MYR Group (MYRG): Reviewing Valuation Following Order Backlog Decline and Earnings Weakness

Most Popular Narrative: 16.1% Undervalued

According to the most widely followed narrative, MYR Group’s shares are considered undervalued, with a fair value estimate notably higher than the current share price.

Sustained momentum in electrification spanning grid upgrades, data center buildouts, and transportation, coupled with robust private and public sector investment, is expected to drive strong demand for MYR Group's infrastructure services. This is anticipated to elevate the overall addressable market and support top-line growth.

Ready to discover what powers this bullish price target? The market expects sharp increases in profits and margins, but there is a surprising twist in the growth story that few investors see coming. Is MYR Group set for an earnings surge, or are big assumptions pushing the value higher? Find out what bold forecasts underpin this valuation and see what makes the experts so optimistic.

Result: Fair Value of $209.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, declining renewables contributions and persistent labor cost inflation could undermine these bullish projections. This may limit MYR Group’s future growth and profitability.

Find out about the key risks to this MYR Group narrative.Another View: What Do Market Comparisons Suggest?

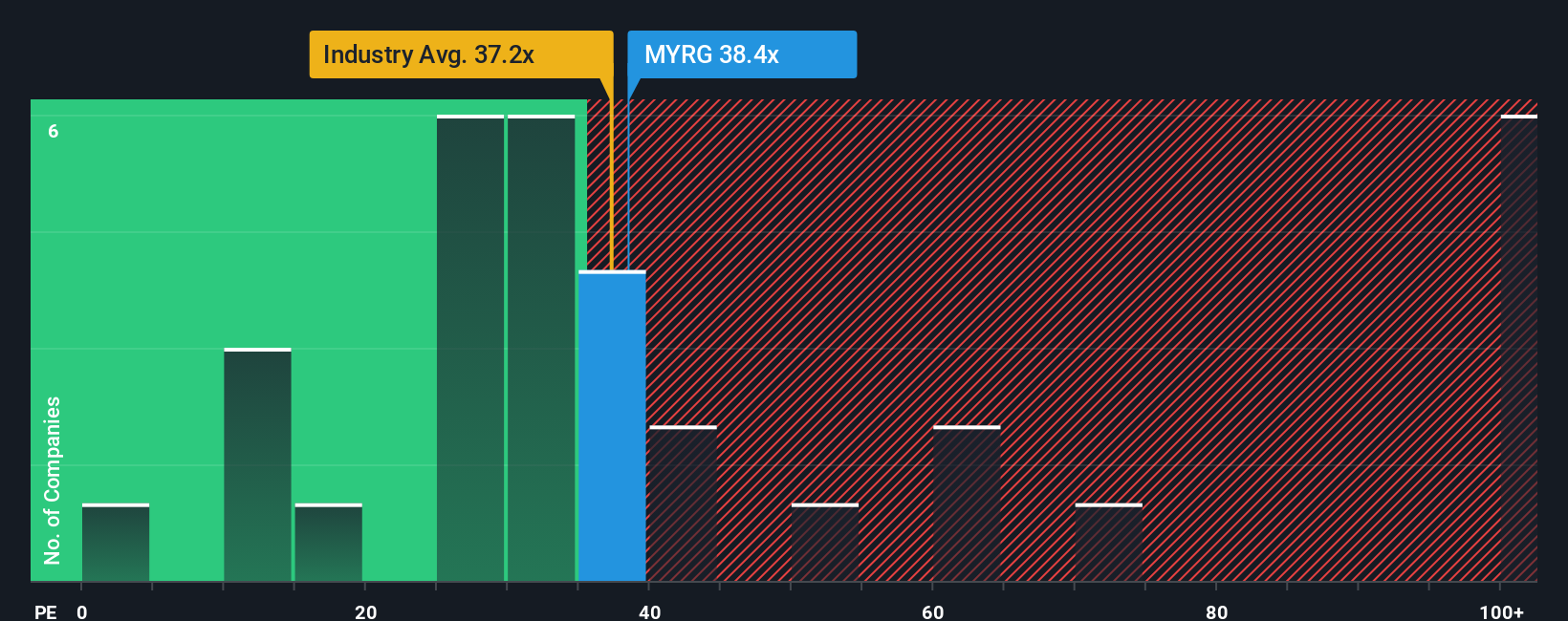

While the fair value debate leans positive, looking at MYR Group's price-to-earnings ratio compared to the industry tells a different story. This perspective suggests MYRG could be priced on the high side, given current expectations. Which view wins out? What are you willing to believe?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MYR Group Narrative

If you have a different perspective or want to dive into the numbers on your own, you can build and share your take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding MYR Group.

Looking for More Investment Inspiration?

Don’t let your next great investment pass you by. Give yourself an edge and stay ahead of the crowd with fresh stock ideas chosen for growth, innovation, and resilience.

- Uncover small companies making a big impact by checking out the latest movers with penny stocks with strong financials.

- Tap into tomorrow’s breakthroughs by seeking out emerging leaders in artificial intelligence using AI penny stocks.

- Lock in steady potential with offerings that stand out to income seekers, thanks to dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal