A Fresh Look at Antero Midstream (NYSE:AM) Valuation After Upsized $650 Million Debt Refinancing

Debt refinancings do not always grab headlines, but when Antero Midstream (NYSE:AM) priced an upsized $650 million private placement of 5.75% senior unsecured notes due 2033, it sent a quiet but meaningful signal to investors. The company plans to use the proceeds, along with its revolving credit facility, to redeem the outstanding 2027 notes. What stands out is how this move could extend the debt maturity profile and add an extra layer of financial flexibility for Antero Midstream in a capital-intensive sector.

Looking more broadly, this refinancing caps off a year in which Antero Midstream’s stock price has steadily appreciated, rising 29% over the past year and showing over 18% year-to-date growth. The company’s recent performance has built steady momentum, especially as it continues to manage debt proactively and strengthen its balance sheet. In that context, investors have watched the stock’s gains track above broader energy peers even as overall market volatility has remained a constant backdrop.

After this kind of run, especially with a potentially lower-risk debt structure coming soon, the real question is whether Antero Midstream is undervalued from here or if investors are already pricing in future growth.

Most Popular Narrative: Fairly Valued

The prevailing narrative among analysts is that Antero Midstream is fairly valued, with the company’s current share price nearly matching the consensus price target based on projected earnings growth and margins.

Rising U.S. LNG export demand and expansion of Gulf Coast LNG facilities are expected to drive higher natural gas volumes from Appalachia. This is seen as supporting Antero Midstream's gathering and processing volumes and underpinning sustained revenue growth. Infrastructure modernization and rising Northeast U.S. in-basin demand, particularly from data centers and industrial projects enabled by favorable regulation, should increase utilization of existing assets and provide additional fee-based revenue opportunities as new infrastructure is built to meet this demand.

Ready for a valuation playbook packed with bold profit forecasts and ambitious margin goals? The central story here weaves together surprising assumptions, spanning market shifts and a potential boost in asset earnings, all to justify the current price. Which growth levers are analysts counting on and do the company’s margins have what it takes for this valuation? Dig deeper and see the detailed numbers that drive the case for Antero Midstream’s fair value.

Result: Fair Value of $18.07 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on a single customer and ongoing regulatory pressures could quickly challenge the company’s growth and earnings outlook.

Find out about the key risks to this Antero Midstream narrative.Another View: What Does Our DCF Model Say?

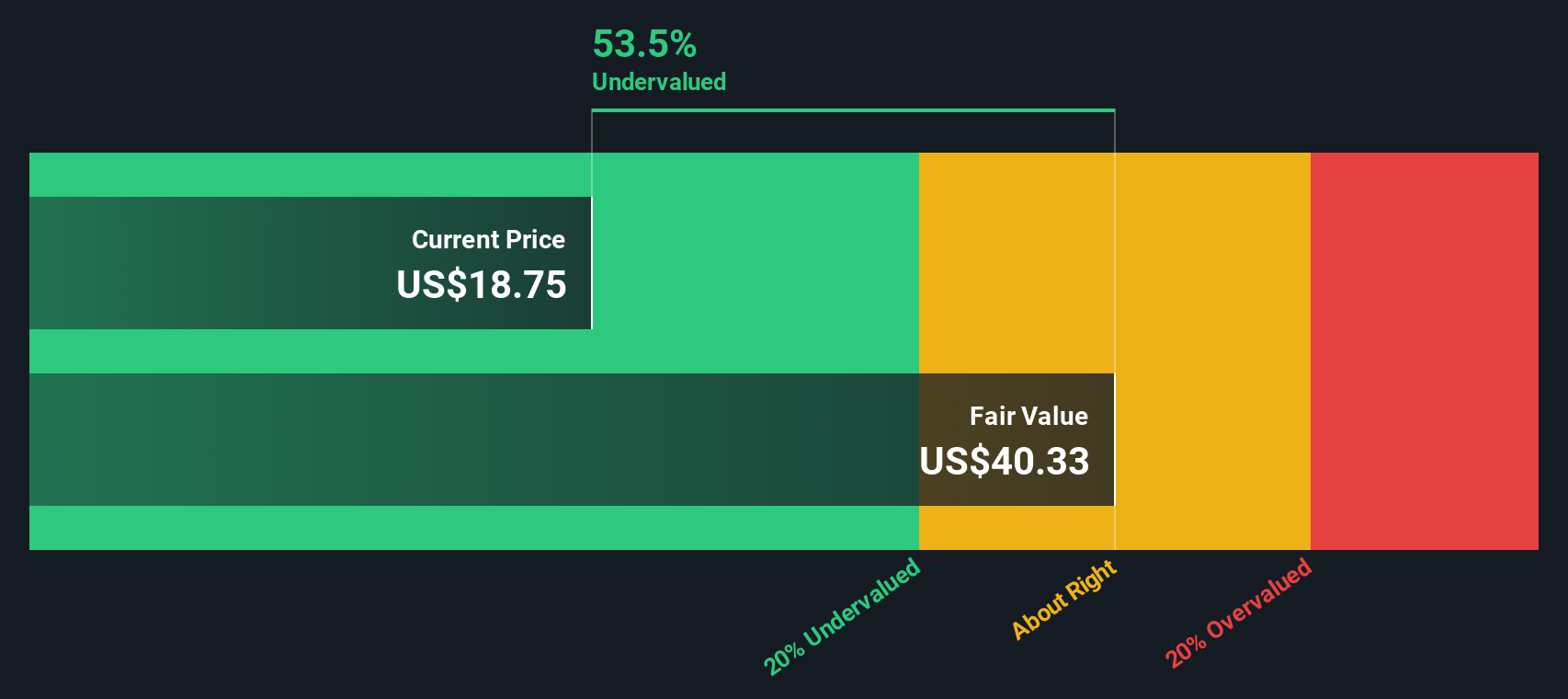

While analysts see Antero Midstream at fair value today, our DCF model presents a different picture. This method suggests the shares could be undervalued, offering a new perspective on the valuation debate. Which story will play out?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Antero Midstream Narrative

If you see things differently, or want to dig into the numbers on your own terms, you can easily shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Antero Midstream research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your potential to just one stock. Use the Simply Wall Street Screener to zero in on innovative opportunities with rapid growth or hidden value, and take control of your next move.

- Maximize returns by targeting solid payouts and steady cash flow through dividend stocks with yields > 3%, which yield over 3% annually.

- Tap into the future of healthcare by uncovering trailblazing firms that are driving breakthroughs with healthcare AI stocks leading innovations.

- Seize overlooked gems priced below their worth when you focus on stocks identified as undervalued stocks based on cash flows, based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal