Assessing the Valuation of National Storage Affiliates Trust (NSA) After Recent Share Price Moves

Most Popular Narrative: 10.7% Undervalued

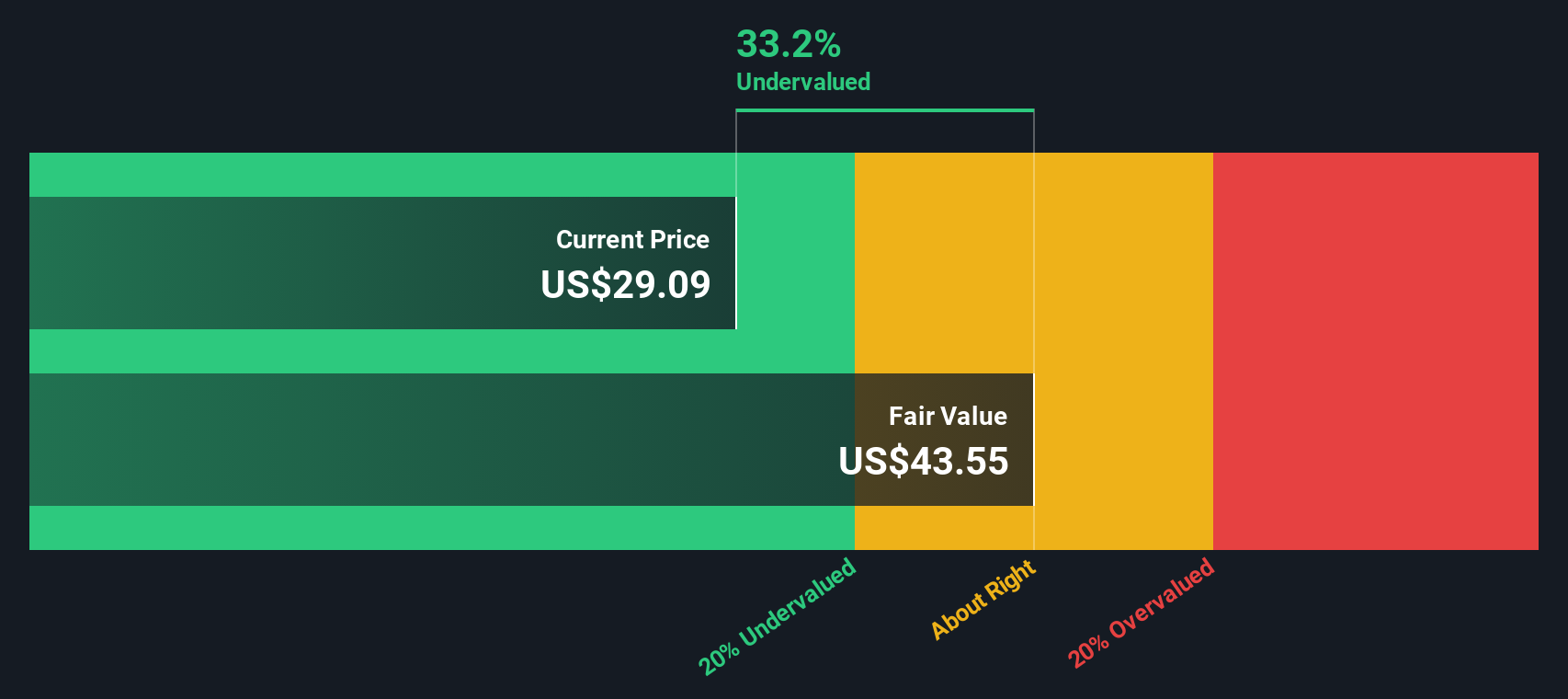

According to the most widely followed narrative, National Storage Affiliates Trust is considered undervalued by analysts, with the current share price trading below the calculated fair value.

The recent internalization and rebranding of PRO (Participating Regional Operator) properties, combined with investments in centralized technology and enhanced digital marketing, are likely to drive efficiency gains and margin expansion as integration challenges subside. This is expected to support earnings growth.

Curious why analysts believe NSA’s future is brighter than the market thinks? The underpinning of this undervaluation lies in a dramatic shift in operational focus and financial strategy that could transform the company’s profitability. Want to know what hidden projection gives rise to this bold valuation? Discover which assumption could change the way investors view this REIT’s path to recovery.

Result: Fair Value of $34.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, elevated costs and persistent macroeconomic headwinds could pressure margins and stall NSA's expected operational improvements. This could challenge the argument for sustained earnings growth.

Find out about the key risks to this National Storage Affiliates Trust narrative.Another View: Looking Beyond Analyst Price Targets

While analysts see value, our own DCF model paints a similar picture. This suggests the current share price still sits below NSA’s longer-term potential. However, DCF estimates rely on several optimistic assumptions. Could this method be missing key risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own National Storage Affiliates Trust Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own perspective in a matter of minutes with Do it your way.

A great starting point for your National Storage Affiliates Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at just one opportunity? Take your investing strategy up a notch with curated stock ideas you can act on right now using Simply Wall St’s screener tools.

- Start building a portfolio of potential growth stories by targeting undervalued businesses that stand out with solid cash flow fundamentals using our undervalued stocks based on cash flows.

- Maximize your passive income strategy by searching among companies offering robust yields with our gateway to dividend stocks with yields > 3%.

- Tap into tomorrow's innovations in medicine and technology by accessing stocks at the forefront of artificial intelligence in healthcare through our handpicked healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal