Perdoceo Education (PRDO): Examining Valuation After Market Rally and Continued Earnings Strength

If you have been watching Perdoceo Education (PRDO) lately, you know its stock just jumped again in the wake of the latest Consumer Price Index numbers landing right where Wall Street expected. That news stoked market-wide excitement, boosting many stocks, including PRDO, which also has its own reasons to celebrate. Consistent earnings beats over the past four quarters and a solid return on equity are keeping this education provider in the spotlight for investors tracking long-term winners.

This pop is no isolated move, either. Momentum has been steadily building for Perdoceo Education throughout the year, reflecting both broader economic optimism and confidence in the company’s management. The stock’s return has been sharply higher over the past year, fueled not just by favorable economic signals but also by a focus on reinvesting profits. Management has been plowing back 78% of income, supporting strong earnings growth. Adding the fact that market experts see the stock as undervalued compared to peers, it is easy to see why investors are taking another look.

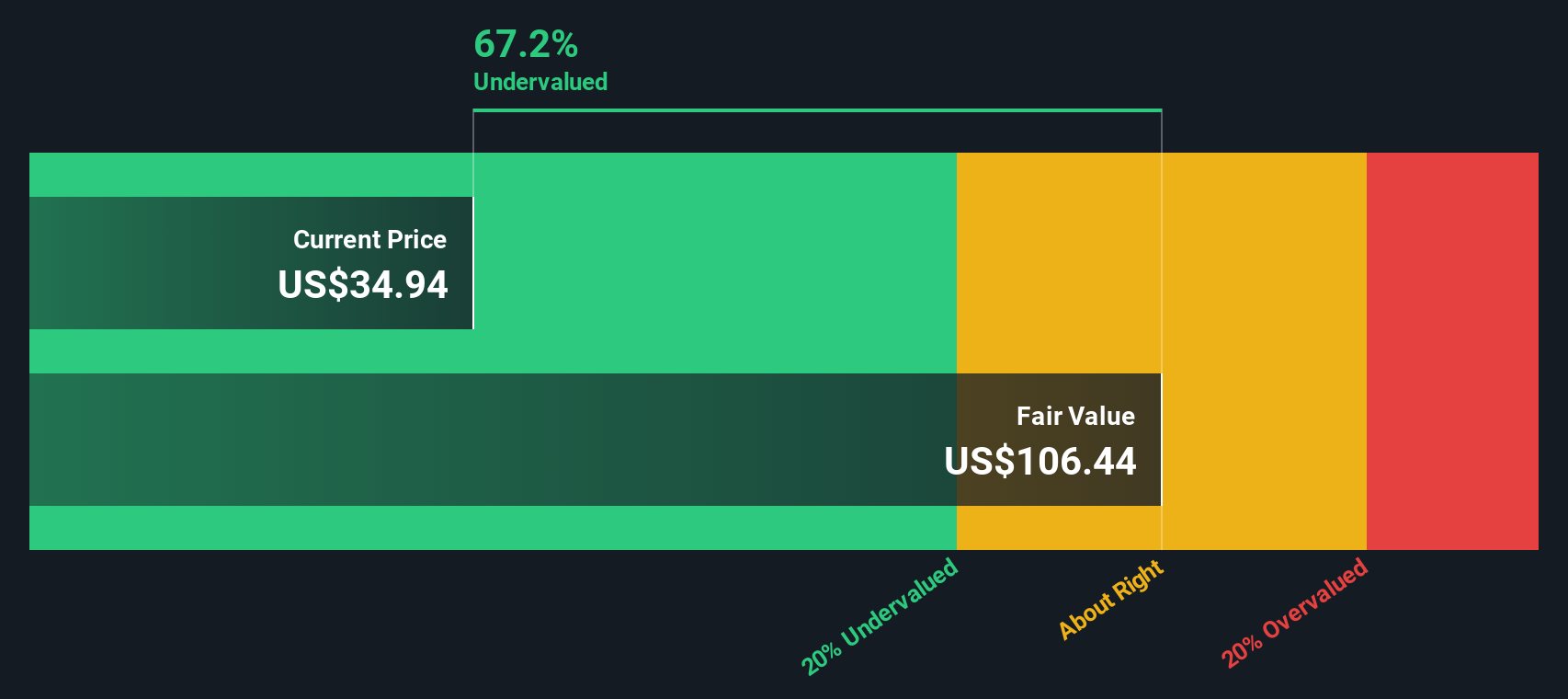

But with shares riding high after this stretch, the key question remains: is Perdoceo Education still a bargain, or has the market now fully priced in its growth story?

Most Popular Narrative: 12.2% Undervalued

According to the most widely followed narrative, Perdoceo Education is trading below its estimated fair value, signaling potential upside for investors who believe in the business’s growth path and underlying financial forecasts.

*"Strategic investment in data-driven student support, enrollment technologies, and generative AI for targeted marketing is driving multiyear highs in retention and engagement. This is expected to reduce revenue leakage from dropouts and increase the efficiency of marketing spend, positively impacting net margins."*

Curious about what’s behind Perdoceo’s bullish price target? Analysts are banking on core business shifts, game-changing tech, and sharper profit strategies. There is a controversial set of assumptions and bold forecasts fueling this “undervalued” verdict. Want to see exactly what’s factored into the projection and where it could go next?

Result: Fair Value of $40.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, because Perdoceo relies heavily on acquisitions and is exposed to regulatory changes, its strong momentum could be disrupted and its earnings growth trajectory may be challenged.

Find out about the key risks to this Perdoceo Education narrative.Another View: What Does the SWS DCF Model Say?

Looking at Perdoceo Education through the lens of the SWS DCF model offers a different perspective. This longer-term, cash-flow-based analysis also finds the stock trading well below estimated fair value. However, could future risks or a shift in assumptions change the story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Perdoceo Education Narrative

If this perspective doesn’t quite fit your outlook, or you’d rather dig through the numbers and conclusions yourself, you can shape your own narrative in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Perdoceo Education.

Looking for more investment ideas?

Opportunity knocks for those who keep an open mind. Take charge of your investing journey and seize overlooked opportunities before others catch on.

- Tap into resilient cash generators and uncover the next wave of smart buys by checking out undervalued stocks based on cash flows in today’s market.

- Zero in on future-focused medical breakthroughs when you scan healthcare AI stocks shaping the next era of healthcare innovation.

- Build your own income strategy by starting with stocks yielding more than 3% and see what stands out among dividend stocks with yields > 3% available now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal