A Look at Amkor Technology's Valuation Following $500 Million Debt Refinancing (AMKR)

If you’ve been wondering what to do next with Amkor Technology (AMKR), now is an interesting time to take a closer look. The company just completed a $500 million senior notes offering, which is more than a simple capital raise; this move is designed to redeem higher-interest 2027 notes and free up room on the balance sheet. For investors, any transaction that lowers interest expense while stretching out the repayment timeline sends signals about management’s confidence and focus on sustainable growth.

Amkor’s recent shift in its capital structure comes amid a year where the stock has experienced both ups and downs. Momentum is building in recent months, with shares up 33% over the past three months and 14% in the past month. That said, the longer-term picture reminds us to be careful, as one-year returns are still down by nearly 9%. Over three and five years, however, Amkor has delivered strong double- and triple-digit returns, hinting at the potential for renewed investor optimism if fundamentals keep improving.

With the refinancing move behind us, is Amkor Technology trading at a bargain, or is the market already pricing in brighter days ahead?

Most Popular Narrative: 8.7% Overvalued

According to the most popular narrative, Amkor Technology shares are currently trading above fair value, with analysts viewing the stock as moderately overvalued based on their key growth and margin assumptions.

Strategic investments in advanced packaging and test operations, notably in Korea and the US, are positioning Amkor as a preferred Turnkey partner for high-performance compute and AI customers. This is resulting in higher utilization rates, premium pricing on leading-edge solutions, and structurally higher net margins over time.

Curious what is powering this bold valuation? The narrative leans on big industry trends and ambitious profit forecasts. Is Amkor on the cusp of margin expansion and revenue acceleration, or are expectations too high? The key assumptions behind this fair value target might surprise you. Dig into the full narrative to see which financial moves and forecasts are shaping the current price estimate.

Result: Fair Value of $24.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent underutilization of legacy assets and ongoing geopolitical tensions could quickly dampen Amkor’s momentum. This may challenge even the most optimistic forecasts.

Find out about the key risks to this Amkor Technology narrative.Another Perspective: Value Signals from Earnings Multiples

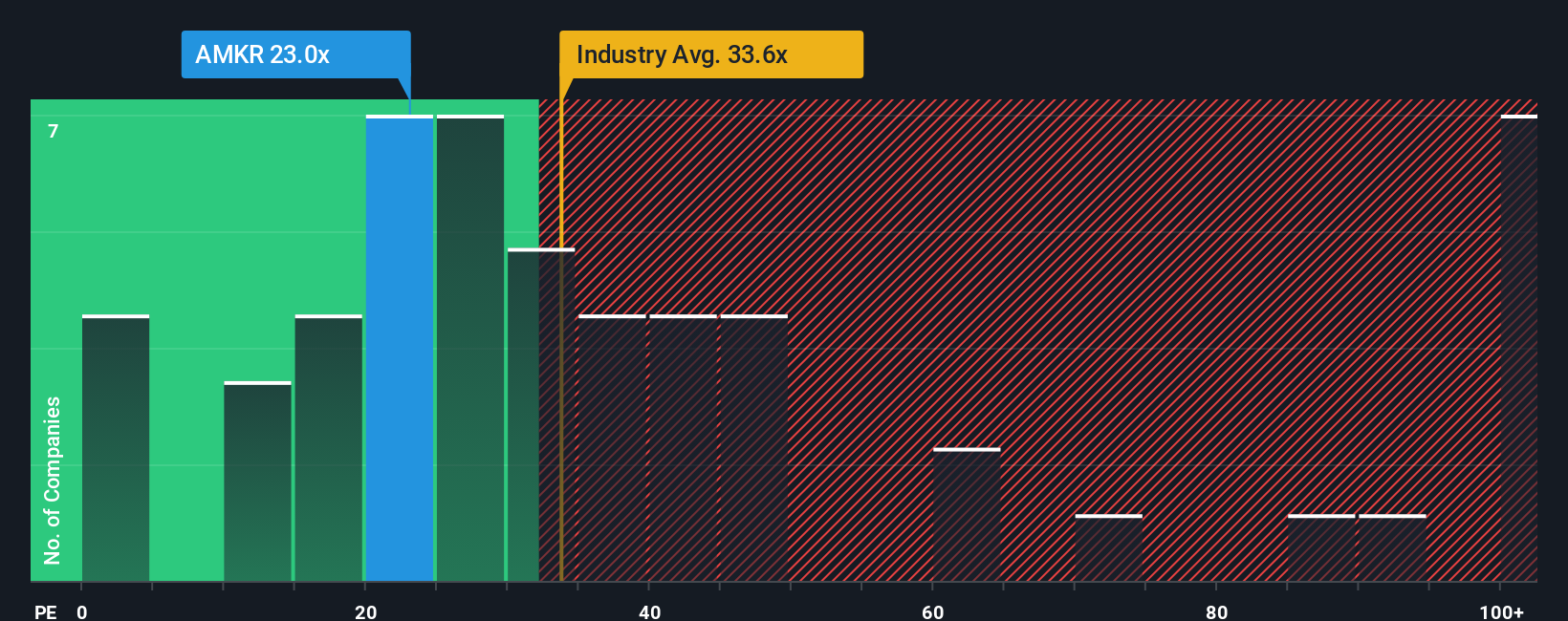

While analysts highlight moderate overvaluation based on future growth, another method compares Amkor's earnings valuation to the overall industry. With this approach, Amkor actually looks attractively priced. Are market fears masking real value, or do risks justify a discount?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amkor Technology Narrative

If you see things differently or want to dig into the numbers yourself, you can easily build your own Amkor Technology narrative in just a few minutes. Do it your way.

A great starting point for your Amkor Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stop waiting on the sidelines. Uncover hidden opportunities and find your next big winner among groups of stocks built around powerful themes and financial strength.

- Start your search for growth by uncovering penny stocks with strong financials using penny stocks with strong financials and spot companies breaking through traditional barriers.

- Fuel your curiosity for game-changing technology when you analyze breakthrough innovators among quantum computing stocks and reveal who is making real progress in quantum computing.

- Maximize your income by seeking out reliable dividend payers with dividend stocks with yields > 3%. These companies could strengthen your portfolio with consistent, above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal