Axcelis Technologies (ACLS): Assessing Valuation After New Ion Implant Platform and Product Launches

If you have been following Axcelis Technologies (ACLS), the company has just rolled out some intriguing updates that could change how investors view its growth story. Two new product launches, the Purion Power Series+ ion implant platform and the GSD Ovation ES high current implanter, were announced this week, both targeting fast-growing corners of the semiconductor market. These moves come just as the company prepares to present at a major industry conference, focusing investor attention squarely on Axcelis' pipeline and innovation strategy.

The buzz around Axcelis has quickly translated into higher trading activity and a sharp stock price move this past month. While the share price is up a striking 34% over the past three months and almost 12% for the month, longer-term shareholders are still digesting a near 10% decline year over year. It has been a year that saw both momentum and a few resets, but the recent product developments hint at renewed energy for the business.

With Axcelis posting fresh gains on new products, investors may be considering whether the market is presenting a real buying opportunity right now, or if optimism about future growth is already reflected in the current price.

Most Popular Narrative: 5% Overvalued

The latest and most widely followed narrative views Axcelis Technologies as trading above its fair value, suggesting the market may be too optimistic about future prospects.

As the installed base of Axcelis tools grows, recurring revenue from higher-margin services, parts, and upgrades (CS&I) continues to increase, providing resilience and predictability to cash flows and supporting improved earnings even during cyclical downturns.

Is Axcelis set up for unstoppable cash flow growth, or do analyst assumptions stretch reality? The calculations behind this narrative are grounded in projections for shrinking profits, revenue softness, and a premium future multiple that most companies only dream of earning. Want to know what has to come true for this number to make sense? The full narrative lays it all out, down to the last forecast.

Result: Fair Value of $78.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, concentrated exposure to China and sluggish adoption of advanced technologies could quickly change the narrative if conditions worsen or if new risks emerge.

Find out about the key risks to this Axcelis Technologies narrative.Another View: A Different Lens on Value

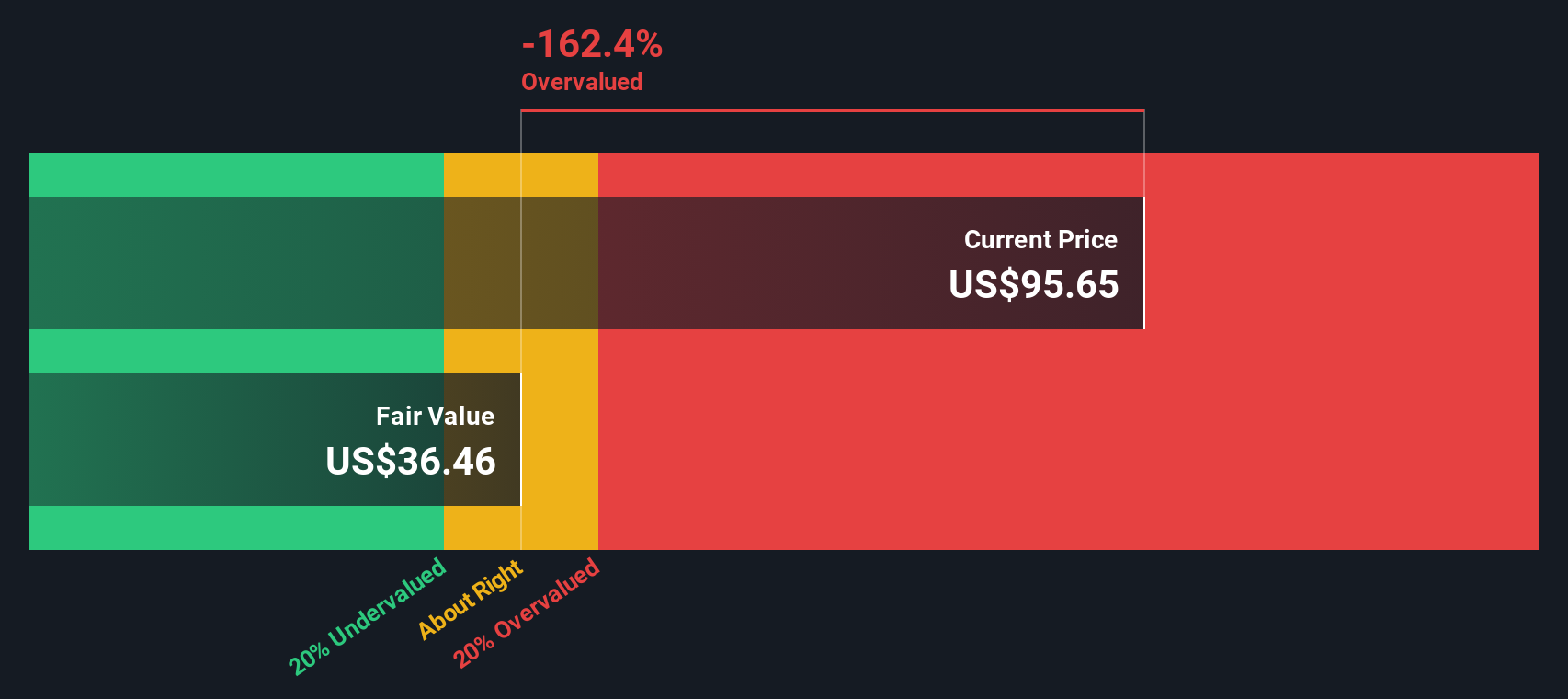

Looking with our DCF model, a more fundamental approach, we get a very different verdict. Axcelis appears significantly overvalued by this measure. Do these models miss something crucial about future opportunities?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Axcelis Technologies Narrative

If you have a different perspective or want to dig into the details firsthand, you can craft your own narrative quickly and see where the numbers lead. Do it your way.

A great starting point for your Axcelis Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep an eye on where the big trends are heading. Make sure you do not miss the next opportunity. These cutting-edge ideas can help you spot potential winners before others catch on.

- Target high yields and reliable income streams by scanning the market for dividend stocks with yields > 3% with proven staying power and strong fundamentals.

- Jump into the fast lane with AI penny stocks that are pushing the boundaries of artificial intelligence and reshaping entire industries.

- Capture the next undervalued breakout by zeroing in on undervalued stocks based on cash flows currently overlooked by the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal