR Lite pricing in Singapore is particularly relevant. This move signals further commitment to international growth and could spur new account openings and trading activity, a key catalyst supporting the company's expansion ambitions.

However, investors should also pay attention to the potential impact of lower market volatility on trading volumes, as...

Read the full narrative on Interactive Brokers Group (it's free!)

Interactive Brokers Group is projected to achieve $5.9 billion in revenue and $740.3 million in earnings by 2028. This outlook is based on a 5.9% annual revenue growth rate, while earnings are expected to increase by $42.3 million from the current $698.0 million.

Uncover how Interactive Brokers Group's forecasts yield a $66.22 fair value, a 6% upside to its current price.

Exploring Other Perspectives

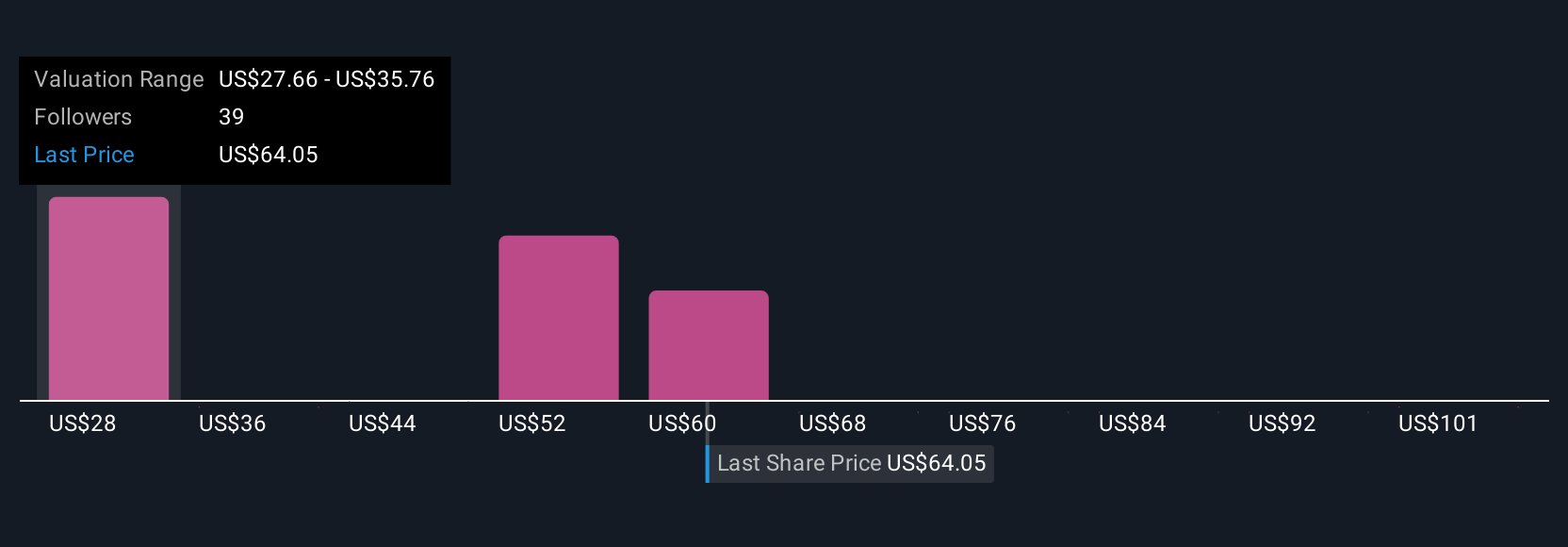

Ten fair value estimates from the Simply Wall St Community range widely from US$17.62 to US$108.63 per share. While many focus on international product rollouts for future growth, you should be aware how variable market conditions can influence these viewpoints.

Explore 10 other fair value estimates on Interactive Brokers Group - why the stock might be worth as much as 74% more than the current price!

Build Your Own Interactive Brokers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interactive Brokers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interactive Brokers Group's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal