Should RH's (RH) Tariff-Driven Guidance Cut and Launch Delay Change Investors' Assumptions?

- In September 2025, RH revised its full-year earnings guidance and provided updated third-quarter expectations, citing US$30 million in incremental tariff costs and delaying a significant brand extension to spring 2026 due to continued tariff uncertainty. The company also reported second-quarter results showing year-over-year increases in revenue and net income, but acknowledged mixed margins and emerging cost pressures.

- An important insight is that RH’s proactive adjustments, both to its financial outlook and its product launch schedule, reflect how tariff headwinds and cost inflation are directly impacting its growth strategy and operational flexibility.

- Next, we'll consider how RH's revised outlook and launch delays due to tariff uncertainties could shift the assumptions underlying its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

RH Investment Narrative Recap

Being a shareholder in RH often means believing in the power of high-end brand development and platform expansion to drive sustainable earnings growth, despite challenges. The recent guidance revision and delay of a major brand extension due to tariff pressures weighs on short-term momentum, but with new gallery openings still planned for 2025, the biggest near-term catalyst, the rollout of fresh retail experiences, remains intact. The key risk now centers on how further tariff uncertainty could erode operating margins if it persists.

Among recent announcements, RH’s latest financial results stand out. The second quarter delivered year-over-year gains in both revenue and net income, which reinforces the underlying demand for RH’s offerings. Yet, these positive figures are tempered by management’s warnings about mounting cost headwinds and cautious outlook, providing important context for evaluating upcoming catalysts like international gallery launches.

However, investors should also stay aware of the threat that persistent cost inflation due to tariffs may…

Read the full narrative on RH (it's free!)

RH's narrative projects $4.3 billion revenue and $442.6 million earnings by 2028. This requires 9.6% yearly revenue growth and a $358.5 million earnings increase from $84.1 million today.

Uncover how RH's forecasts yield a $262.25 fair value, a 14% upside to its current price.

Exploring Other Perspectives

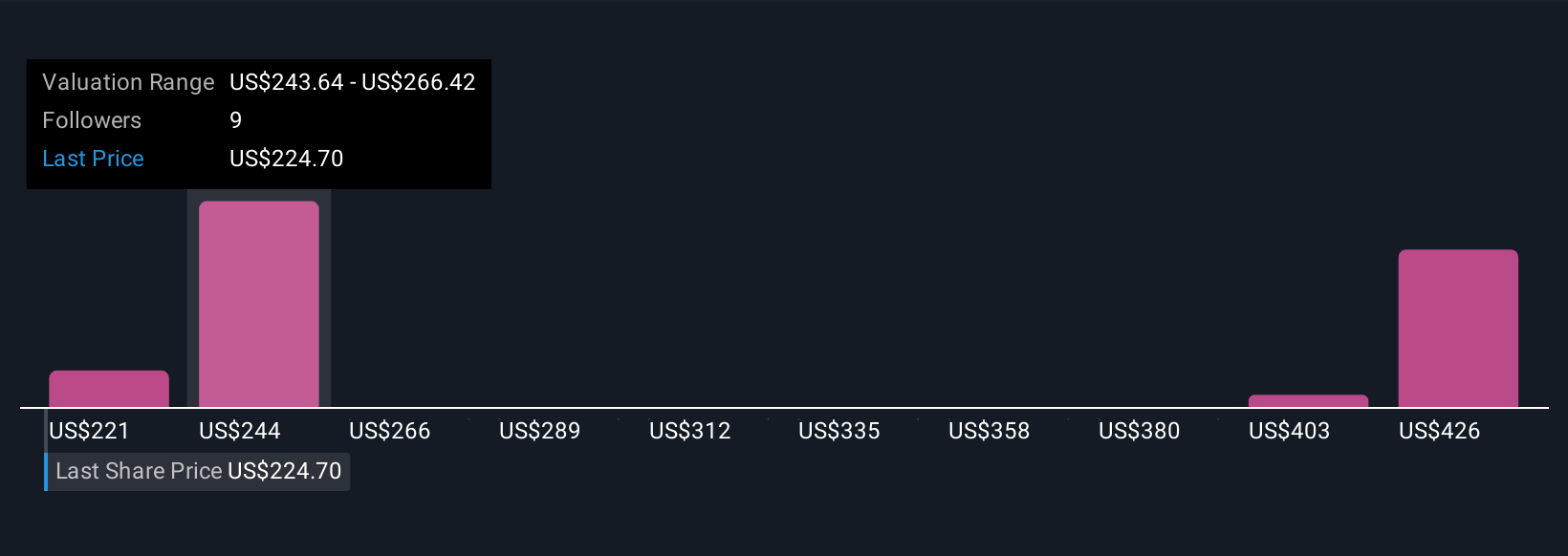

Across five Simply Wall St Community fair value estimates, opinions range from US$220.85 to US$451.84, revealing wide differences in forecasts. With ongoing tariff concerns impacting margin outlooks, considering multiple viewpoints is especially important for understanding where RH could head next.

Explore 5 other fair value estimates on RH - why the stock might be worth as much as 96% more than the current price!

Build Your Own RH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RH research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free RH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RH's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal