Is Belden's Quantum Security Push With Chicago Quantum Exchange Reframing the Investment Thesis for BDC?

- Belden Inc. recently announced its affiliation with the Chicago Quantum Exchange, joining forces with this prominent quantum science and engineering hub to advance quantum-safe networking solutions for critical infrastructure sectors.

- This partnership marks a shift for Belden as it integrates quantum security into its core offerings, responding directly to heightened industry demand for future-proof protection against quantum-era cybersecurity risks.

- We'll look at how Belden's entry into quantum-secure networking could influence its future role in safeguarding essential digital infrastructure.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Belden Investment Narrative Recap

For investors to be comfortable as Belden shareholders, they need to believe in the company's transformation from a traditional connectivity provider to a leader in secure, high-value solutions for critical infrastructure. The new partnership with the Chicago Quantum Exchange is a credible step in future-proofing product lines, but the immediate impact on Belden’s main catalysts, like enterprise and industrial digitalization, appears incremental rather than substantial in the short term. Persistent margin pressure from input cost inflation and price competition remains the key short-term risk.

Among recent announcements, Belden’s Q2 2025 results demonstrate robust sales and earnings growth, with net income and EPS up significantly year-over-year. This performance is directly relevant as it underlines the strength of Belden’s operations even as the company diversifies and invests in emerging areas like quantum-safe networking, aligning with the major catalysts of digital transformation and smart infrastructure demand.

In contrast, information on margin pressures tied to input costs and commoditization is something investors should be keenly aware of...

Read the full narrative on Belden (it's free!)

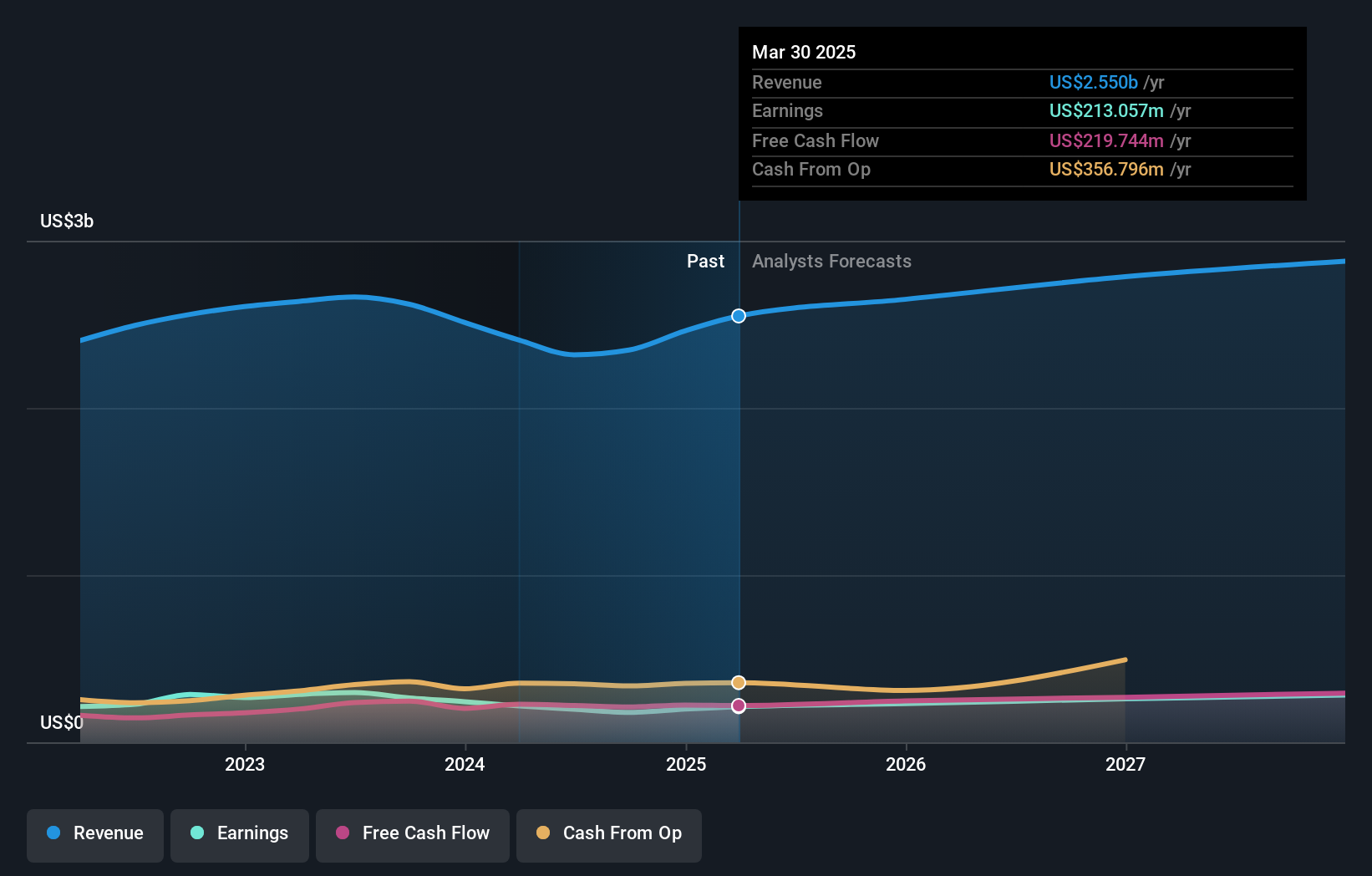

Belden's outlook projects $3.0 billion in revenue and $277.7 million in earnings by 2028. This scenario assumes a 4.4% annual revenue growth rate and a $52.7 million earnings increase from current earnings of $225.0 million.

Uncover how Belden's forecasts yield a $142.60 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided three fair value estimates for Belden, ranging from US$80.69 to US$142.60 per share. While these perspectives vary, keep in mind that cost inflation and intensifying price competition could affect margin stability and influence future valuation outcomes.

Explore 3 other fair value estimates on Belden - why the stock might be worth 38% less than the current price!

Build Your Own Belden Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Belden research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Belden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Belden's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal