Is Rising Analyst Optimism on EPS and Revenue Growth Altering the Investment Case for Quanta Services (PWR)?

- In recent days, Quanta Services saw revised analyst estimates projecting a 19.12% increase in EPS and a 14.06% rise in quarterly revenue year-over-year ahead of its upcoming earnings report.

- This wave of analyst optimism and improved profitability expectations has increased market interest in the company, even as the stock recently underperformed broader market trends.

- We’ll now explore how elevated analyst projections for earnings and revenue growth may influence Quanta Services’ broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

Quanta Services Investment Narrative Recap

To be a shareholder in Quanta Services, you need to believe in the company’s ability to capture significant, multi-year demand for utility, renewables, and data center infrastructure amid rising power needs and the global energy transition. The recent upward revisions to analyst EPS and revenue forecasts support the narrative of robust, near-term growth, though this optimism does not fundamentally alter the biggest short-term catalysts or core risks, such as execution on large-scale projects and exposure to cyclical infrastructure spending.

Among recent announcements, Quanta’s updated outlook for full-year 2025 revenue (US$27.4–27.9 billion) and increased earnings guidance stand out as most relevant. These positive projections directly align with analysts' heightened expectations, reinforcing the company's growth trajectory and supporting the short-term catalyst tied to project backlogs and continued contract wins in the power and renewables space.

Yet, despite headline growth, a key area for investors to watch remains the risk that large infrastructure projects could face regulatory delays or...

Read the full narrative on Quanta Services (it's free!)

Quanta Services' narrative projects $37.5 billion revenue and $1.7 billion earnings by 2028. This requires 12.9% yearly revenue growth and a $728.2 million earnings increase from $971.8 million today.

Uncover how Quanta Services' forecasts yield a $419.40 fair value, a 11% upside to its current price.

Exploring Other Perspectives

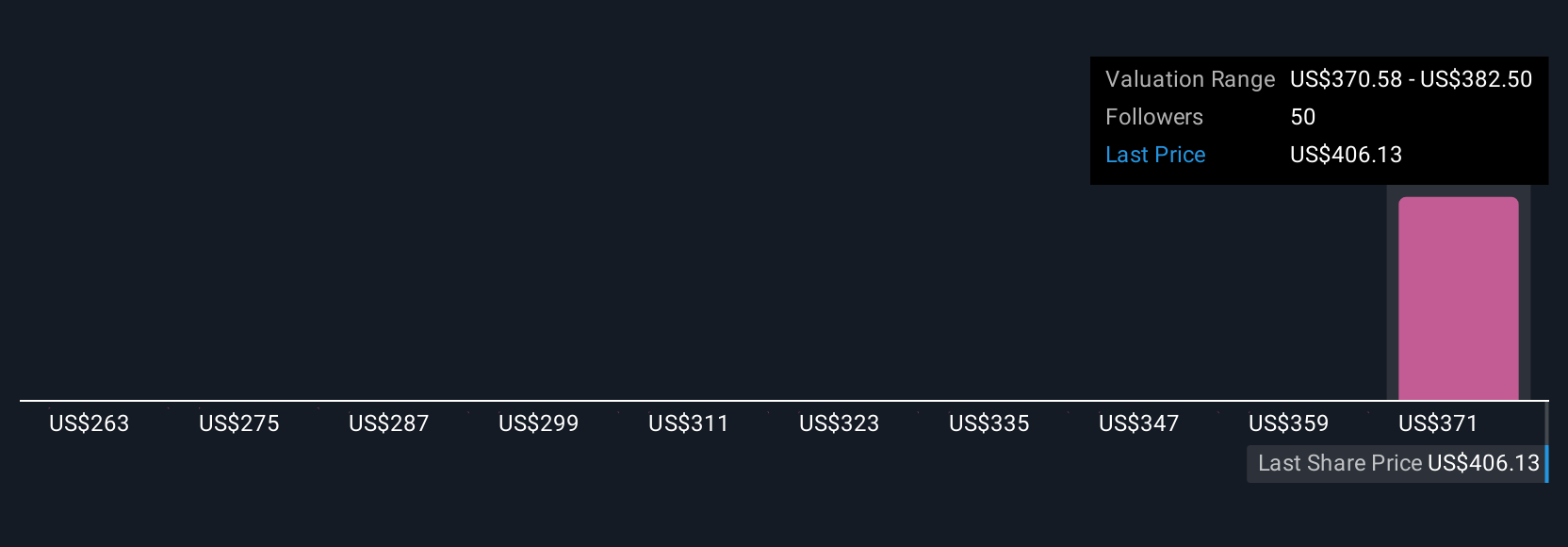

Fair value opinions from the Simply Wall St Community span US$263 to US$419, with four distinct estimates highlighting broad disagreement on Quanta’s outlook. While some see upside aligned with strong backlog catalysts, others point to lingering concerns around project timing and regulatory complexities shaping future performance.

Explore 4 other fair value estimates on Quanta Services - why the stock might be worth as much as 11% more than the current price!

Build Your Own Quanta Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Quanta Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quanta Services' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal