Global Ship Lease (NYSE:GSL): Assessing Valuation Following Preferred Dividend and Analyst Value Recognition

If you have been following Global Ship Lease (NYSE:GSL), the past week likely caught your eye. The company just announced its next cash dividend for Series B Preferred Shares, reinforcing management’s ongoing commitment to rewarding shareholders. At the same time, Global Ship Lease is attracting value-focused interest, with some stock watchers highlighting its comparative undervaluation based on price-to-earnings and price-to-book ratios.

Together, the preferred dividend news and the increased investor attention have added momentum to Global Ship Lease’s stock this year. Over the past month, shares climbed 6%, and the gains extend further over the past three months and year. In fact, Global Ship Lease has notched a 43% total return for shareholders in the year, which reflects growing confidence in management’s strategy, even in the face of moderate declines in annual revenue and net income.

With the market signaling renewed optimism and valuation metrics indicating that shares may be trading at a discount, some investors are considering whether Global Ship Lease presents a rare buying opportunity or whether the market has already priced in its future growth potential.

Most Popular Narrative: 10.4% Undervalued

According to the most widely followed analyst narrative, Global Ship Lease is seen as undervalued compared to its estimated fair value. The narrative points to forward-looking analyst models that factor in revenue growth, margin trends, and capital allocation strategy as key catalysts for this view.

"The increasing complexity and inefficiency of global container supply chains, driven by shifting trade patterns, decentralization of manufacturing, and ongoing geopolitical disruptions, is boosting demand for midsize and smaller containerships. GSL's focus in these vessel classes positions the company to benefit through sustained high utilization and favorable charter rates, directly supporting future revenue growth and earnings visibility."

Want to know what’s driving this double-digit discount to fair value? The secret sauce of this narrative is rooted in bold estimates for future earnings, revenue direction, and profit margins that break from the crowd. Curious how these consensus forecasts stack up against the market’s more cautious outlook? The full story reveals the assumptions behind the headline price target. Find out which figures truly separate analyst expectations from current valuations.

Result: Fair Value of $35.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent geopolitical tensions and unexpected swings in charter rates could quickly challenge Global Ship Lease’s currently bullish valuation story.

Find out about the key risks to this Global Ship Lease narrative.Another View: Discounted Cash Flow Perspective

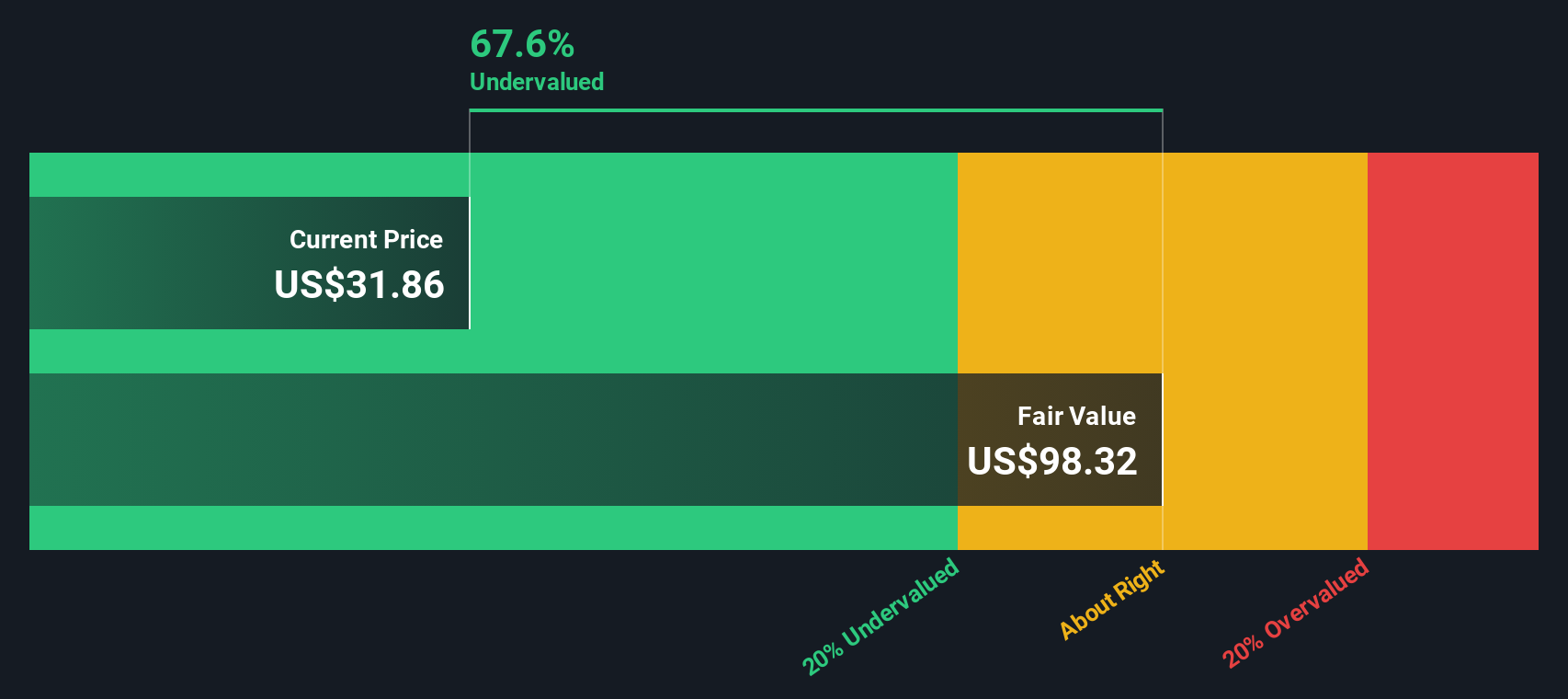

While analyst price targets suggest the stock is undervalued, our DCF model paints an even more optimistic picture. The model indicates shares trade well below calculated fair value. Could this deeper discount hold the real opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Global Ship Lease Narrative

If the current story does not align with your perspective, or you are keen to draw your own conclusions, you can easily run the numbers and craft your own narrative in just a few minutes. Do it your way

A great starting point for your Global Ship Lease research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your next winning opportunity slip past you. Expand your search and uncover stocks poised for growth, value, and innovation with these compelling strategies:

- Tap into overlooked potential by zeroing in on undervalued stocks based on cash flows, your shortcut to companies trading below their intrinsic worth.

- Spot breakthrough trends early by connecting with AI penny stocks, which are shaping tomorrow’s markets through cutting-edge artificial intelligence.

- Boost your portfolio’s income with dividend stocks with yields > 3%, finding stocks that deliver reliable returns above 3% yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal