Will a 6 Percent Dividend Hike Shift Hawkins' (HWKN) Capital Allocation Narrative?

- Hawkins, Inc. recently announced a 6% increase in its quarterly cash dividend at its July 30, 2025 board meeting, maintaining its commitment to shareholder returns.

- This dividend hike stands out as a signal of management confidence and financial resilience during a period of acquisitions and active debt management.

- Next, we'll examine how Hawkins’ dividend increase underscores its financial strength and shapes the company’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Hawkins' Investment Narrative?

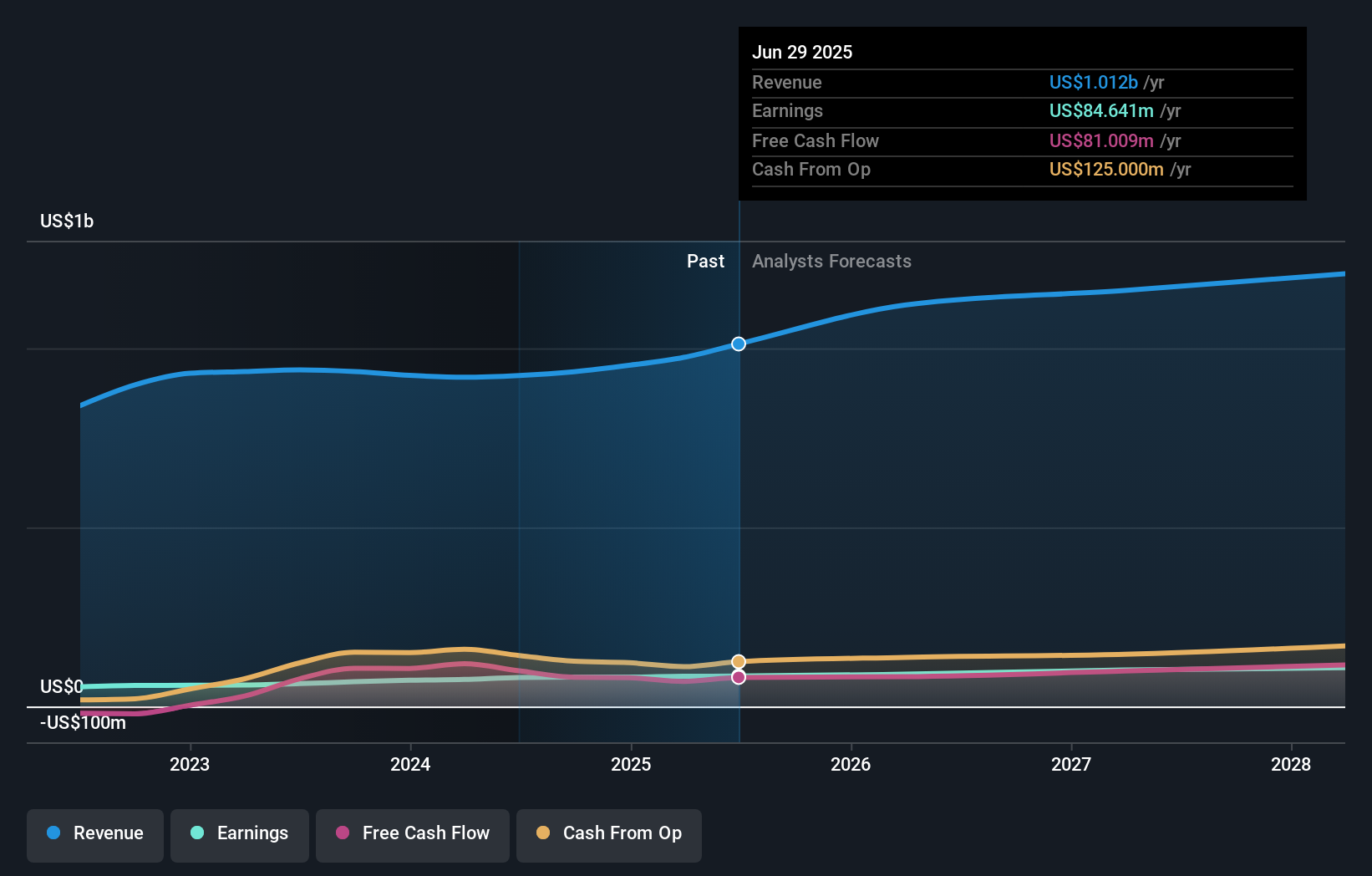

For Hawkins, Inc. shareholders, the investment thesis has long revolved around steady earnings, prudent capital allocation, and a reliable dividend stream, all underpinned by seasoned management. The recent 6% dividend increase is a tangible show of board confidence, reinforcing Hawkins' tendency to prioritize shareholder returns, even as expansion and acquisition activity has nudged debt levels higher. While the dividend hike itself is unlikely to materially alter short-term catalysts like acquisition integration or market share gains, it does reduce some uncertainty around capital allocation and signals that management sees underlying earnings stability. Still, this doesn’t fully address key risks: Hawkins remains richly valued relative to peers, faces the challenge of integrating new businesses with potentially modest industry growth, and carries a high debt load. Recent price momentum suggests optimism persists, but the valuation premium may now warrant closer attention as market conditions shift.

But, on the other hand, Hawkins’ high debt levels present a meaningful risk investors should not overlook. Hawkins' shares are on the way up, but they could be overextended by 30%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Hawkins - why the stock might be worth 23% less than the current price!

Build Your Own Hawkins Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hawkins research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hawkins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hawkins' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal